Standards

OVERVIEW OF accrual Accounting

Prior to reviewing this standard, it is important to understand the process of closing and the parties responsible for completing the closing process.

Closing refers to the process of finalizing an entity’s financial information and creating reports after a specified accounting period has ended. Closing procedures are performed on an interim and year-end basis to keep accounting data organized and ensure all transactions for the period are properly accounted for and recorded on a timely and accurate basis. The Office of the University Controller requires Constituent Reporting Units (CRUs) to submit closing documentation on an interim and year-end basis. A CRU is determined by meeting a $35,000,000 threshold in revenues, expenses, or net assets for a minimum of 2 consecutive years. A CRU will be removed from the list if the threshold is not met for 3 consecutive years. Review the internal controls and roles and responsibilities IU accounting standards book for a detailed explanation of a UCO-IRR-2.00 Constituent Reporting Unit and a List of Active CRUs at Indiana University. Key fiscal officers within a CRU are responsible for several items at interim close including reviewing IU accounting standards, reviewing system and user roles, financial statement variance analysis, balance sheet balance substantiation, posting and reviewing accruals, and account reconciliation. Key fiscal officer responsibilities included in year-end close procedures consist of interim closing activities in addition to specific year-end items such as org reversion, covering cash balances, and sub-certification. Both interim and year-end closing procedures are accompanied by a checklist to be submitted by the CRU alongside required materials. The list and relevant scope are subject to change annually and individual specific requirements as determined by each campus and/or RC need to be considered in addition to this checklist.

Review the UCO Fiscal Officer Calendar for closing deadlines. It is important to note that several KFS e-docs are due by a specific date. If you use Financial Processing (FP) e-docs in KFS, these documents must be in the system and fully approved by 10:00 p.m. for the entries to be processed by the accounting cycle and reflected in the closing reports. Because some KFS e-docs require additional administrative approvals, on the day of each closing, e-docs should be completed by 12:00 p.m. to allow for all necessary routing and approvals. If you require access to KFS, please contact your RC fiscal officer.

UCO-CLS-1.00: Accrual Accounting

Prerequisites

Prior to reading the Accrual Accounting Standard, it is beneficial to review the standards below to gain foundational information:

- UCO-SYS-2.03 Accrual Voucher Standard

- Accounting Fundamentals Standards

- Chart of Accounts and General Ledger Standards

- Financial Statements Standards

Preface

Indiana University is required by Government Accounting Standards (GASB) to prepare financial statements on a full accrual basis. The accrual accounting requirement applies to all fund groups of the institution and all financial activities that may be significant enough to influence the university’s financial results. Please refer to the UCO-SYS-2.03 Accrual Voucher Standard for the current AV threshold. The Office of the University Controller requires that financial statement accruals are processed at a minimum, quarterly, and as a best practice, on a monthly basis. The following standard outlines the general principles of accrual accounting, how accrual entries impact the income statement and balance sheet of the university and the department, as well as the methods for which the transactions are recorded at Indiana University. For more information about the accrual voucher document used to complete accrual transactions, please see the UCO-SYS-2.03 Accrual Voucher Standard.

Introduction

Understanding Accrual vs. Cash Basis of Accounting

There are two main methods of accounting, accrual method and cash basis method. Indiana University is required to follow the accrual method of accounting under US GAAP. Accrual accounting recognizes revenues when earned and expenses when incurred, regardless of when cash is exchanged. For example, if the revenue is earned in June, it is recorded to the income statement in June, regardless of when the entity received payment from the customer. This method differs from the cash basis method which records revenues and expenses only when monies are exchanged.

To illustrate the differences in these accounting methods, let’s review the following scenarios:

Scenario 1: On January 1, a unit signs a lease to rent space in a building. The monthly rental payment is $100,000/month, but the contract specifies that you will pay the rent for the entire year up front for a total of $1,200,000.

- Cash basis – The unit would record this expense on 1/1 when you paid the $1,200,000.

- Accrual basis – The unit would record a prepaid expense in the month you paid the fee (i.e., $1,200,000) and then you would recognize a $100,000 expense for each subsequent month you use the building for each of the next twelve months.

Indiana University is required to follow the accrual basis of accounting in example B.

Scenario 2: On January 1, you agree to perform consulting services for a client to be completed over the next two years. Each month you agree to perform $240,000 of work on the client’s behalf. The client signs the fee agreement and pays you $2,880,000.

- Cash basis – The unit would record the revenue on 1/1, when you received the cash from the customer.

- Accrual basis – The unit would record unearned revenue in the month you received the fees and then you would recognize the revenue when you actually perform the services for the client.

Indiana University is required to follow the accrual basis of accounting in example B.

Accrual Entries

In order to comply with the accrual method of accounting, accrual entries above the IU threshold established in the UCO-SYS-2.03 Accrual Voucher Standard, must be posted to recognize revenue and expenses in the appropriate accounting period. For example, revenue that has been earned during the period where cash has not yet been received must be recorded in the general ledger to recognize the earned income. The same is true for expenses that have been incurred and not yet paid. Likewise, cash received or paid in advance of services or goods provided must be deferred to the correct accounting period. Note that accrual accounting entries impact both the income statement and the balance sheet. Accruals (and deferrals) are made via journal entries at the end of each accounting period using an Accrual Voucher in the Kuali Financial System. These are completed during the interim and annual closing processes so that the reported income statement and balance sheet are accurate and complete.

There are many types of accruals, but most fall under one of the two main types: revenue accruals and expense accruals.

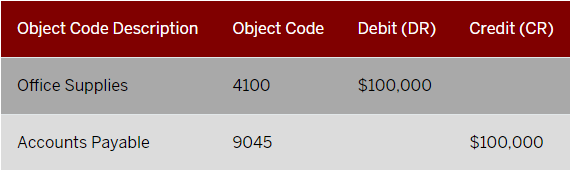

- Expense accrual: when services or goods have been received by an IU department but have not yet been paid. At Indiana University, all BUY.IU purchase entries are automated, and the accounts payable accrual will be posted automatically. For example, assume a department purchased and received $100,000 of office supplies in June 202X, but the invoice (bill) was not paid until July 202X. As the expense was incurred but not paid, in addition to the expense, a payable will need to be recorded. For IU’s current year financial statements to be complete, the following accounting entry will be recorded in the general ledger:

- The university records an automated accrual entry for accounts payable at year-end. Fiscal officers reconciling accounts should ensure that any manual accrual entries made by the department have not duplicated the automated accounts payable entry recorded by the university. Additionally, the fiscal officer should ensure that any significant accrual which was not recorded in the automated AP process is booked manually.

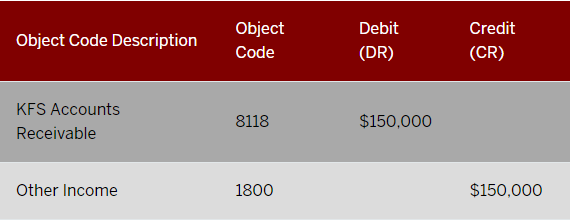

- Revenue accrual: when revenue has been earned by providing goods or services, but payment has not yet been received. Under the accrual method of accounting, revenue is recognized when earned. If payment has not yet been received it will be reflected in the general ledger as a receivable. For example, assume an external research company orders and receives $150,000 worth of goods from the university’s biology department. The external company will pay for the goods the following month after receiving an invoice. In the Kuali Financial System (KFS), creating an invoice automatically generates an accrual entry posted to the general ledger as accounts receivable and recognizes the revenue from the sale of the goods as earned before the payment is received. For the current period’s financial statements to be accurate and complete (under the accrual method of accounting) the following accounting entry must be recorded in the general ledger in the period the goods are sent to the customer.

Importance and Impact of Accruals

It is critical that all significant accrual entries are recorded accurately, timely, and completely to ensure that the university’s external financial statements are fairly stated, as required by Government Accounting Standards Board (GASB).

Accrual accounting is also important for internal management reporting and decision making to ensure that financial statements accurately reflect the financial position of the university.

To summarize, accrual adjusting entries are required for:

- Ensuring accuracy and consistency of the university’s financial statements in accordance with Governmental Accounting Standards Board (GASB) and Generally Accepted Accounting Principles(GAAP).

- Providing informed management and executive decision making.

- Supporting comparative analysis across organizations, as well as between financial statement periods and budgeted to actual results.

Period accruals, deferrals, and other adjusting entries must be recorded prior to issuing period financial statements. These accruals are typically posted on the 10th day of the subsequent month (i.e. a February tuition accrual will be posted in the system on March 10th). If the 10th falls on a weekend or holiday, the accrual will be posted on the next business day. Refer to the UCO Fiscal Officer Calendar for actual cutoff dates. Accruals are an important part of proper financial statement reporting which is utilized in both internal and external audit procedures. It is key to have the reports readily available for audit purposes. A unit’s inability to provide the requested information can adversely impact IU’s audit and potentially impact funding.

Recording of Accruals

There are system-generated and non-system-generated accruals within IU. Because the university operates on a full accrual basis, multiple accrual entries are generated on a university-wide basis by enterprise systems. It is critical that departments do not duplicate system-generated accruals. See below for more information on these system-generated accrual entries.

Non-System-Generated Accruals

Non-system-generated accruals are accruals that are calculated and entered manually by the departmental user to appropriately account for activities during the period. Manual accrual entries generated by a department are entered into KFS via an Accrual Voucher Adjusting Entry (AVAE). See requirements and best practices below. Examples of when to use this document include the accrual of revenues earned but not yet received or recording expenses incurred but not yet paid. This allows the entity to reflect the amount of revenue or expense incurred in the proper fiscal period and allows the matching of income with expense. These entries may be set up to automatically reverse in a subsequent period on a specified future date. For examples and more information on how the Accrual Voucher works, please see the UCO-SYS-2.03 Accrual Voucher Standard.

Internal Accrual Entries

Internal accrual entries (between any two IU accounts) should be limited to only internal receivables (object 8117) and internal payables (9117). The department recording the transaction must ensure that both the internal receivable AND the internal payable are both recorded to the respective accounts. No other internal accrual transactions should be recorded.

Accrual Entries between IU and the IU Foundation (IUF) or other Component Units of the University

Accrual entries between IU and the IU Foundation or other component units of the university (affiliate university organizations) should be recorded by university departments in accordance with Generally Accepted Accounting Principles when revenues are earned or expenses have been incurred and the amounts meet the university’s minimum accrual threshold. These transactions should be recorded as external receivables using the object codes below.

Receivables (object code 8119) and corresponding revenue amounts (object code 1179) from the IU Foundation should be recorded on an Accrual Voucher (AV) document on a quarterly basis at minimum only if all of the following criteria have been met:

- The unit has incurred a reimbursable expense from the IU Foundation.

- The unit has initiated a reimbursement e-doc from the Foundation (IUF ETA doc reference number must be referenced within the KFS AV document).

- The unit has not already received the cash from IUF in the accounting period that the expense was incurred.

A fiscal officer should confer with their campus controller regarding any significant accruals between IU and IUF or other component units prior to recording the transaction.

System-Generated Accruals

The university generates multiple system accruals. It is critical that university departments do not manually duplicate a system-generated accrual. See the list of system-generated accrual entries below. Additionally, all system accrual object codes below are restricted for manual use and may not be adjusted. If you have questions regarding the accuracy of a system-generated accrual, consult with your campus controller.

Human Resource Management System (HRMS)

- Salaries Payable (9050) – The posting of salaries, wages, and benefits to the labor ledger and the general ledger occurs when each payroll is closed. However, since the cash has not been paid, the offset for payroll expenses is recorded as a salaries payable accrual. On payday, the entry to salaries payable is reversed and cash is reduced.

- Biweekly Payroll Accrual (9050) – The biweekly payroll accrual is an estimate of payroll expense for days worked in a month that have not been processed in payroll. This entry typically occurs in the last few working days of the month. Additional information can be found within the payroll accruals document.

- Accrued Vacation and Sick Liability (9056 and 9058) – Annually, a calculation is made to record the university’s accrued vacation and sick liability. The entry is based on a number of factors including salary plan, age, years of service, rate of pay, and vacation balances. Typically, this entry is booked in the latter part of June and reversed in June of the following year. Liability amounts are recorded for vacation, sick, employer contributions for vacation and sick, and an employer contribution for Federal Insurance Contributions Act (FICA).

BUY.IU

- Accounts Payable (9045) – To properly recognize expense when the good/service is provided, even if payment has not been made, an accrual adjusting entry is posted as a liability. Accruals posted to object code 9045 are system-generated and act as an offset to invoice expenses, credit memo credits, and cash disbursements entries recorded through BUY.IU. The liability is relieved when the ACH, wire, or payment is sent to the supplier.

- Year-End Accounts Payable Accrual (9045) – During the AP accrual batch process, BUY.IU identifies the invoice transactions posted to the general ledger (GL) in July that had an invoice date of June 30 or prior. Those entries, which include actual expenses and liabilities, will be posted back to June (period 12). This process is repeated a second time prior to second close to capture additional BUY.IU invoices where the invoice was dated June 30 or prior. These transactions will be posted back to June (period 13).

Student Information Systems (SIS)

- Tuition Accrual (Multiple) – The Office of the University Bursar is responsible for assessing student tuition and fees in the Student Information System (SIS). The accounting feed occurs monthly to create and record entries from the SIS in the Kuali Financial System (KFS) general ledger. Tuition is both accrued and expensed automatically by the system.

- Unearned Revenue Accrual (9404) – When a student registers for classes, the SIS creates an entry to debit accounts receivable and credit unearned revenue. For example, for the spring semester, registration opens in mid-October and payment is due in early January. Since a majority of the students register for the spring semester prior to 12/31, a large receivable and offsetting unearned revenue (liability) is created from SIS. These amounts result in an overstatement of assets and liabilities. To correct this, the Office of the University Controller does an accrual adjusting entry to eliminate the receivable that pertains to the spring semester; the offset being unearned revenue. This results in a balance in unearned revenue (as it pertains to tuition) consisting of payments made by students prior to 12/31 for the spring semester. The entry to record the unearned revenue is made outside of the 2nd quarter financial statement. This entry is recorded centrally outside of KFS and units are not expected to make any manual adjustments.

KFS

- Depreciation (89** and 51**) – The principle of historical cost requires that capital assets are recorded at their original cost. However, as time passes and the assets are used, they will typically depreciate in value. In order to reflect this change in asset value in IU’s financial statements, capital assets are depreciated over their useful life. Depreciation expense (income statement) and accumulated depreciation (balance sheet) are driven by information contained in the Kuali Financial Capital Asset System. Depreciation is calculated using the straight-line method and is recorded on the 3rd Thursday of each month (except for year-end). For more information, please refer to the Capital Asset Standards.

- Non-Student Accounts Receivable (8118) – These are funds owed to the university by outside entities that have received goods or services for which payment is expected. Specifically, this accrual includes charges billed to external parties and all charges billed to students outside of the SIS. Under accrual accounting, in order to properly recognize revenue earned when the payment has not yet been received, an accrual is posted as a receivable balance. This entry is subsequently reversed when payment is received for the good or service provided. All invoices recorded through the KFS Accounts Receivable system will automatically record a receivable to 8118. If the invoice was not entered during the period when the revenue was earned by the department, the university department must also record a manual AVAE document to recognize the receivable in the appropriate accounting period.

Requirements and Best Practices

In order to ensure the accuracy of the university and unit level (internal) financial statements, it is important that each university department follows the accrual accounting method and adjusts its accruals as required.

This portion of the standard outlines requirements related to the closing procedures for accruals, as well as best practices. While not required, the best practices outlined below allow users to gain a better picture of the entity’s financial health and help identify potential issues on a more frequent basis. This allows organizations to identify errors, mistakes, and pitfalls which can be remedied quickly and prevent larger issues in the future.

Requirements

Required quarterly for items listed below:

- Review all system-generated (automated) accruals for material accuracy and completeness. Fiscal officers should understand the cause of any material variances. Additionally, fiscal officers should not duplicate any system-generated (automated) accruals. Any questions regarding system accruals should be discussed with your campus controller.

- Record any appropriate manual accrual or deferral entry over the IU required threshold to ensure the accuracy of the interim and annual financial statements. Refer to the Closing Checklist document for threshold values.

- Ensure that all significant contracts or external agreements of the departmental organization have been reviewed timely and communicated to the campus controller to ensure that accrual entries are properly recorded in the appropriate period.

- Ensure that proper substantiation for all accrual entries is available upon request by external or internal auditors and that documentation is attached to all transactions where required.

- Ensure that all accounts and object codes (income statement and balance sheet) are reconciled on a quarterly basis to identify any missing or inaccurately recorded accrual entries and that all entries have appropriately reversed from a prior period.

- Substantiate all balance sheet balances that have resulted from manual accrual entries. Refer to the UCO-CLS-2.00: Balance Sheet Substantiation Standard for further information.

Best Practices

- Complete the closing procedures required above on a monthly basis to ensure accurate and timely financial results.

Accrual accounting is a method that records revenue when it is earned and records expenses when they are incurred, not when the cash is received. Different than cash accounting, this method provides a more realistic understanding of income and expenses and helps with long term projections.

Accounting method which records revenues and expenses only when monies are exchanged.

US Generally Accepted Accounting Principles (US GAAP) is the combination of authoritative standards (requirements) and the commonly accepted ways of recording and reporting accounting information.

Prepaid expenses are future expenses that have been paid in advance. In other words, prepaid expenses are costs that have been paid but are not yet used up or have not yet expired.

Unearned revenue is a liability account that reports amounts received in advance of providing goods or services. When the goods or services are provided, this account balance is decreased and a revenue account is increased.

An Accrual Voucher is a KFS document used to post accruals, adjustments, and recode entries.

The organization responsible for establishing accounting and financial reporting standards for state and local governments and those entities that are funded by state and local government.

US Generally Accepted Accounting Principles (US GAAP) is the combination of authoritative standards (requirements) and the commonly accepted ways of recording and reporting accounting information.

A deferral often refers to an amount that was paid or received, but the amount cannot be reported on the current income statement since it will be an expense or revenue of a future accounting period. In other words, the future amount is deferred to a balance sheet account until a later accounting period when it will be moved to the income statement.