Standards

OVERVIEW OF Substantiation

Prior to reviewing this standard, it is important to understand the process of closing and the parties responsible for completing the closing process.

Closing refers to the process of finalizing an entity’s financial information and creating reports after a specified accounting period has ended. Closing procedures are performed on an interim and year-end basis to keep accounting data organized and ensure all transactions for the period are properly accounted for and recorded on a timely and accurate basis. The Office of the University Controller requires Constituent Reporting Units (CRUs) to submit closing documentation on an interim and year-end basis. A CRU is determined by meeting a $35,000,000 threshold in revenues, expenses, or net assets for a minimum of 2 consecutive years. A CRU will be removed from the list if the threshold is not met for 3 consecutive years. Review the internal controls and roles and responsibilities IU accounting standards book for a detailed explanation of a UCO-IRR-2.00 Constituent Reporting Unit and a List of Active CRUs at Indiana University. Key fiscal officers within a CRU are responsible for several items at interim close including reviewing IU accounting standards, reviewing system and user roles, financial statement variance analysis, balance sheet balance substantiation, posting and reviewing accruals, and account reconciliation. Key fiscal officer responsibilities included in year-end close procedures consist of interim closing activities in addition to specific year-end items such as org reversion, covering cash balances, and sub-certification. Both interim and year-end closing procedures are accompanied by a checklist to be submitted by the CRU alongside required materials. The list and relevant scope are subject to change annually and individual specific requirements as determined by each campus and/or RC need to be considered in addition to this checklist.

Review the UCO Fiscal Officer Calendar for closing deadlines. It is important to note that several KFS e-docs are due by a specific date. If you use Financial Processing (FP) e-docs in KFS, these documents must be in the system and fully approved by 10:00 p.m. for the entries to be processed by the accounting cycle and reflected in the closing reports. Because some KFS e-docs require additional administrative approvals, on the day of each closing, e-docs should be completed by 12:00 p.m. to allow for all necessary routing and approvals. If you require access to KFS, please contact your RC fiscal officer.

UCO-CLS-2.00: Balance Sheet Substantiation

Prerequisites

Prior to reading the Balance Sheet Substantiation Standard, it is beneficial to review the below standards to gain foundational information:

- Accounting Fundamentals Standards

- Chart of Accounts and General Ledger Standards

- Financial Statements Standards

Preface

This standard discusses the elements of the balance sheet substantiation document and how it is used internally within Indiana University. Information presented below will walk through what a balance sheet substantiation is, how to complete this closing procedure, requirements, and best practices related to this process. For further information on how to pull the balance sheet report to conduct a balance sheet substantiation, refer to the Financial Statement Reports Instructions.

Introduction

The balance sheet substantiation is key during quarter and year-end close as it helps the responsibility center (RC), campus, and IU ensure the accuracy of their financial statements.

Balance sheet substantiation within IU refers to detailed documentation or work papers substantiating the non-system-generated object code balance sheet amounts. Non-system-generated object codes are object codes manually added by a user and are not part of the initial system-generated object codes. The supporting documentation or substantiation should be detailed enough that a person without extensive knowledge of the entity can review the support, understand the nature of the balance, and tie it to the amounts on the balance sheet. To ensure accuracy of balances and compliance with all local, state, and federal requirements, auditors request substantiation showing how balances on the balance sheet are derived. In order to ensure all fiscal officers are familiar with the requirements for balance sheet substantiation, examples of appropriate support to provide are discussed below.

Importance and Impact of Balance Sheet Substantiation

A balance sheet provides a snapshot of an entity’s financial position or health at a given time. As a result, IU strives to be as accurate as possible in its financial reporting. To help increase accuracy, the Office of the University Controller (UCO) requires all non-system-generated balance sheet amounts above a threshold (as noted in the closing checklist) be supported by detailed documentation at the object code level. System-generated object codes are not included because they have system integrated internal controls in place and UCO has the ability to access the subledgers to substantiate their balances. Supporting documentation for system-generated object codes is only required when manual adjustments have been made by the entity. By providing this information, executive management is able to provide greater assurance that the financial statements are accurate, improve transparency, and help to reduce risk.

In addition, having the substantiation readily available assists in the audit both internally and externally. Balance sheet substantiation is a crucial internal control in financial reporting which is heavily reviewed in the audit process. Without substantiation, auditors are unable to verify balance sheet balances, which could lead to a misrepresentation of the balance sheet and audit findings with major negative impacts. This may lead to issues concerning internal controls or the integrity of the financial statements which impacts future funding from government organizations, creditors, or individual donors.

How to Perform a Balance Sheet Substantiation

All university entities with accounts that have non-system-generated asset and liability balances must be able to provide substantiation for the balances on their balance sheet. It is encouraged that entities complete balance sheet substantiation within five business days after the close of each fiscal quarter.

Instructions to Substantiate Balances

- Run the entity balance sheet for the required period. For instructions on how to run the balance sheet, please see the Financial Statement Reports Instructions.

- Highlight all non-system-generated object codes. Please refer to the list of system-generated object codes below to determine which object codes do not need to be substantiated.

List of System-Generated Object Codes:

| Object Code | Object Code Name |

|---|---|

| 8000 | Cash |

| 8116 | Payroll Deduction/Benefits Internal Receivable |

| 8118 | Accounts Receivable – Non-Student |

| 8160, 8163 | Bursar Accounts Receivable |

| 86–, 89– | Plant Level, Note: Substantiation for 8900 and 8950 (allowances) still required |

| 9045 | Invoices Payable |

| 9050 | Accrued Payroll |

| 9056 | Accrued Vacation Liability |

| 9058 | Accrued Sick Liability |

| 9060, 9065 | Bursar Payables |

| 9120 | Notes Payable – Lease Purchase |

| 92– | Bond Payable Level |

| 9465 | Bursar-Deferred Income |

| 96– | Notes Payable – Capital Lease |

| 98– | Fund Balances |

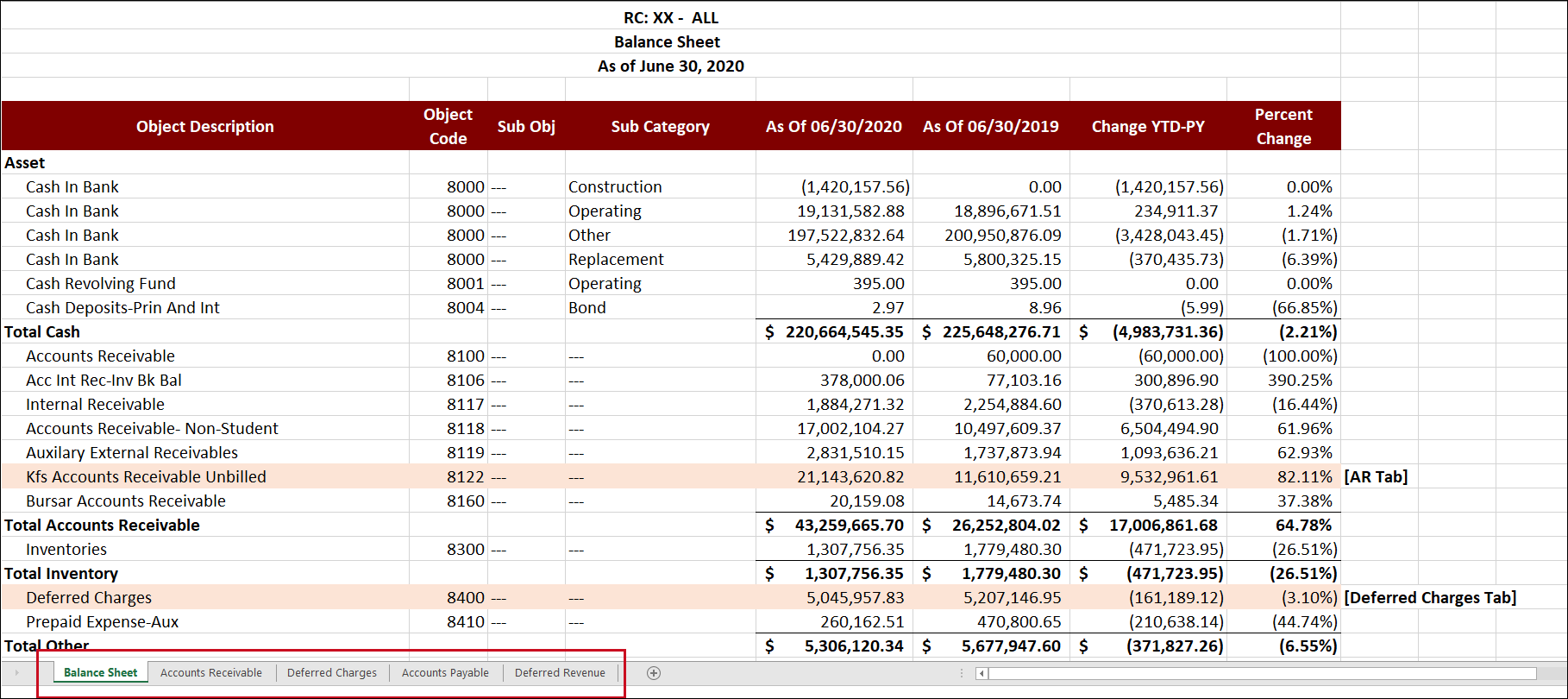

A Balance Sheet Substantiation Template has been made available for users to reference and use during this process. The balance sheet substantiation template breaks out the most common non-system-generated balances that need substantiation. Included in this template are examples of substantiation that the UCO deems acceptable for the most common non-system-generated balances. This substantiation support should be placed in the same Excel file as the balance sheet as shown in the example below so that all information is kept in one place.

Acceptable Substantiation

For reference of what is considered sufficient/appropriate substantiation and what is poor substantiation, please see the table below:

| Examples of Sufficient Balance Sheet Substantiation | Examples of Insufficient/Poor Balance Sheet Substantiation |

|---|---|

| Actual Allowance Calculations | KFS Screenshots |

| Supplier Invoices or Statements | Payroll Deduction/Benefits Internal Receivable |

| Inventory Counts | Post-it® Notes |

| Aging Reports | Calculations in PDF Format |

| Subledger Transactions |

Below is an example of the Excel document containing the organization’s balance sheet at year-end and the subsequent tabs housing substantiation documents for the non-system-generated object codes.

Campuses may have additional requirements and submission deadlines in place. Verify submission guidelines with the specific campus office and fiscal officer.

Additional Examples of Balance Sheet Substantiation

In addition to the template available in the Reference Materials Library, this portion of the standard will present examples of the most common non-system-generated balances that need substantiation along with the UCO approved substantiation, calculations, and additional support for those balances. For any additional questions, contact the campus office or the Accounting and Reporting Services team at uars@iu.edu.

Cash In Transit

Object Code 8005 Balance as of June 30th: $3,800

UCO recommended substantiation:

An Excel spreadsheet with columns indicating the date, cash sales, credit card sales, and total (as shown below) is the recommended substantiation for cash in transit. The total should account for the object code balance.

| Date | Cash Sales | Credit Card Sales | Total |

| June 28 | $800 | $400 | $1,200 |

| June 29 | $750 | $800 | $1,550 |

| June 30 | $550 | $500 | $1,050 |

| Total | $2,100 | $1,700 | $3,800 |

Accounts Receivable – Non-KFS Subsystem

Object Code 8119 Balance as of June 30th: $50,000.00

UCO recommended substantiation:

Accounts receivable substantiation should always provide a list of the invoices that comprise the receivable balance. The invoices list should include the customer’s name or number, invoice number, date, and amount. An aging report should be completed for the entity’s largest accounts receivable object codes and cover at least 75% of the balance (see example below).

| Customer Name | Amount | Invoice # | Current | 1-30 days | 31-60 days | 61-90 days | Over 91 days | Total |

| Jones | $15,000 | AB123 | $1,000 | $2,000 | $4,000 | $1,000 | $7,000 | $15,000 |

| Smith | $2,000 | CC899 | $500 | $1,500 | $2,000 | |||

| Brown | $13,000 | FB778 | $10,000 | $1,100 | $1,900 | $13,000 | ||

| Williams | $5,000 | OU156 | $250 | $4,750 | $5,000 | |||

| Green | $15,000 | SC462 | $5,000 | $3,000 | $1,000 | $6,000 | $15,000 | |

| $50,000 | $16,750 | $9,750 | $6,100 | $4,400 | $13,000 | $50,000 |

Accounts Receivable – KFS System Showing Unbilled Activity

Object Code 8122 Balance as of June 30th: $25,000.00

UCO recommended substantiation:

An Excel spreadsheet or listing indicating the customer’s name, amount, and date of service as highlighted below. These amounts can be pulled from the entity’s subsidiary detail ledger. The total should account for the object code balance.

| Customer Name | Amount | Date of Service |

| Ball | $9,000 | June 20 |

| Burns | $4,500 | June 25 |

| Freeman | $6,000 | June 26 |

| Short | $5,500 | June 28 |

| $25,000 |

Allowance for Bad Debt

Object Code 8900 Balance as of June 30th: ($4,368.40)

UCO recommended substantiation:

Allowance for bad debt substantiation should always provide an Excel spreadsheet showing the bad debt allowance percentage and actual write-off calculation. For the balance ending June 30th, the current year write-off percentage would be calculated by finding the average of the prior 3 years write-off percentages as shown below.

| 20xx | 20×1 | 20×2 | |

|---|---|---|---|

| Actual write-offs | $3,870 | $5,125 | $3,469 |

| Total annual revenue | $240,000 | $259,500 | $262,700 |

| Write-off % | 1.61% | 1.97% | 1.32% |

Average write-off %: 1.63%

To get the dollar amount, multiply the new write-off percentage by the total credit sales for the current fiscal year.

| Total credit sales for current fiscal year | $268,000 |

| Average write-off %: | 1.63% |

| Total estimated bad debt allowance | $4,368.40 |

Total credit sales for current fiscal year x average write-off= Total estimated bad debt allowance ($268,000 x 1.63% = $4,368.40)

Inventory

Object Code 8300 Balance as of June 30th: $3,264.21

UCO recommended substantiation:

Organizations that carry inventory must state in their support the date of the last physical count. When an inventory count is conducted, an inventory schedule listing the part number (if available), item description, units on hand, average cost per unit, and total value should be submitted. Otherwise, please provide the last page of the inventory report showing totals from the subsystem. Entire inventory reports should be available upon request. Below is an example of an inventory physical count spreadsheet.

| Valuation Date: | 06/30/20XX | |||

| Part Number | Part Description | On Hand | Avg. Cost | Value |

| D0172630 | Item 1 | 0.00 | $10.00 | $329.70 |

| D0101000 | Item 2 | 1.00 | 10.39 | 10.39 |

| D0110000 | Item 3 | 0.00 | 115.00 | 0.00 |

| D0110003 | Item 4 | 7.00 | 6.38 | 44.66 |

| D0110004 | Item 5 | 143.00 | 7.60 | 1,086.80 |

| D0113200 | Item 6 | 37.00 | 2.23 | 82.51 |

| D0115000 | Item 7 | 255.00 | 1.95 | 497.25 |

| D0115001 | Item 8 | 3.00 | 1.95 | 5.85 |

| D0115002 | Item 9 | 332.00 | 1.95 | 647.40 |

| D0115003 | Item 10 | 287.00 | 1.95 | 559.65 |

| Inventory value per physical count 6/30/XX | $3,264.21 |

Allowance for Inventory

Object Code 8955 Balance as of June 30th: ($401.15)

UCO recommended substantiation:

Allowance for inventory substantiation should always provide an Excel spreadsheet indicating the actual write-off calculation. For the balance ending June 30th 20×3 of $401.15, the current year write-off percentage would be calculated by finding the average of the prior 3 years write-off percentages as shown below.

Allowance % calculation (3 year average of inventory shrinkage %):

| 20XX | 20X1 | 20X2 | |

| Actual write-offs | $570 | $460 | $250 |

| Total inventory value at physical count | $3,150 | $3,820 | $2,300 |

| Inventory shrinkage /obsolescence % | 18.10% | 12.04% | 10.87% |

To get the dollar amount, multiply the new average inventory shrinkage/obsolescence: 13.67% by the total inventory value for the current fiscal year as below.

| Inventory value | $2,934.51 |

| Estimated allowance % | 13.67% |

| Total estimated inventory allowance | $401.15 |

Prepaid Expense

Object Code 8400 Balance as of June 30th: $30,000

Assumptions:

- Purchased 3 year equipment maintenance contract

- Original cost: $36,000

- Purchased January 1, 2007

- Expense $1,000/month ($36,000 / 3 years / 12 months)

UCO recommended substantiation:

UCO recommends providing an Excel spreadsheet detailing the calculations relating to the prepaid expense. For the example above, the entity has a prepaid maintenance contract of $36,000 for 36 months. Monthly expense is therefore $1,000/month ($36,000 / 36 weeks).

*Note: Contracts/invoices should be kept by the entity and made available upon request. They are not required for submission.

The table below supports a June 30, 20XX prepaid expense balance of $30,000. The table shows the monthly expenditure and prepaid balance for each month.

| January | February | March | April | May | June | |

| Expense | $1,000 | $1,000 | $1,000 | $1,000 | $1,000 | $1,000 |

| Prepaid Expense: | ||||||

| Beginning Balance | $36,000 | $35,000 | $34,000 | $33,000 | $32,000 | $31,000 |

| Less: expense incurred | $1,000 | $1,000 | $1,000 | $1,000 | $1,000 | $1,000 |

| Ending Prepaid Expense Balance | $35,000 | $34,000 | $33,000 | $32,000 | $31,000 | $30,000 |

Example of calculation:

| Purchase price: | $36,000 | |

| Contract period in months: | 36 | |

| Contract start date: | Jan 1, 20XX | |

| Months remaining on contract | 30 | (as of June 30, 20XX) |

| Prepaid expense balance | $30,000 | (months remaining * 1,000) |

The following year the calculation would be as follows:

| Months remaining on contract | 18 | (as of June 30, 20X1) |

| Prepaid expense balance | $18,000 | (months remaining * 1,000) |

Accounts Payable (excluding 9041 and 9045)

Object Code 9000 Balance as of June 30th: $35,730

UCO recommended substantiation:

Accounts payable substantiation should provide a list of outstanding invoices that make up the payable balance. This can be done in Excel and should include supplier name, invoice date, and amount. The invoices should be kept by the entity and made available upon request. They are not required for submission.

| Supplier Name | Invoice Date | Amount |

|---|---|---|

| ABC Corp | 6/09/XX | $11,500 |

| GFS | 5/22/XX | $16.230 |

| KLM Vending | 6/25/XX | $3,400 |

| Service LLC | 6/30/XX | $4,600 |

| Total | $35,730 |

Deposit Liability

Object Code 9118 Balance as of June 30th: $11,500

UCO recommended substantiation:

Deposit liability supporting documentation should include a list of customer names and how much their deposit balance is, as shown below. These amounts can be pulled from the detail ledger and must be presented to UCO in an Excel spreadsheet.

It is the fiscal officer’s responsibility to ensure these balances should not have been refunded, expired, or escheated. Please provide us with the last reconciliation date to provide assurance these are monitored on a regular basis.

| Customer Name | Deposit Amount |

| Adams | $1,500 |

| Cummings | $3,000 |

| Newton | $2,500 |

| Smith | $2,500 |

| Williams | $2,000 |

| Total | $11,500 |

Deferred Income

Object Code 9400 Deferred Income Balance as of June 30th: $60,000

Assumptions:

- Organization receives a mandatory student fee for summer term

- Fee is earned and recognized over the entire term

- Summer term equals 14 weeks

- Total mandatory fee received in May: $140,000

UCO recommended substantiation:

UCO recommended deferred income supporting documentation includes an Excel spreadsheet detailing calculations related to the deferred income, if any. For the example above, the entity earns $10,000/week ($140,000 / 14 weeks).

*Note: Contracts/invoices should be available upon request, but are not required for submission.

The table below supports a June 30th deferred income balance of $60,000.

Income and deferred income are calculated as follows:

| May | June | July | August | Total | |

| (4 weeks) | (4 weeks) | (4 weeks) | (2 weeks) | ||

| Income (based on $10,000 week) | $40,000 | $40,000 | $40,000 | $20,000 | $140,000 |

Deferred Income Calculation:

| Beginning balance | $140,000 | $100,000 | $60,000 | $20,000 |

| Less: amount earned | $40,000 | $40,000 | $40,000 | $20,000 |

| Ending deferred income balance | $100,000 | $60,000 | $20,000 | $0 |

At the end of the summer term, deferred income balance is zero. Income of $140,000 was recognized over the four-month period.

Requirements and Best Practices

This portion of the standard outlines requirements related to a balance sheet substantiation, as well as best practices. While not required, the best practices outlined below allow users to gain a better picture of the entity’s financial health and help identify potential issues on a more frequent basis. This allows organizations to identify errors, mistakes, and pitfalls which can be remedied quickly and prevent larger issues in the future.

Requirements

- Run the balance sheet and perform a balance sheet substantiation review quarterly.

- Provide substantiation for any non-system-generated asset and liability object code balances on your balance sheet. The minimum university threshold for all balance sheet balances requiring substantiation is noted in the Closing Checklist.

- Ensure the accuracy, reliability, and completeness of the balance sheet substantiation. The (RC) fiscal officer is responsible for ensuring the balance sheet substantiation is correct.

Best Practices

- Run the balance sheet and perform a balance sheet substantiation review on a monthly basis. Please refer to the Financial Statement Reports Instructions for more information on how to pull a balance sheet.

- Provide substantiation for any non-system-generated asset and liability object code balances on your balance sheet. Ensure that the supporting documentation is detailed and can be traced to the balance. Explain any discrepancies.

- Review and analyze the substantiation documentation and working papers of the entity. This is the responsibility of the fiscal officer. Analyzing the balance sheet substantiation allows the fiscal officer to determine if the current internal controls are efficient and effective enough for accurate recording of transactions. The questions that need to be asked will vary depending on the needs; however, the following questions are some common examples:

- Were there any manual adjustments done to the system-generated object codes? In general, system-generated object codes should not be manually adjusted; however, if any manual adjustments were done, the supporting documentation is required.

- Are all non-system-generated object codes over the threshold substantiated? Only the object codes listed above are system-generated; any object code not on the list should have supporting documentation for the balance.

- Are the closing balances equal to the supporting documentation balances? All balances should equal each other. If any discrepancies between closing balances and supporting documentation is found, the fiscal officer should review to determine what is causing the difference and correct.

- Are there any controls the department may require to increase the accuracy of the non-system-generated object codes? The department needs to evaluate if there are any internal document controls they may need to have in place to substantiate the balances better.

UCO-CLS-2.01: Material Transactions Substantiation

Prerequisites

Prior to reading the standard on Material Transactions Substantiation, it is beneficial to review the below standards to gain foundational information:

Preface

This standard discusses the elements of the material transactions substantiation process and how it is conducted internally within Indiana University. Information presented below will outline requirements for transaction support, the documentation required to substantiate a transaction, and requirements and best practices related to this process.

Introduction

Material transaction substantiation is key to ensuring the accuracy of IU financial statements and compliance with external regulatory requirements. Material transaction substantiation at IU refers to detailed documentation and/or work papers substantiating line item transactions that exceed the $5 million threshold (NOTE: the threshold does not apply to document total amounts, but to individual transactions). The supporting documentation or substantiation should be detailed enough that a person without extensive knowledge of the transaction can review the support, understand the nature of the transaction, and tie it back to the general ledger detail. Auditors request documentation that supports financial transactions showing why and how a transaction was completed in order to ensure accuracy, completeness, and compliance with all local, state, and federal requirements. In order to ensure all fiscal officers and transaction initiators are familiar with the requirements for material transactions substantiation, examples of appropriate support are discussed below.

Importance and Impact of Material Transactions Substantiation

Substantiating material transactions is an important tool for account management and preparation for external audits. Reviewing material financial transactions helps identify transaction errors, inaccurate balances, improper spending, embezzlement, and highlights other negative activity, such as theft or fraud, before balances are finalized for a period-end close. Failure to detect these errors may lead to issues concerning internal controls or the accuracy of the financial statements which impacts future funding from government organizations, creditors, or individual donors.

In order to ensure the integrity of an entity’s financial reports, it is important that each entity review and substantiate material transactions on a quarterly basis. By reviewing and substantiating material transactions as part of the quarterly closing procedures, the university can produce reliable and accurate financial statements free from material misstatement that could result in false conclusions. This is important for the university’s externally audited consolidated financial statements as well as internal management reporting for decision making.

Identifying and Substantiating Material Transactions

Documentation is a critical aspect of substantiating financial transactions. Examples of types of transactions that need to be substantiated include accounts receivable, accounts payable, contracts and grants, unearned revenue, and state appropriations. Please see the UCO-AFO-1.02 Financial Transaction Substantiation Standard for more information. Standard procedures should be in place to ensure entities are appropriately substantiating material transactions. Fiscal officers are responsible for ensuring that material transactions are substantiated.

To meet the material transaction substantiation requirements, documentation needs to answer the questions of: Who, What, Where, When, and Why?

Properly identifying and substantiating material transactions involves:

- Reviewing line item detail transactions for amounts $5 million and above at the time the transaction is submitted.

- Determining and gathering the appropriate supporting documentation (i.e. contracts, written agreements, schedules, and invoices) for each material transaction. Ensuring transactions are substantiated, supported, and answer all of the who, what, where, when, and why questions.

Substantiating Material Transactions

All material transactions must have a Material Transactions Coversheet attached to the KFS document or a reference to a UCO approved process narrative index number when the transaction is submitted.

Material Transactions Coversheet

A material transactions coversheet is required to be completed and attached to the KFS transaction document for any non-routine transaction. A material transactions coversheet is also required for any routine transaction that does not have a completed and approved process narrative on file at UCO. In order to complete the material transactions coversheet, the initiator of the KFS transaction document should gather a copy of the source documentation. This documentation will be needed to complete the material transactions coversheet.

Financial Process Narrative

For material transactions that are routine, a process narrative must be completed and approved by UCO. For additional information on process narratives and the process for completing them, please refer to the UCO-IRR-1.01 Financial Process Narrative Standard . When the financial process narratives are considered complete, the department will receive an assigned index number of the process narrative. This index number can be referenced on the source document along with attaching specific supporting documentation for the transaction. It is important to note that financial process narratives are required to be reviewed by the department and updated on an annual basis for audit purposes or as changes to processes occur.

Material Transactions Substantiation Examples

Example 1: Income/Receivable Transaction Substantiation

A distribution of income and expense document was completed in May 2021 claiming receipts from the EFT account and appeared on the material transactions report. The total document amount was $6,722,727, broken out into line item amounts of $650,000 and $6,072,727. Only the line item of $6,072,727 will need to have substantiation attached to the document.

Material Transaction to Substantiate

| Organization Name | Transactions Ledger Entry Description | Transaction Post Date | Object Code | Amount of Revenue Recorded |

| Org 123 | XYZ Revenue | 5/4/2021 | 1481 | $6,072,727.00 |

Documentation Attached to the Transaction

- A completed material transactions coversheet if non-routine or process narrative in process or a note on the document that UA-XXXX has approved process narrative XX on file with UCO.

- A copy of the original XYZ contract related to XYZ revenue.

- A copy of the KFS DI document.

- The statement of receipts and disbursements from XYZ company with specific dollar amounts per the university that are tied to the KFS DI document.

Example 2: Expense Transaction Substantiation

A distribution of income and expense document was completed in September 2020 moving scholarship expenses from the main scholarship account to departmental accounts throughout the university in which the expense belongs. The total document amount was $5,868,526.29, broken out into line item amounts of $155,805, $360,793.87, and $5,351.927.42. Only the line item of $5,351,927.42 will need to have substantiation attached to the document.

Material Transaction to Substantiate

| Organization Name | Transactions Ledger Entry Description | Transaction Post Date | Object Code | Amount of Revenue Recorded |

| Org 456 | Allocation of ABC at Sept 29 | 9/29/2020 | 5880 | ($5,351,927.42) |

Documentation Attached to the Transaction

- A completed material transaction coversheet if non-routine or process narrative in process or a note on the document that UA-XXXX has approved process narrative XX on file with UCO.

- A copy of the SIS report listing the scholarship recipients and the amount of each scholarship awarded with any critical data redacted.

- A copy of the KFS DI document.

- An account reconciliation.

Example 3: Deferred Software Agreement Transaction Substantiation

A general accounting adjustment document was completed in June 2020 to move the fiscal year 2021 allocation of ABC costs from an expense object code to a deferred charges object code since the agreement was to begin on 7/1/2021. The total cost of the ABC agreement of $6,200,000 was deferred until fiscal year 2021 and will need to have substantiation attached to the document.

Material Transaction to Substantiate

| Organization Name | Transactions Ledger Entry Description | Transaction Post Date | Object Code | Amount of Revenue Recorded |

| Org 789 | Defer XYZ Agreement | 6/2/2020 | 8400 | $6,200,000.00 |

Documentation Attached to the Transaction

- A completed material transaction coversheet if non-routine or process narrative in process or a note on the document that UA-XXX has approved process narrative XX on file with UCO.

- A copy of the original XYZ contract related to XYZ agreement.

- A copy of a paid invoice.

Requirements and Best Practices

This section outlines general requirements and best practices related to performing material transaction substantiation. Following the requirements and best practices outlined below will help to avoid audit errors, financial misstatements, fraud, and allow users to gain a better understanding of their entity’s financial health.

Requirements

- Every financial transaction at Indiana University is required to have substantiation.

- Compile the transaction substantiation at the time the transaction is initiated.

- Substantiation detail for every financial transaction over $5M is required to be attached to the document in KFS.

- Material transactions without adequate documentation attached should not be approved.

- The fiscal officer is responsible for having all financial transaction substantiation available for audit and other purposes.

- The fiscal officer is responsible for the accuracy, reliability, and completeness of all financial transactions on their account.

Best Practices

- Review financial transactions on a monthly basis and have the required substantiation on file for review.

- Prior to approving any document, validate the transaction by reviewing supporting documentation to verify the transaction is necessary and appropriate.

An accounts receivable aging report is a record that shows the unpaid invoice balances along with the duration for which they've been outstanding.

An isolated transaction that will not recur on a regular basis.

Transactions that happen on a recurring basis.

An agreement, contract or grant documentation, analysis conducted, calculations completed, emails, memos, receipts, etc. that supports the transaction.