4 University Administration

Trustees • Board of Advisors • Physical Facilities • Budget

The Trustees of Indiana University

Chair

W. Quinn Buckner

Email: bdot@iu.edu

Vice Chair

Harry L. Gonso

Email: bdot@iu.edu

Chair, Student Relations Committee

Kelsey E. Binion

Email: bdot@iu.edu

Cathy Langham

Email: bdot@iu.edu

Chair, Finance, Audit and Strategic Planning Committee

Cindy Lucchese

Email: bdot@iu.edu

Chair, Nominating Committee

Michael J. Mirro, M.D.

Email: bdot@iu.edu

Chair, Academic Affairs and University Policies

Jeremy A. Morris

Email: bdot@iu.edu

Chair, Facilities and Auxiliaries Committee,

Donna Spears

Email: bdot@iu.edu

Vivian Winston

Email: bdot@iu.edu

Board of Advisors

Doug Bates

2018-2021

Stites & Harbison PLLC

Michael Bauer (Chair)

2017-2020; 2020-2023

Wes Banco

Ideisha Bellamy

2022-2025

Mayhurst, Inc.

Cory Cochran

2022-2025

River Hills

John Colin

2019-2022; 2022-2025

Simpson, Thompson & Colin, LLC.

Patty Cress

2022-2025

Retired, US Census Bureau

Jeremy Finn

2022-2025

Monroe Shine & Co.

Jerome K. “Jerry” Finn

2021-2024

Retired, Caesars Foundation

Nick Garing

2022-2025

The Exchange Pub & Kitchen

Shelley R. Gast

2021-2024

Norton Healthcare

Judge Maria Granger

2018-2021; 2021-2024

Judge, Floyd Superior Court, #3

Lisa Huber

2022-2025

Retired

D. Jack Mahuron

1990-1996; 2003-2009;

2011-2017; 2017- 2020; 2020-2023

Clark Memorial Hospital

Martin Padgett

2021-2024

Clark Memorial Hospital

Rudolph “Rudy” Spencer III

2022-2025

BlueSky Foundation, Inc.

Marguerite Stearns

2021-2024

Bill White

2022-2025

Indiana Members Credit Union

Beau F. Zoeller

2021-2024

Frost, Brown, Todd Attorneys, LLC

Physical Facilities

| BUILDING | YEAR OCCUPIED | SQUARE FEET |

| Crestview Hall | 1972 | 41,078 |

| University Center South (previously Library) | 1972 | 82,007 |

| Physical Sciences Building | 1972 | 32,393 |

| Service Building | 1974 | 12,202 |

| Hillside Hall | 1975 | 50,995 |

| Life Sciences Building | 1975 | 79,039 |

| University Center North (previously University Center) | 1976 | 39,835 |

| Multipurpose Building (previously Children’s Center) | 1978 | 2,051 |

| Activities Building | 1979 | 32,522 |

| Knobview Hall | 1991 | 77,797 |

| Ogle Center | 1994 | 87,689 |

| Library | 2005 | 75,887 |

| Forest Lodge | 2008 | 27,810 |

| Grove Lodge | 2008 | 27,810 |

| Meadow Lodge | 2008 | 34,721 |

| Orchard Lodge | 2008 | 34,721 |

| Woodland Lodge | 2008 | 34,721 |

| Hausfeldt Building* | 2010 | 4,001 |

| Subtotal | 777,279 | |

| Leased Space | ||

| Graduate Center – Water Tower Square | 2012 | 5,565 |

| Total | 782,844 |

Data has been updated and cross-referenced with the Bureau of Facilities Programming and Utilization and is accurate as of October 2021 (dates of occupancy and gross square feet may have changed from previous versions).

* Hausfeldt Building was leased from 2002 to 2010 and was purchased in 2010.

Official Budget

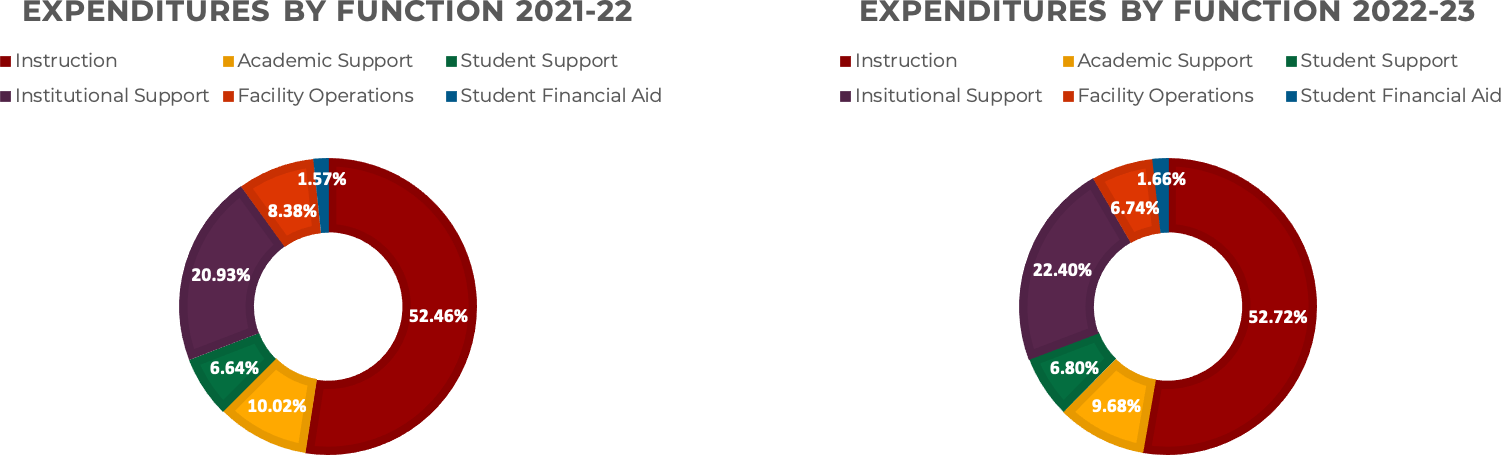

Expenditures by Function

General Fund Only

| 2021-22 | 2022-23 | % Inc/-Dec | |

| Instruction | $28,382,526 | $27,074,020 | -4.6% |

| Research | 0 | 0 | N/A |

| Academic Support | 5,418,534 | 4,970,911 | -8.26% |

| Student Support | 3,592,147 | 3,489,651 | -2.85% |

| Institutional Support | 11,319,678 | 11,500,444 | 1.6% |

| Physical Plant | 4,533,538 | 3,460,562 | -23.67% |

| Student Financial Aid | 849,829 | 850,000 | 0.02% |

| Total Expenditures | $54,096,252 | $51,345,588 | -5.08% |

Notes:

Instruction – Includes all expenditures with the primary purpose of instructional activity.

Research – Includes separately budgeted expenditures for research bureaus, institutes and similar programs.

Academic Support – Includes libraries, academic computing services, audio-visual services, academic unit administration, course development, and related expenditures.

Student Support – Includes student services administration, cultural and social development, counseling and career guidance, and financial aid administration.

Institutional Support – Includes executive and general management, administration, fiscal operations, sponsored program administration, student records and admissions.

Facility Operations – Includes all expenditures related to the operations and maintenance of the plant.

Student Financial Aid – Includes all forms of student financial assistance.

Fiscal years 2021-22 and 2022-23 are base budget as of July 1 of each fiscal year.

Source: Indiana University Budget Office

| 2021-22 | 2022-23 | |

| Instruction | 52.47% | 57.73% |

| Research | 0.00% | 0.00% |

| Academic Support | 10.02% | 9.68% |

| Student Support | 6.64% | 6.8% |

| Institutional Support | 20.93% | 22.4% |

| Facility Operations | 8.38% | 6.74% |

| Student Financial Aid | 1.57% | 1.66% |

Summary by Fund Group

| 2021-22 | 2022-23 | % Inc/-Dec | |

| General Educational Fund | $54,096,252 | $51,345,588 | -5.08% |

| Designated and Other Restricted | 8,668,417 | 7,624,716 | -12.04% |

| Contract & Grants | 15,885,445 | 500,000 | -96.85% |

| Auxiliary Enterprises | 3,570,852 | 3,415,655 | -4.35% |

| Total Expenditures | $82,220,966 | $62,885,959 | -23.52% |

Notes:

General Educational Fund – Funds supported primarily by state appropriation and student fees. Includes academic departments, physical plant, and general administration.

Designated and Other Restricted – Funds allocated for specific purposes by Trustees or donor/agency. Includes Federal Pell Grants, gifts, and special scholarships.

Contract & Grants – Funds whose use is specified by the donor or agency. Includes scholarships, research grants, contracts, and federal relief from HEERF II and III.

Auxiliary Enterprises – Self-supporting activities for the benefit of students, faculty, staff, and the public. Examples include student housing, dining services, and parking.

Fiscal years 2021-22 and 2022-23 are base budget as of July 1 of each fiscal year.

Source: Indiana University Budget Office

| 2021-22 | 2022-23 | |

| General Educational Fund | 65.79% | 81.65% |

| Designated and Other Restricted | 10.54% | 12.12% |

| Contract and Grants | 19.32% | .8% |

| Auxiliary Enterprises | 4.34% | 5.43% |

Function Codes

Each account within the university’s chart of accounts is coded for its primary activity. These codes are used to aggregate similar expenditures of the institution. The following set of codes has been used to display the budgeted expenditures

Instruction: Includes those accounts whose primary purpose is instructional activity.

Research: Includes separately budgeted expenditure accounts for research bureaus and institutes and similar units and programs. Sponsored research activity is recorded in distinct restricted fund accounts.

Public Service: Includes accounts primarily designed to serve the general public, including patient services of teaching clinics and other centers and activities.

Academic Support: Includes libraries, academic computing services, museums, audio-visual services, academic unit administration, course development, and related expenditures.

Student Support: Includes student services administration, cultural and social development, counseling and career guidance, and financial aid administration.

Institutional Support: Includes executive and general management and administration, fiscal operations, sponsored program administration, student records and admissions.

Facility Operations: Includes all expenditures related to the operations and maintenance of the plant.

Student Financial Aid: Includes all forms of student financial assistance.

Funds Included in the IU Operating Budget

General Educational Fund

State appropriation, student fee income, other income: Supported primarily by state appropriation and student fees. Includes academic departments, schools and divisions, other academic support, physical plant, general administration.

Medical Practice Support: Provided by private practice patient revenues supporting academic departmental expenditures in the School of Medicine.

Designated and Other Restricted Funds

Continuing Education: Supported primarily by participants’ fees. Examples include non-credit instruction, Indiana Executive Development Program, professional development programs.

Public Service: Supported primarily by user fees. Examples include professional publications in law, history, folklore.

Faculty Research: Includes unrestricted fund support for faculty research.

Other Designated: Funds allocated for specific purposes by Trustees. Includes student activity fee-supported activities and special professorships.

Designated and Restricted Scholarships and Fellowships: Student aid funds whose use is specified by either the Trustees or the donor/ agency. Includes Pell grants but excludes state student assistance. For smaller, less regular sources, the amount and frequency of expenditures is determined by the current availability of resources and not included in the budget.

Special State Appropriations: State appropriations designated in appropriation acts for specific purposes. Largest units: The Indiana Institute for Disability and the Community, Indiana Geological Survey, and Department of Toxicology.

Faculty Endowment Match Program: Supported by donors with a defined annual match from the school and the President for gifts of $500,000 or more received after December 1, 1995 for the purpose of direct faculty support. Used to fund expenditures of endowed professorships or chairs.

Other Restricted: Funds whose use is designated by donor. Includes gifts and special professorships.

Contracts and Grants

Funds whose use is specified by donor or agency. Includes scholarships, fellowships, research grants and contracts.

Auxiliary Enterprises

Auxiliary Enterprises: Activities, largely self-supporting, for the benefit of students, faculty, staff, and the public. Examples include Ambulatory Care, student housing, bookstores, Indiana Memorial Union, Intercollegiate Athletics.

Funds Included in the IU Operating Budget Indirectly.

Service Departments

Service Departments: Units providing supporting services to Indiana University. Operated from charges to departments in other fund groups. Examples include Printing Services, Computing Services, and Telecommunications. Because their revenue source is other University funds, their budgets are not counted again in the totals presented.

Funds Not Included in the IU Operating Budget.

IU Endowments

Donor funds for which the principal donated cannot be expended; it must remain intact in perpetuity, and therefore is not an operating budget component. The interest income earned on the principal amount can be expended and budgeted in the fund groups above.

Loan Funds

Non-current funds provided by various sources that may be lent to students, faculty and staff. Loan funds arising from gifts, bequests, governmental grants and student fees are generally operated on a revolving fund basis, with loan and interest payments remaining in the loan fund group for future lending. Due to the noncurrent nature of this fund group, it is excluded from the annual operating budget.

Plant Funds

Non-current, unexpended funds used to acquire long-lived assets for institutional purposes, including land acquisitions, construction and major remodeling of facilities, retirement of indebtedness, renewal and replacement of property and equipment, and the cost (or fair value at time of donation) of long-lived assets.

IU Foundation and IU Research & Technology Corporation

Separate legal entities. Indiana University does not maintain control or custody of these resources.