Standards

OVERVIEW OF Financial Sub-Certification

Prior to reviewing this standard, it is important to understand the process of closing and the parties responsible for completing the closing process.

Closing refers to the process of finalizing an entity’s financial information and creating reports after a specified accounting period has ended. Closing procedures are performed on an interim and year-end basis to keep accounting data organized and ensure all transactions for the period are properly accounted for and recorded on a timely and accurate basis. The Office of the University Controller requires Constituent Reporting Units (CRUs) to submit closing documentation on an interim and year-end basis. A CRU is determined by meeting a $35,000,000 threshold in revenues, expenses, or net assets for a minimum of 2 consecutive years. A CRU will be removed from the list if the threshold is not met for 3 consecutive years. Review the internal controls and roles and responsibilities IU accounting standards book for a detailed explanation of a Constituent Reporting Unit and a List of Active CRUs at Indiana University. Key fiscal officers within a CRU are responsible for several items at interim close including reviewing IU accounting standards, reviewing system and user roles, financial statement variance analysis, balance sheet balance substantiation, posting and reviewing accruals, and account reconciliation. Key fiscal officer responsibilities included in year-end close procedures consist of interim closing activities in addition to specific year-end items such as org reversion, covering cash balances, and sub-certification. Both interim and year-end closing procedures are accompanied by a checklist to be submitted by the CRU alongside required materials. The list and relevant scope are subject to change annually and individual specific requirements as determined by each campus and/or RC need to be considered in addition to this checklist.

Review the UCO Fiscal Officer Calendar for closing deadlines. It is important to note that several KFS e-docs are due by a specific date. If you use Financial Processing (FP) e-docs in KFS, these documents must be in the system and fully approved by 10:00 p.m. for the entries to be processed by the accounting cycle and reflected in the closing reports. Because some KFS e-docs require additional administrative approvals, on the day of each closing, e-docs should be completed by 12:00 p.m. to allow for all necessary routing and approvals. If you require access to KFS, please contact your RC fiscal officer.

Financial Sub-Certification

Prerequisites

Prior to reading the standard on Financial Sub-Certification, it is beneficial to review the below items to gain foundational information:

- FIN-ACC-1: Role of Fiscal Officer, Account Manager and Account Supervisor

- FIN-ACC-470: Internal Controls

- FIN-ACC-650: Financial Compliance: Authority and Accountability

- Internal Controls Standard

- Closing Standards

Preface

This standard is an overview of the Financial Sub-Certification process for Indiana University. Information presented below will provide a general understanding of the Financial Sub-Certification, reporting requirements, and best practices.

Introduction

Indiana University (IU) is committed to procedures that enhance our institution’s internal control environment. According to FIN-ACC-470: Internal Controls, “All Constituent Reporting Units (CRUs) must annually attest to their financial activity, internal control structure, and overall adherence to IU Accounting Standards through the university’s Sub-Certification process.” As part of this process, IU has developed a Financial Sub-Certification requirement for all Constituent Reporting Unit (CRU)s. The Financial Sub-Certification process serves two primary objectives:

- To provide reasonable assurance of a sufficient and effective internal control structure which can identify weaknesses in financial processes and systems, and

- To support the Executive Vice President for Finance and Administration’s (EVPFA) basis for the annual financial attestation (Management Representation Letter) by providing reasonable assurance of the underlying financial activity reported in the university’s financial statements.

Importance and Impact of Financial Sub-Certification

As outlined in FIN-ACC-650: Financial Compliance: Authority and Accountability, “The Executive Vice President for Finance & Administration (EVPFA) formally delegates to the Office of the University Controller (UCO) oversight authority for the university’s external financial audits, fiscal internal controls, and related compliance. This delegation encompasses financial policy, standards, transactions, systems, and reporting, as it relates to external financial compliance for the university as a whole. UCO oversees the Fiscal Governance, Compliance, and Accountability Standards within the IU Accounting Standards which further delegates institutional responsibilities by the EVPFA for university financial compliance. The IU Accounting Standards serve as the authoritative and comprehensive guide on accounting, financial reporting, fiscal compliance, and controls at Indiana University.”

Indiana University’s EVPFA is required, in connection with the annual financial audit, to attest via the external audit Management Representation Letter that the university’s financial statements present fairly, in all material respects, the financial position of the university. The EVPFA is further required to attest responsibility for adoption of sound accounting policies, establishing and maintaining effective internal controls over financial reporting, and preventing and detecting fraud.

Financial Sub-Certification is a means to focus on accountability and compliance with internal control responsibilities across the institution. This is especially important in a decentralized operational and financial decision-making organizational structure.

Financial Sub-Certification Overview

What is a Financial Sub-Certification

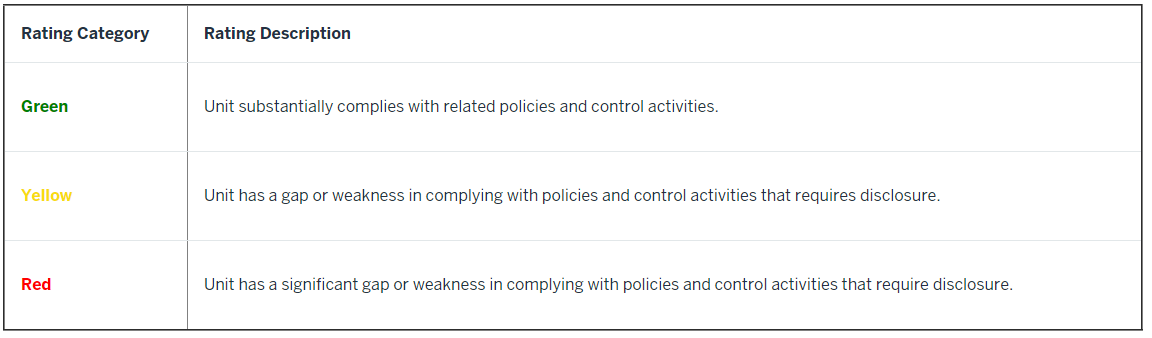

The Financial Sub-Certification is a rating of the effectiveness of the Constituent Reporting Unit’s (CRU) internal controls. The individual completing the Financial Sub-Certification will use the following rating scale to assess each financial area listed.

For each area assessed as “yellow” or “red,” the individual completing the Financial Sub-Certification will be asked to identify the gaps or weaknesses and briefly articulate the steps that will be taken to resolve the identified gaps or weaknesses. If substantial explanation is required, please attach a further explanation and an action plan to the Financial Sub-Certification. If a section does not apply, please indicate N/A.

Who Should Complete a Financial Sub-Certification

The Office of the University Controller (UCO) only requires Financial Sub-Certification of the Constituent Reporting Units (CRUs). As a best practice, CRUs may require the Financial Sub-Certification of smaller units for internal assurance purposes.

Once the document is completed, it must be signed by the CRU’s:

- Unit Leader (Dean, VP, etc.)

- CRU Fiscal Officer and

- Campus Vice-Chancellor for Finance (or equivalent)

In the event that a responsible party has not been in their current position for the duration of the reporting period, the signature can be deferred to Campus Vice-Chancellor for Finance or equivalent.

When Should a Financial Sub-Certification Be Completed

A Financial Sub-Certification should not be finalized until ALL closing activities are complete.

Final Steps of the Financial Sub-Certification Process

Once the Financial Sub-Certification process is completed, the CRU should forward the signed completed Financial Sub-Certification to their Campus Controller by the specified time on the closing calendar. For UA units, please send directly to the Accounting & Reporting Services team at uars@iu.edu. Additional reviews will be completed by UARS and the UCO Internal Controls Manager.

Requirements and Best Practices

This section outlines general requirements and best practices related to Financial Sub-Certification.

Requirements

- As outlined in FIN-ACC-470: Internal Controls, “All Constituent Reporting Units (CRUs) must annually attest to their financial activity, internal control structure, and overall adherence to IU Accounting Standards through the university’s Sub-Certification process.

Best Practices

- An optional version of the Financial Sub-Certification form, the Unit Level Sub-Certification Form, can be used for non-reporting units reporting up to a CRU as an additional assurance tool. However, UCO will not be collecting this version of the form.

A defined segment (organization or grouping of organizations) within Indiana University that have revenues, expenses, or net assets over a predetermined threshold as defined by the Office of the University Controller closing procedures.