Standards

Chart of Accounts OVERVIEW

This portion of the book is focused on chart of accounts standards.

The chart of accounts (COA) is the governing structure for all financial transactions. Indiana University generates thousands of financial transactions on a daily basis. IU’s COA drives the university’s external compliance, internal and external reporting, and organizes all financial data in the general ledger. Review these standards for details about the main COA attributes and how they are used to organize financial data. In particular, this section of the book is focused on the COA framework, including attributes such as the responsibility center codes (RC), organization codes (Org), account, the chart of accounts fund and sub-fund groups, consolidation codes, object levels, and object codes, and how they impact accounting and financial reporting at Indiana University.

UCO-COA-1.00: Framework

Prerequisites

Prior to reading the Chart of Accounts Framework standard, it is beneficial to review the below standards to gain foundational information:

Preface

This standard discusses elements of the chart of accounts and how it impacts financial accounting and reporting internally at Indiana University. The information presented below will walk through a general understanding of the chart of accounts, its uses within university accounting, where to locate a listing of the chart of accounts, and how it is used to record accounting entries within Indiana University.

Introduction

The chart of accounts (COA) is the set of tables that define codes and coding structures such as accounts, organizations, responsibility centers (RC), object codes, etc. and provides structure for all accounting, reporting, and budgeting needs at IU.

The COA exists primarily to support and validate entries into the general ledger (GL). For example, transactions cannot be applied to an account in the GL unless that account exists in the COA. Each individual attribute could be dependent on one or more chart attributes such as the fund group or organization associated with an account. Defining these attributes and their various relationships is how the financial structure of an institution is defined. By leveraging the COA, the entity can organize its information to support activities such as document routing, management of internal controls, and internal and external reporting.

The chart of accounts is an organizational tool that provides various ways to specifically identify and summarize financial data for a given accounting period. It is used to organize transactional data so that internal and external users can better understand an entity’s financial health. The chart of accounts has the flexibility to create or terminate new parameters like accounts, but if the account does not currently exist in the chart of accounts, it cannot be used.

Importance and Impact of the Chart of Accounts

IU is a large and evolving organization with many accounting complexities. The chart of accounts helps departments, campuses, and university administrators accurately review and create financial statements and reports that directly impact the livelihood of the university. The chart of accounts is especially pertinent for external and internal reporting. Without the ability to organize financial data, it would be nearly impossible to report at the RC, department, or consolidated levels, preventing management at all three levels from tracking their entity’s financial health.

With the addition of multiple levels organized in IU’s chart of accounts (i.e., RC, object code, account, etc.), users can reap multiple benefits including:

- Auxiliary users can more easily identify object codes that are not relevant to their unit such as tuition revenue and state appropriations.

- Campus charts are not required to contain object codes unrelated to their activities. Examples of this include dental school expense object codes in the Southeast campus or inventory for RC code 79 – External Affairs. This makes for a more efficient and effective organization of data for multiple types of users.

- The use of multiple charts allows the university to easily evaluate the financial health of the institution as a whole as well as a single campus.

Additionally, the chart of accounts is an important internal control procedure ensuring strong reporting hierarchy and correct routing of transactions. The lack of a chart of accounts would cause confusion during the review and approval process and lead to errors in accounting and financial representation. This in turn can impact future funding either through state appropriations, gifts, or contract and grants from donors that rely on accurate financial statements.

Lastly, the chart of accounts is an important factor for budget construction. The bedrock of IU’s finances, budgeting is a key component to ensure all departments and the university as a whole are not expending more than what is being earned. The chart of accounts helps the budget team equitably allocate funding to each unit within the university based on their individual financials. Without a solid chart of accounts, there can be major consequences to tax filing, ability to maintain existing loans and bonds, and general management of funds.

Indiana University’s Chart of Accounts Framework

Chart of Accounts Attributes

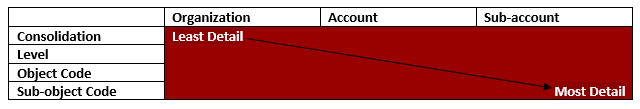

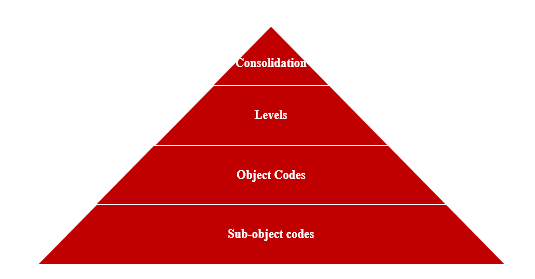

Indiana University’s chart of accounts provides multiple levels of detail and information related to chart fields such as object codes and responsibility centers. These codes were created to assist departments and units with the classification of financial activities for financial reporting. These unique chart attributes help users better group and identify financial information at both a high and low level of detail. The level of detail required is based on the user’s needs, i.e., is the executive management team within a school looking at the high-level financial health of the university or is a fiscal officer trying to identify a specific transaction? The below diagram shows IU’s main attributes organized by least to most detail available.

Chart of Accounts Structure

Chart Codes

Indiana University’s chart of accounts is organized into two kinds of chart codes: campus level charts (including university administration) and auxiliary charts. IU has a unique chart of accounts structure for each of its nine campuses including UA –university administration, which stores financial information for organizations that serve all IU campuses.

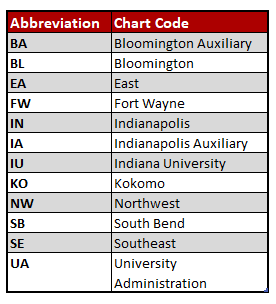

Due to IU’s substantial number of financial reports and information, the university has created twelve separate chart codes to narrow down the search for relevant financial data. Chart codes define the valid charts that make up the high-level structure of the chart of accounts. It also defines who has management responsibilities for each chart. Accounts and object codes are specific to each chart. Below are the twelve chart codes specific to IU.

Who to Contact with Questions?

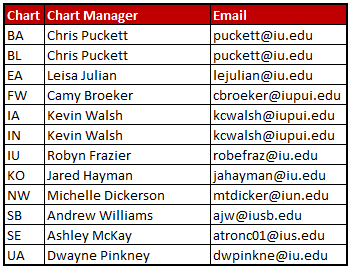

Each campus has its own chart of accounts with specific campus codes, RCs, and organizations. Campus representatives are best equipped to answer questions. Below is the current listing of chart managers by campus.

For any accounting or report specific questions regarding the chart of accounts, contact the Accounting and Reporting Services team at uars@iu.edu.

Requirements and Best Practices

This portion of the standard outlines requirements related to the chart of accounts framework, as well as best practices. While not required, the best practices outlined below allow users to gain a better picture of the entity’s financial health and help identify potential issues on a more frequent basis. This allows organizations to identify errors, mistakes, and pitfalls which can be remedied quickly and prevent larger issues in the future.

Requirements

- Fiscal officers should be knowledgeable of the IU chart of accounts framework standard. In addition, fiscal officers should review the glossary to gain pertinent knowledge of accounting at IU.

- If users have questions regarding the account structure or attributes, contact the Accounting and Reporting Services team at uars@iu.edu.

Best Practices

- For additional information on the structure of the chart of accounts, attend the KFS Training Series held by the Financial Training and Communications team. Register by visiting the training website.

UCO-COA-1.01: RC, Org, and Account

Prerequisites

Prior to reading the Chart of Accounts RC, Org, and Account standard, it is beneficial to review the below standards to gain foundational information:

Preface

This standard discusses attributes of the chart of accounts including responsibility center codes (RC), organization codes (Org), accounts, and how they impact accounting and financial reporting at Indiana University. The information presented below will walk through a general understanding of RC codes, org codes, the available accounts, and sub-accounts within IU. The intent of this document is to provide a high-level overview of these chart attributes. The functionality and appropriate usage of the codes and accounts will be discussed in other standards.

Introduction

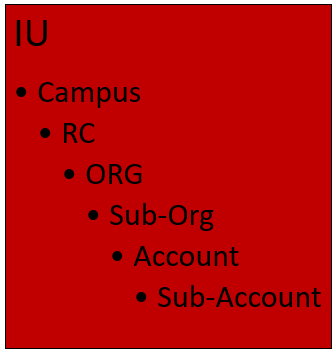

Indiana University is a multi-billion dollar institution with a complex and diverse financial reporting system. The chart of accounts structure is used extensively to meet internal and external reporting needs. It provides units with a means of tracking and reviewing transactional data to ensure fiscal compliance with reporting standards, budget adherence, and accurate financial reporting. By creating a chart of accounts structure, the user is provided with a variety of ways to summarize financial data ranging from a high-level overview at the responsibility center level down to the most detailed level of sub-accounts within a unit.

Responsibility centers are units within the campus hierarchy to which executive management has delegated management authority. For academic units, a responsibility center generally corresponds to a college or school. For administrative units, a responsibility center is a collection of related support service organizations. Each responsibility center is unique and has its own organizational structure. Organizations are a collection of accounts and/or other organizations that form a hierarchy, starting with the university as a whole at the top and moving down through campuses, schools, and departments. Each organization reports to another organization that then reports to a responsibility center. Account numbers organize and catalog financial data and transactions at IU for a single activity. All financial transactions must have an account number, object code, and dollar amount.

These attributes provide a foundation for management at all levels to facilitate internal and external financial reporting and analysis. The use of RC, orgs, accounts, and sub-accounts within IU’s chart of accounts allows the financial users both internally and externally to easily evaluate the financial well-being of the institution as a whole down to a more granular account level as shown in the chart hierarchy above. Users can determine the appropriate level needed for analyzing and reporting financial data. This allows users to better understand their entity’s financial stability which is pertinent for internal and external reporting and compliance.

Importance and Impact of the RC, Org, and Account

IU is a large and evolving organization with many accounting complexities, which is why the chart of accounts is critical to accurate and transparent reporting. This reporting hierarchy is an important tool used to determine appropriate allocation and use of funds from units, as well as for planning and budgeting purposes. These attributes ensure compliance with applicable reporting standards, adherence to allocated budgets, and stewardship of IU resources. Categorizing financial data also allows users to understand the nature of the activity at a glance. In addition, by grouping financial data at various organizational levels, users can more precisely review the financial health of the university ensuring greater financial integrity.

Lastly, these attributes are key in external financial, sponsored research, financial aid, and tax reporting, among others. For example, improperly categorizing IU’s financial transactions impacts both reporting and tax filings resulting in potential fines, audit findings, and future funding. Correct reporting is relied upon by executive management to make important decisions regarding the financial health of individual units.

Indiana University’s Responsibility Center Organizational Hierarchy

Responsibility Center Codes

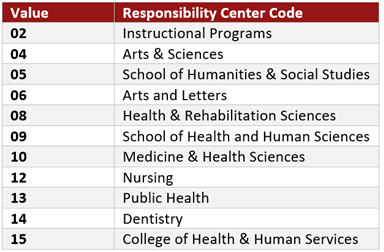

Responsibility centers represent various colleges or administrative centers within the university. Each responsibility center is specific to a chart of accounts code within the campus. While there are more than one hundred responsibility center codes in combination with chart codes, some examples of RC codes are listed below.

Each responsibility center has an identifying code (04-Arts and Sciences) and description (ARSC-Arts and Sciences) which is then associated with organizations to indicate where responsibility for that organization resides. While an RC is an attribute of an account, the organization (org) code is an important attribute of an RC. If there is an RC associated with an organization, it is denoted with an “R” as the last letter of the org code (i.e., MAIN LIBRARY DINING – BA-MNDR). To inquire on a responsibility center code at IU, refer to the Responsibility Center Lookup.

Within a responsibility center, the organizational structure can be many levels deep. Reports can be run at the responsibility center level for a high-level financial overview.

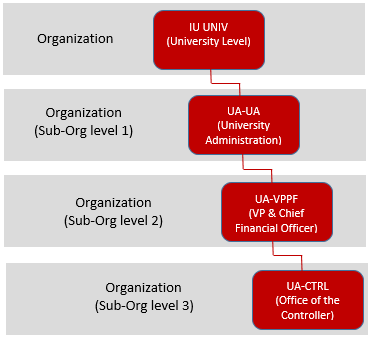

Organization Codes

Organization codes define units at many different levels within the university and allow users to further drill down to find more precise financial information. They are a collection of accounts, or a collection of other organizations known as sub-organizations. The below diagram is an example of the Office of the University Controller presented within the organizational hierarchy.

Structurally, organization codes can include all fund groups and up to four alphanumeric characters (i.e., CTRL), but may have less. There are hundreds of organization codes within the university. A few examples are listed below.

- BOWN – Bowen Research Center

- RCOM – Research Compliance

- REL – Religious Studies

- WEDR – Wells Library Dining

For a full detail of the available organization codes at IU, refer to the Organization Code listing.

In general, an organization may have any of the following attributes:

- Chart of Accounts

- Responsibility Center

- Campus

- Department

- HRMS

Account Numbers

An account number is an identifier for a given pool of funds that represent a specific activity or purpose. Accounts store information about financial transactions; they describe the purpose of and who is making a transaction. All accounts at IU are self-balancing and include both balance sheet and income statement object codes. Accounts are seven digits, unique, and chart specific.

Some accounts have specific start and end dates, such as grant accounts. Other accounts exist for an unlimited time, such as a department’s general fund account. Account numbers are organized into fund groups, which are further divided into sub-fund groups. Fund groups can be identified by the account number prefix. The table below identifies the associated fund group by the prefix of an account.

| Account Prefix | Fund Group | Fund Group Code | Short Description of Fund Group |

|---|---|---|---|

| 03-19 | General Fund | GF | Expense-driven, base-budgeted accounts used for daily operating expenses (e.g., office supplies, payroll, etc.) and funded by tuitions, fees, and state appropriations. |

| 11, 20-24 | Designated Funds | DS | Funds set aside by the university for a specific purpose or function. |

| 25-29 | Restricted Funds | RF | Funds provided from an external source, often as a gift, with restrictions on how the funds may be used. |

| 40-59 | Contract and Grant Funds | CG | Each restricted account represents a specific contract or grant. These funds are administered through the Office of Research Administration. |

| 60-66 | Auxiliary Enterprises | AE | Accounts linked to revenue-generating activities that provide a good or service that does not directly support IU’s mission. |

| 68 | Clearing Funds | CL | These accounts are used as a temporary placeholder until the correct account classification for a transaction is determined and cleared within 30 days. |

| 70 | Loan Funds | LF | Funds held by the university for the purpose of making loans to students. This includes campus based and short-term loans. Both loan types are administered by the University Loan and Collections Services or through the Bursar. |

| 80-85 | Endowment Funds | EN | Gifts to IU, or funds designated by IU, which have been restricted to the extent that only income derived from the investment of gift principal may be expended. These accounts do not include endowment received and held by the Indiana University Foundation. The University Office of the Treasurer centrally manages endowment fund accounts. |

| 90-95 | Plant Funds | PF | This fund group contains university capital assets and related activity. Renewal and replacement accounts that cover the cost of repairs and replacements, retirement of indebtedness accounts for payment of debt obligations, construction and major remodeling accounts for capital improvements, and major maintenance of physical facilities. |

| 96-98 | Agency Funds | AF | Funds held for others for which IU acts as custodian or fiscal agent on behalf of the university. |

| 99 | Other Funds | OF | Used by Treasury to record investments that are distributed to operating accounts. |

For further information on this topic, refer to the UCO-COA-1.02 Fund and Sub-Fund Groups Standard.

Sub-Account Numbers

Sub-accounts achieve further division of an account for internal reporting purposes and allow for tracking of financial activity within a particular account at a finer level of detail. Instead of associating budget, actuals and encumbrances with an account, a sub-account can be specified within that account to apply these entries. Sub-accounts are often used to help track expenses when several different activities may be funded by the same account. For example, a large organization may have money in a general account that is used by several different areas of that organization. The organization might segregate the budgets for each of the areas into sub-accounts such as marketing, research, and recruitment. When expenses are applied to the account, they can be applied to the sub-account level, allowing direct comparisons between the budget and the actual income and expenditures of these smaller categories. Because all of the activity is still within a single account, it is still easy to report on the finances of the overall account.

Structurally, sub-accounts are account specific, can include up to five alphanumeric digits, and assumes all attributes of the account to which it reports, including Fiscal Officer, account supervisor, fund group, and function code.

Higher Education Function Codes

A Higher Education Function Code is a functional expense classification that groups expenses according to the purpose for which the costs are incurred. It classifies the purpose and activities of an account such as instruction, research, or public outreach. The classification explains why the expense was incurred rather than what was purchased. Higher education function codes help donors, granting agencies, and creditors understand the various mission-related activities at IU and their relative importance. This information can also aid in reporting and in some cases may determine applicable business rules. For example, the nursing school recently hired three new employees – two professors and a financial analyst. For tracking purposes, these salaried employees are paid through the general fund and noted with the following higher education codes: professors/faculty – IN (instruction) and administrative staff – IS (institutional support). The nursing school dean asked the fiscal officer how much was spent in FY2X on new administrative employees’ salaries. The fiscal officer was able to easily pull the financial information by using the IS higher education code. Another example, the biology department internally designated funds to conduct research on bat activity in southern Indiana. For tracking purposes, the higher education function code for departmental research (DR) was used. As part of the grant agreement, IU was required to submit expenses related to the project on a quarterly basis. By using the DR higher education code, the biology department fiscal officer was able to easily track and report those expenses to the funding agency.

Requirements and Best Practices

This portion of the standard outlines requirements related to the chart of accounts RC, org code, and account, as well as best practices. While not required, the best practices outlined below allow users to gain a better picture of the entity’s financial health and help identify potential issues on a more frequent basis. This allows organizations to identify errors, mistakes, and pitfalls which can be remedied quickly and prevent larger issues in the future.

Requirements

- Fiscal officers should be knowledgeable of this standard in full. In addition, fiscal officers should review the accounting glossary to gain pertinent knowledge of accounting at IU.

- It is the responsibility of the fiscal officers to ensure the proper usage of individual accounts during the selection process. In addition, the fiscal officer must ensure attributes on all accounts, orgs, and RCs are accurate, appropriate, and updated annually. Contact your RC fiscal officer or campus business office for internal reporting requirements related to proper usage.

- If users have questions regarding the chart structure or attributes, contact the University Accounting and Reporting Services team at uars@iu.edu.

Best Practices

- For additional information on the structure of the chart of accounts, attend the KFS Training Series held by the Financial Training and Communications team. Register by visiting the training website.

UCO-COA-1.02: Fund and Sub-Fund Groups

Prerequisites

Prior to reading the Chart of Accounts Fund and Sub-Fund Groups standard, it is beneficial to review the below standards to gain foundational information:

- Accounting Fundamentals Standards

- UCO-COA-1.00 Framework Standard

- UCO-COA-1.03 Consolidation, Object Levels, and Object Codes Standard

Preface

This standard discusses the chart of accounts fund and sub-fund groups and how they impact financial accounting and reporting internally at Indiana University. The information presented below will walk through a general understanding of the fund and sub-fund groups and the available groups within IU. The intent of this document is to provide a high-level overview of the fund and sub-fund groups. The functionality and appropriate usage of fund groups will be discussed in other standards.

Introduction

Indiana University receives funds from a variety of sources, some of which restrict the general usage.

Main sources of revenue to the university include state appropriations, tuition, contract and grants, and gifts. As many of these revenue sources impose restrictions on the use of the money, IU uses fund and sub-fund attributes within the chart of accounts to properly record the revenue. Fund accounting is an important concept for all public universities and is employed to ensure correct tracking of resources whose use is limited by donors, granting agencies, law, other outside individuals or entities, or by governing boards. As noted by the National Association of College and University Business Officers (NACUBO), a fund is maintained for each specific purpose. In general, fund groups categorize the characteristics and limitations placed on the resources recorded in accounts.

A fund group is used to define the broadest category of funds and is relied on for internal and external reporting. While the fund group is the broadest category of funds, the sub-fund group provides additional detail to narrow down the definition and usage. On IU’s financial report, fund group attributes are divided between three categories: net investment in capital assets, unrestricted, and restricted (either internally or externally). These concepts are discussed below in detail. For unrestricted funds, the governing board (management) of Indiana University, granting organizations, or government agencies can designate resources to be used for certain purposes such as student loans or capital construction (designated funds). This imposes a special stewardship obligation. IU must demonstrate that all resources are recorded and used in accordance with the directives of the outside funding sources. This stewardship obligation requires an accounting system that provides for the unique identification and recording of individual resources so that they are not commingled with other funds. By defining fund and sub-fund groups, the university is able to appropriately track and ensure money received is being spent based on restrictions.

Importance and Impact of Fund Groups

IU is a large and evolving organization with many accounting complexities, which is why the chart of accounts is critical to accurate and transparent reporting. These attributes ensure proper use of funds, compliance with applicable reporting standards, adherence to allocated budgets, and stewardship of IU resources. Categorizing financial data also allows users to understand the nature of the activity at a glance.

Use of fund groups to correctly record an entity’s finances into appropriate funds enables the university to keep the revenue it receives in the proper categories and prevent revenue from being spent on inappropriate expenses. The use of fund groups within the chart of accounts also helps in the decision-making process for management to ensure the best use of resources. Without the ability to ensure dollars are recorded in the correct fund type, management would be unable to accurately determine what resources are available for use for both unrestricted and restricted purposes. This can lead to a misuse of funds and compliance issues.

The fund group attributes are key in external financial and tax reporting. Not submitting or incorrectly representing the financial data for the university can have major impacts on funding and can result in fines, IRS findings, and additional audit procedures. Additionally, improper use of the attributes could impact the annual external financial audit, which again, is relied upon by external users and is the official financial record and position of the university. For example, expenditures on contracts and grant funds must be in compliance with external agencies and Uniform Guidance. Fund groups are also critical for tracking contracts and grants. Without proper allocation of money within fund groups, users can not track spending or ensure money is used in accordance with internal or external restrictions. Improper use of fund group attributes would result in IU’s inability to determine what is reportable on the required tax forms which are submitted to local, state, and federal organizations.

Indiana University’s Fund Types

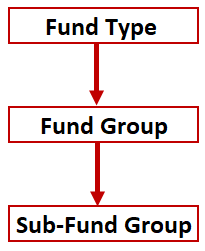

Fund types are used to classify resources into funds according to specified activities, designations, or restrictions for financial accounting and reporting purposes. These distinctions may be imposed by sponsors, donors, external regulations, or directives issued by the Board of Trustees. A fund is an accounting entity with a self-balancing set of accounts consisting of assets, liabilities, and fund balances. A sub-fund group is a further classification of fund groups to easily identify the allocation of money. The diagram to the right breaks out the hierarchy of funds.

Fund types are used to classify resources into funds according to specified activities, designations, or restrictions for financial accounting and reporting purposes. These distinctions may be imposed by sponsors, donors, external regulations, or directives issued by the Board of Trustees. A fund is an accounting entity with a self-balancing set of accounts consisting of assets, liabilities, and fund balances. A sub-fund group is a further classification of fund groups to easily identify the allocation of money. The diagram to the right breaks out the hierarchy of funds.

Fund Groups

In higher education accounting, funds are classified into one of six groups defined by the National Association of College and University Business Officers (NACUBO) as:

- Current funds – consists of funds expendable for operating purposes and are divided into two fund subgroups: current funds-unrestricted and current funds-restricted. Current funds-unrestricted are available for any operating purpose of the institution and may be transferred to other fund groups such as plant funds, loan funds, or endowment funds.

- Endowment and similar funds – composed of three subgroups: (1) endowment funds, (2) term endowment funds, and (3) board-designated or quasi-endowment funds. The fund balances of donor-restricted permanent endowment and term endowment funds include donations for endowment purposes, earnings required to be added to the endowment, and net appreciation on investments that are subject to future appropriation for spending. At Indiana University, the term endowment sub-fund group is generally not utilized.

- Loan funds – categorized as restricted or unrestricted, but are grouped in the same fund. Restricted loan fund balances include donor and governmental funds restricted for purposes of making loans, endowment earnings specified for loans, and interest income on loans previously issued from restricted loan funds. Unrestricted loan fund balances include funds designated by the board for loan purposes.

- Plant funds – consists of up to four sub-funds, as follows: (1) unexpended plant funds, (2) funds for renewals and replacements, (3) funds for the retirement of indebtedness, and (4) investment in plant. Plant fund balances may include funds contributed by donors for plant construction or acquisition, student fees raised for construction or for the payment of interest and principal on debt, amounts held in reserve in the funds for the retirement of indebtedness, or funds for renewals and replacements in accordance with externally imposed bond indentures.

- Annuity and Life Income Funds – used to account for assets provided by donors under split-interest agreements and the obligations to make payments to the beneficiaries of those agreements. The agreements specify how the benefits of the assets of the fund are shared between the institution and the beneficiary(ies). Currently, at IU, this fund group is used exclusively for the Riley Hospital Endowment.

- Agency Funds – resources held by an institution as a custodian or fiscal agent for others, such as student organizations, individual students, faculty organizations, or individual faculty members. Agency funds have only assets and liabilities and do not include individual revenue or expense transactions for the institution.

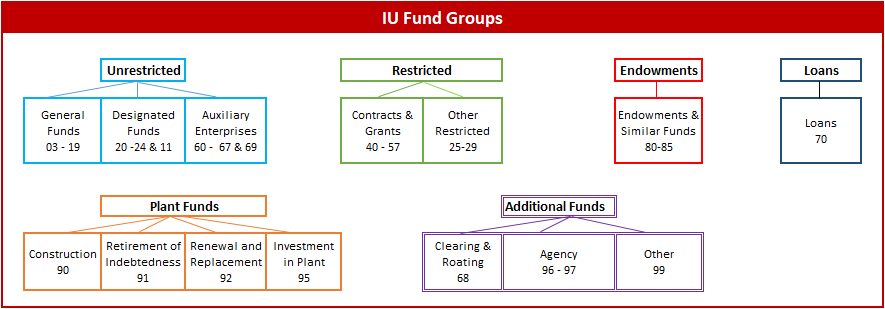

At Indiana University, fund types are used to classify funds with similar funding sources that are consolidated into one of the below fund groups. Separate funds are maintained within each fund type to ensure compliance with limitations and restrictions placed on the use of resources. Within Indiana University, there are fourteen fund groups and more than fifty sub-fund groups. See here for a full list of the available fund and sub-fund groups. Users are not able to create a new fund group document, but users can select both the appropriate fund and sub-fund groups. The fund groups are broken up into the below categories.

Unrestricted Funds

Include those economic resources of the institution which are expendable for any purpose in performing the primary objectives of the institution, i.e., instruction, research, and public service, and which have been designated by the governing board for a specific purposes.

Unrestricted funds do not have rules for use placed by the source of the funds. Only university business rules are applicable for use of unrestricted funds. Examples of sources of unrestricted funds would be tuition and fees and funds from sales and services. The unrestricted fund groups at IU are discussed below. Note – for full list of available sub-funds by campus and account prefix, see the quick reference document.

| Fund Group Name | Major Sub-Fund Group | Account Prefix Number |

|---|---|---|

| General Fund | N/A | 03-19 |

| Designated Fund | Continuing Education, Public Services, Internal Research, Other | 20, 21,22, 23 |

| Auxiliary Enterprise Funds | Auxiliary Funds , Service Funds | 60-67 & 69 |

Restricted Funds

These funds have specific requirements and/or intentions for use set by the funding source. Examples would be funds from a donor or funds from a specific research contract or grant. Restricted sub-funds at IU include:

| Fund Group Name | Major Sub-Fund Group | Account Prefix Number |

|---|---|---|

| Contract and Grant Funds | N/A | 40-57 |

| Other Restricted Funds | Fellowships, Scholarships, Special State Appropriations, Matching Endowments, and Restricted Other | 25, 26, 27, 28, 29 |

Loan Funds

| Fund Group Name | Major Sub-Fund Group | Account Prefix Number |

|---|---|---|

| Loan Funds | Internal Loan Fund and Loan Funds | 70 |

Endowment and Similar Funds

Endowment funds are primarily used for scholarships and some faculty support; received from interest paid on invested donor gifts. In general, the IU Foundation is the main recipient of endowments and IU does not typically receive endowments unless IU is specified by the endowment (i.e., IU is named as the beneficiary).

| Fund Group Name | Major Sub-Fund Group | Account Prefix Number |

|---|---|---|

| Endowment Funds | N/A | 80 |

| Life Estate Funds | N/A | 82 |

| Quasi-Endowment Funds | N/A | 81 |

| Riley Hospital Endowment Funds | N/A | 83-85 |

Plant Funds

Plant funds are primarily used for new construction, renovation, building repairs, and maintenance. These fund groups are managed centrally either through manual entry or automatic batch entry.

| Fund Group Name | Major Sub-Fund Group | Account Prefix Number |

|---|---|---|

| Construction Fund | N/A | 90 |

| Retirement of Indebtedness Fund | N/A | 91 |

| Renewal and Replacement Fund | N/A | 92 |

| Investment in Plant Fund | N/A | 95 |

Additional Funds

| Fund Group Name | Major Sub-Fund Group | Account Prefix Number |

|---|---|---|

| Clearing and Rotating Funds | N/A | 68 |

| Agency Funds | Internal Agency Fund , External Agency Fund , Work Study Agency Fund | 96, 97, 98 |

| Component Unit Agency Funds | N/A | multiple accounts |

| Other Funds | Other Fund | 99 |

Requirements and Best Practices

This portion of the standard outlines requirements related to the chart of accounts fund and sub-fund groups, as well as best practices. While not required, the best practices outlined below allow users to gain a better picture of the entity’s financial health and help identify potential issues on a more frequent basis. This allows organizations to identify errors, mistakes, and pitfalls which can be remedied quickly and prevent larger issues in the future.

Requirements

- Fiscal officers should be knowledgeable of IU chart of accounts fund and sub-fund groups standard in full. In addition, fiscal officers should review the glossary to gain pertinent knowledge of accounting at IU.

- It is the responsibility of the fiscal officers to ensure the proper usage of individual fund and sub-fund groups during the selection process. Contact your RC fiscal officer or campus business office for internal reporting requirements related to proper fund group usage.

- If users have questions regarding the chart structure or attributes, contact the Accounting and Reporting Services team at uars@iu.edu.

Best Practices

- For additional information on the structure of the chart of accounts, attend the KFS Training Series held by the Financial Training and Communications team. Register by visiting the training website.

UCO-COA-1.03: Consolidation, Object Levels, and Object Codes

Prerequisites

Prior to reading the Chart of Accounts Consolidation, Object Levels, and Object Codes standard, it is beneficial to review the below standards to gain foundational information:

Preface

This standard discusses attributes of the chart of accounts including consolidation codes, object levels, object codes, and how they impact accounting and financial reporting at Indiana University. The information presented below will walk through a general understanding of the consolidation hierarchy, the appropriate usage of object codes, and the available clearing object codes within IU.

Introduction – What are Consolidation, Object Levels, and Object Code Attributes

An object code classifies a financial transaction as an income, expense, asset, liability, or fund balance. At Indiana University these attribute classes function similarly to accounts in most other organizations and become the basis for internal and external reporting. When submitting an object code document, users must specify the following required details:

| Chart Attributes | Definition |

|---|---|

| Fiscal Period | An institution’s defined yearly period used for the purposes of financial reporting. A requirement for submission of object code; it defines the active fiscal years to which general ledger entries can be posted. |

| Chart Code | Each campus has a unique chart. In addition, there are subsidiary charts on the Bloomington and Indianapolis charts to separate the activity of some auxiliary units. University administration, which includes organizations that serve all IU campuses, also has a unique chart. A requirement for submission of object code. |

| Object Code | All object codes belong to an object level. This is the summary code for a given range of detailed object code classifications and identifies the level to which the object code belongs. A requirement for submission of object code. |

| Object Sub-Type Code | This is the designation assigned to similar groups of object codes e.g. AR – Accounts Receivable, CA – Cash, DR – Depreciation etc. A requirement for submission of object code; most often used to help with internal reporting. |

Indiana University’s object code attributes were created to facilitate internal and external financial reporting and analysis. These attributes provide departments/units with the proper classification for the accurate recording of financial activities. As noted in the above consolidation pyramid, users can determine what level of reporting is needed, ranging from consolidation (high level overview) to sub-object code (highest level of detail). If a user wants to be granular and look at what a department spent on academic assistants, they can run a report using the single object code (2350) for academic assistant salaries. If the user wanted a broader look at spending on all student academic appointees in general, a report by the student academic appointees (SAAP) level code would be more appropriate. If the user wanted to zoom out even further and look at expenses related to compensation as a whole, a report by the CMPN consolidation level would be ideal. The level of detail required is based on the user’s needs.

Importance and Impact of Object Codes

IU is a large and evolving organization with many accounting complexities, which is why the chart of accounts is critical to aid in accurate and transparent reporting. These attributes ensure proper use of funds, compliance with applicable reporting standards, adherence to allocated budgets, and stewardship of IU resources. Categorizing financial data also allows users to understand the nature of the activity at a glance.

Object code attributes within the chart of accounts are associated with external compliance and certain IU policies related to grant and contract revenue, capital assets, travel, and sales tax. For example, these attributes help ensure a strong reporting hierarchy and correct routing and approval of transactions. Failure to use these attributes in the appropriate manner within the chart of accounts can cause confusion during the review and approval process and lead to errors in accounting and financial presentation. This in turn could jeopardize future funding sources such as state appropriations, gifts, or contracts and grants that rely on accurate financial statements.

Lastly, these attributes are key in external financial and tax reporting. Improperly categorizing IU’s financial transactions impacts what is reported on tax forms submitted to local, state, and federal organizations which can result in fines, negative IRS findings, and additional audit implications. Not submitting or incorrectly representing the financial data for the university can have major impacts on funding.

Indiana University’s Object Code Consolidation Hierarchy

Consolidation

All object levels report to a higher object consolidation code and are grouped with similar object levels for reporting presentation purposes. There are less than 30 object consolidation codes within IU’s chart of accounts. Examples of object consolidation codes include liabilities (LIAB), indirect cost recovery income (IDIN), and financial aid (SCHL). Please refer to the Object Consolidation Lookup.

Object Level

All object codes report to a higher object level code and are grouped with similar object codes for reporting presentation purposes. In other words, level codes are made up of a combination of related object codes. There are less than one hundred object levels within IU’s chart of accounts. Examples of object levels include academic salaries (ACSA), taxes (TAX), and repairs and maintenance (R&M). Please refer to the Object Level Lookup.

Object Code

An object code classifies a financial transaction as an income, expense, asset, liability, or fund balance. Object codes store information about financial transactions and categorize activity based on the nature of the transactions. There are over three thousand unique object codes within IU’s chart of accounts. In the Kuali Financial System (KFS), object codes are unique to a fiscal year and chart code. Object codes are automatically generated for the subsequent year prior to budget construction.

Object codes consist of a four-digit code and can remain the same over multiple fiscal periods within the same chart code. While every effort is made to keep object codes consistent across charts, there is some variability. For example, in the BA chart, object code 1470 may be used for Parking Garage – Poplars while the same 1470 object code is used for Other Gifts within the IU chart and for Jumpstart and Unlock Fees in the SE chart. Ensure when recording financial transactions that both the correct chart code and object code are used. The Office of the University Controller is responsible for the creation and maintenance of a full object code dictionary. Review object codes via the Object Code Lookup.

Sub-Object Code

Sub-object codes are tools that allow departments to further divide the activity of an object code as they choose. The main purpose of a sub-object code is for budgetary and expense tracking along with internal reporting purposes. Sub-object codes are unique to both an account and an object code and will assume all attributes of the associate object code. For example, a department might create sub-object codes within the office supplies object code to track purchases at a more granular level.

Appropriate Usage of Object Codes

IU’s budget and reporting structures are built on object codes. Specific object codes may have certain implications:

- Reportable object codes trigger tax reporting, such as miscellaneous income on Tax Form 1099-MISC.

- Some object codes are associated with external compliance and certain IU policies related to grant and contract revenue, capital assets, travel, sales tax, etc.

- Some object codes drive document routing configurations.

Object codes, like account numbers, have some logic built into the code. The first digit of the object code allows users to easily identify the accounting classification (i.e., income, expense, asset, liability). These object code prefixes (first digit) allow IU employees to easily identify and communicate about financial activity. KFS, however, does not rely on the object code prefix logic. The below table identifies the associated financial statement line item by the prefix of an object code.

| Prefix | Object Code |

|---|---|

| 0 or 1 | Income |

| 2 or 3 | Salaries and Wages |

| 4 or 5 | General Expense |

| 56 or 57 | Benefits |

| 6 | Employee Travel (non-employee travel: 4088 and 4089) |

| 7 | Capital Equipment |

| 8 | Assets |

| 9 | Liabilities/Transfer Codes/Fund Balance |

Project Codes

Project codes are specialty codes which are used to track how much is spent on a particular project, especially when the project is supported by many accounts. Project codes are optional and are used in conjunction with object codes, levels, and consolidation. Because project codes are not specific to an account, they can be used to track project activity that is shared across multiple accounts within an organization or even across multiple organizations.

An example of a project code might be to track activity related to a major campaign, such as the IU Bicentennial. The use of this code allows individuals to run specific reports to get a listing of all revenues and expenditures that have been assigned to the project. In order to submit a project code document, users must specify the following required attributes:

| Chart Attributes | Definition |

|---|---|

| Chart Code | Each campus has a unique chart. In addition, there are subsidiary charts on the Bloomington and Indianapolis charts to separate the activity of some auxiliary units. University administration, which includes organizations that serve all IU campuses, also has a unique chart. A requirement for submission of project code. |

| Organization Code | The organization code is unique within the chart to which it belongs and identifies the organization the report is being run for along with identifying the level to which the project code belongs. A requirement for submission of project code. |

Requirements and Best Practices

This portion of the standard outlines requirements related to the chart of accounts consolidation, object levels, and object codes, as well as best practices. While not required, the best practices outlined below allow users to gain a better picture of the entity’s financial health and help identify potential issues on a more frequent basis. This allows organizations to identify errors, mistakes, and pitfalls which can be remedied quickly and prevent larger issues in the future.

Requirements

- Fiscal officers should be knowledgeable of the chart of accounts consolidation, object levels, and object codes standard in full. In addition, fiscal officers should review the glossary to gain pertinent knowledge of accounting at IU.

- It is the responsibility of the fiscal officers to ensure the proper usage of individual object codes during the object code selection process. Contact your RC fiscal officer or campus business office for internal reporting requirements related to proper object code usage.

- If users have questions regarding the account structure or attributes, contact the Accounting and Reporting Services team at uars@iu.edu.

Best Practices

- For additional information on the structure of the chart of accounts, attend the KFS Training Series held by the Financial Training and Communications team. Register by visiting the training website.

A chart of accounts (COA) is a financial organizational tool that provides a complete listing of every account in the general ledger of a company broken down into subcategories. The chart of accounts can be expanded and tailored to reflect the operations of the company.

The general ledger (GL) acts as a repository of all financial and budget information. The GL contains all the financial transactions that are created via Kuali Financials documents, fed in from external systems, or created during batch processing.

Fund Groups are a way to organize accounts based on shared activity or objective, e.g. general fund accounts, contract & grant funds, etc.

Fund accounting is an accounting and reporting system commonly employed by independent colleges and universities to keep track of resources whose use is limited by donors, granting agencies, law, other outside individuals, entities, or by governing boards. A fund is maintained for each specific purpose.

Uniform Guidance is a set of authoritative rules and regulations about federal grants from the Office of Management and Budget (OMB).

A split-interest agreement is when more than one beneficiary is involved. This means a donor is providing a gift that benefits a government and someone else (typically the donor, their spouse, or their children) so the benefit of the gift is shared.

General funds are primarily unrestricted funds of the university. The general fund is budgeted annually and the main sources of funds are student fees and state appropriations with matching expenditures.

The designated fund is the use of unrestricted funds for institutional designated purposes such as a specific activity or project. Most designated funds are now budgeted and most have a multi-year life. The designated fund includes several major sub-fund such as continuing education, public services, etc.

Auxiliary enterprise funds furnish goods or services either internally or externally and charge a fee directly related to the cost of the goods or services. The auxiliary enterprise fund at IU is broken out between auxiliary funds and service funds.

The auxiliary fund is an enterprise that furnishes goods or services to students, faculty, or staff and charges a fee directly related to, although not necessarily equal to, the cost of the goods or services. This means that the entity is self-supporting.

Service funds are an enterprise that furnishes goods or services to other internal university departments and charges a fee directly related to, and equal to, the cost of the goods or services. This means that the entity is self-supporting, but is not allowed to make a profit.

Sources of funds include federal grants and contracts, state grants, special appropriations, and gifts and grants from private sources. Restricted C&G funds should not be recorded in this fund group until the terms of the agreement under which they were given to the university have been met. C&G funds are subject to Uniform Guidance.

Other restricted funds are expendable for operating purposes, but restricted by donors or other outside agencies as to the specific purpose for which they may be expended. Commonly used other restricted funds include fellowships, scholarships, and special state appropriations.

State appropriations are appropriations made to the university by the State Legislature. Income fund deposits are from tuition and other receipts deposited into the income fund for operating purposes.

Derived from indirect cost recovery, educational and administrative allowances, unrestricted gifts, and revenues from intellectual property (patents, copyrights, royalties).

The loan funds consist of loans to students, faculty, or staff, and of resources available for such purposes. Many are temporary and require repayment of principal and interest while some specify forgiveness of repayment under certain conditions. These funds are derived from private and governmental gifts and grants, federal borrowing, and unrestricted allocations. Interest revenue is returned to this fund as an increase to the available fund balance. Examples of loans included in the loan fund include Federal Perkins Loans, health professional loans, nursing loans, and institutional loans.

Endowment funds are funds with respect to which donors or other outside agencies have stipulated, as a condition of the gift instrument, that the principal is to be maintained inviolate and in perpetuity and invested for the purpose of producing present and future income which may either be expended or added to principal.

Life estate funds are funds contributed to an institution subject to the requirement that the institution periodically pay the income earned to designated beneficiaries.

Quasi-endowment funds are funds which the governing board of an institution or university management, rather than a donor or other outside agencies, have determined are to be retained and invested.

Riley Hospital endowment funds contributed to IU are directly related to the Riley Hospital. Similar to quasi-endowment funds, interest income is reinvested at year-end.

The construction fund is a subset of the plant funds and used for the acquisition of plant assets.

The retirement of indebtedness fund is a subset of the plant funds and used for long-term capital financing and debt.

The renewal and replacement fund is a subset of the plant fund whose funds are set aside for replacement of renewable property. An example of use of replacement funds is the purchase of computer replacements.

The investment in plant fund is a subset of the plant fund whose funds used for the purchase of capital assets. The fund is also used to record bonds and notes payable.

The clearing and rotating fund group is specific to IU and is used to record interim accounts that should be closed out (net to zero) at the end of the fiscal period. To post to this fund group, please reach out directly to the UCO cash accounting team prior to posting entries.

Funds held by an institution as custodian or fiscal agent for others such as student organizations, individual students, or faculty members. The agency fund is divided between internal and external fund recording.

The internal agency fund acts as the fiscal agent or trustee for the university. For financial reporting purposes, this fund group balance is reported as unrestricted at fiscal year-end. Common uses of this fund include withholdings for taxes for employees and sales tax. This fund group is managed internally by UCO.

This fund group is in direct relationship with the university mission and acts as reimbursement to the university for use of university property or service. This fund is managed by individual campuses and fiscal officers.

The work study agency fund is used to track money received for federal work study and is managed internally by UCO payroll.