Glossary

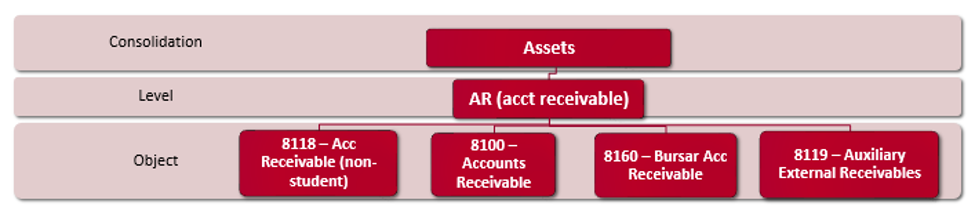

**Above is a table showing the difference between reporting levels object codes, level codes, and consolidation

| Term | Definition |

|---|---|

| Account Numbers | This is a 7-digit number for a pool of funds assigned to a specific university organization for a specific function. |

| Affiliated Organization | A legal entity operating substantially for the benefit or under the auspices of the university that operates in such a way that it could enter into a foreign source arrangement where part or all of the benefit of that arrangement is intended for the university. Significant Affiliated Organizations to IU include, but are not limited to, the following: Indiana University Foundation and IU Medical Group Foundation. |

| Agency Funds | Funds held by an institution as custodian or fiscal agent for others such as student organizations, individual students, or faculty members. The agency fund is divided between internal and external fund recording. |

| Auxiliary Enterprise Funds | Auxiliary enterprise funds furnish goods or services either internally or externally and charge a fee directly related to the cost of the goods or services. The auxiliary enterprise fund at IU is broken out between auxiliary funds and service funds. |

| Auxiliary Funds | The auxiliary fund is an enterprise that furnishes goods or services to students, faculty, or staff and charges a fee directly related to, although not necessarily equal to, the cost of the goods or services. This means that the entity is self-supporting. |

| Chart of Accounts | A chart of accounts (COA) is a financial organizational tool that provides a complete listing of every account in the general ledger of a company broken down into subcategories. The chart of accounts can be expanded and tailored to reflect the operations of the company. |

| Chart of Accounts Code | The two-letter chart code associated with the account. |

| Clearing and Rotating Funds | The clearing and rotating fund group is specific to IU and is used to record interim accounts that should be closed out (net to zero) at the end of the fiscal period. To post to this fund group, please reach out directly to the UCO cash accounting team prior to posting entries. |

| Construction Fund | The construction fund is a subset of the plant funds and used for the acquisition of plant assets. |

| Contract and Grant Funds | Sources of funds include federal grants and contracts, state grants, special appropriations, and gifts and grants from private sources. Restricted C&G funds should not be recorded in this fund group until the terms of the agreement under which they were given to the university have been met. C&G funds are subject to Uniform Guidance. |

| Designated Fund | The designated fund is the use of unrestricted funds for institutional designated purposes such as a specific activity or project. Most designated funds are now budgeted and most have a multi-year life. The designated fund includes several major sub-fund such as continuing education, public services, etc. |

| Designated Reporting Unit (DRU) | University administrative offices with significant activities or responsibilities that may impact foreign gift reporting compliance. DRUs include, but are not limited to Bursar, Office of Research Administration, Indiana University Foundation, and Kelley School of Business. |

| Endowment Funds | Endowment funds are funds with respect to which donors or other outside agencies have stipulated, as a condition of the gift instrument, that the principal is to be maintained inviolate and in perpetuity and invested for the purpose of producing present and future income which may either be expended or added to principal. |

| Exclude 01* Accounts | The university has 01* accounts that may need to be excluded in certain circumstances. These accounts are associated with contract and grant beginning balance amounts. These accounts reside in the sub-fund group: Other Designated: IU Initiative (SDCI). |

| Exclude Campus Consolidation Accounts | These 23* accounts are used to record adjusting entries to the balance sheet for internal activity that is consolidated at the university-wide financial statement level. The university has eight designated fund accounts (one for each campus) that are used to record the university consolidation entries in preparation for the annual financial audit. Depending on the type of reporting, it is not uncommon to exclude the following accounts for internal reporting purposes. BL 2320013 EA 2367013 IN 2371013 FW 2362013 KO 2363013 NW 2360013 SB 2355013 SE 2350013 UA 2310013 |

| External Agency Fund | This fund group is in direct relationship with the university mission and acts as reimbursement to the university for use of university property or service. This fund is managed by individual campuses and fiscal officers. |

| Financial Object Codes | Object codes are detailed, four-digit identifiers for income, expense, asset, liability, and fund balances. They are unique to a chart of account. |

| Financial Object Level Codes | Object level codes, or levels, are less specific than object codes. Levels are made up of similarly grouped object codes. See the understanding reporting levels chart for more details. |

| Financial Sub-Object Codes | Sub-object codes allow a department to specify a more detailed breakdown of an object code. |

| Fund Accounting | Fund accounting is an accounting and reporting system commonly employed by independent colleges and universities to keep track of resources whose use is limited by donors, granting agencies, law, other outside individuals, entities, or by governing boards. A fund is maintained for each specific purpose. |

| Fund Group | Fund groups are a way to organize accounts based on shared activity or objective, e.g. general fund accounts, contract & grant funds, etc. |

| General Fund | General funds are primarily unrestricted funds of the university. The general fund is budgeted annually and the main sources of funds are student fees and state appropriations with matching expenditures. |

| General Ledger | The general ledger (GL) acts as a repository of all financial and budget information. The GL contains all the financial transactions that are created via Kuali Financials documents, fed in from external systems, or created during batch processing. |

| Internal Agency Fund | The internal agency fund acts as the fiscal agent or trustee for the university. For financial reporting purposes, this fund group balance is reported as unrestricted at fiscal year-end. Common uses of this fund include withholdings for taxes for employees and sales tax. This fund group is managed internally by UCO. |

| Investment in Plant Fund | The investment in plant fund is a subset of the plant fund whose funds used for the purchase of capital assets. The fund is also used to record bonds and notes payable. |

| Life Estate Funds | Life estate funds are funds contributed to an institution subject to the requirement that the institution periodically pay the income earned to designated beneficiaries. |

| Loan Funds | The loan funds consist of loans to students, faculty, or staff, and of resources available for such purposes. Many are temporary and require repayment of principal and interest while some specify forgiveness of repayment under certain conditions. These funds are derived from private and governmental gifts and grants, federal borrowing, and unrestricted allocations. Interest revenue is returned to this fund as an increase to the available fund balance. Examples of loans included in the loan fund include Federal Perkins Loans, health professional loans, nursing loans, and institutional loans. |

| Object Code | An object code is used to organize and catalog financial data. An object code classifies a financial transaction as income, expense, asset, liability, or fund balance. |

| Object Consolidation | An object consolidation is a grouping of object levels for reporting purposes. |

| Object Level | An object level is a grouping of object codes for reporting purposes. |

| Organization Code | The organization code is unique within the chart to which it belongs and identifies the organization the report is being run for. |

| Organization Hierarchy | The organizational hierarchy presents the financial data based on organization code and provides a high level review of the data at a more consolidated level. In many cases, an organization reports directly to another organization. By selecting the organization hierarchy, users will be able to see all data from the selected organization plus any organizations that report to the selected organization. |

| Other Restricted Funds | Other restricted funds are expendable for operating purposes, but restricted by donors or other outside agencies as to the specific purpose for which they may be expended. Commonly used other restricted funds include fellowships, scholarships, and special state appropriations. |

| Quasi-Endowment Funds | Quasi-endowment funds are funds which the governing board of an institution or university management, rather than a donor or other outside agencies, have determined are to be retained and invested. |

| Renewal and Replacement Fund | The renewal and replacement fund is a subset of the plant fund whose funds are set aside for replacement of renewable property. An example of use of replacement funds is the purchase of computer replacements. |

| Responsibility Center Code | Code assigned to organizations that represent schools or major administrative units to facilitate the responsibility center management budgeting model. |

| Restricted Other Fund | Derived from indirect cost recovery, educational and administrative allowances, unrestricted gifts, and revenues from intellectual property (patents, copyrights, royalties). |

| Retirement of Indebtedness Fund | The retirement of indebtedness fund is a subset of the plant funds and used for long-term capital financing and debt. |

| Riley Hospital Endowment Funds | Riley Hospital endowment funds contributed to IU are directly related to the Riley Hospital. Similar to quasi-endowment funds, interest income is reinvested at year-end. |

| Service Funds | Service funds are an enterprise that furnishes goods or services to other internal university departments and charges a fee directly related to, and equal to, the cost of the goods or services. This means that the entity is self-supporting, but is not allowed to make a profit. |

| Special State Appropriations | State appropriations are appropriations made to the university by the State Legislature. Income fund deposits are from tuition and other receipts deposited into the income fund for operating purposes. |

| Split-Interest Agreement | A split-interest agreement is when more than one beneficiary is involved. This means a donor is providing a gift that benefits a government and someone else (typically the donor, their spouse, or their children) so the benefit of the gift is shared. |

| Sub-Account Numbers | An account within an account. Cannot be used without entering the account number above. |

| Sub-Fund Group | Optional parameter to limit report to a specific sub-fund group. |

| Uniform Guidance | Uniform Guidance is a set of authoritative rules and regulations about federal grants from the Office of Management and Budget (OMB). |

| Work Study Agency Fund | The work study agency fund is used to track money received for federal work study and is managed internally by UCO payroll. |