2.2 Marketing’s Role in the Strategic Planning Process: Portfolio Analysis

The marketing department contributes to the strategic planning process in multiple ways. It provides a portfolio analysis (discussed below), and conducts an Environmental Scan to develop a SWOT analysis (discussed in the next chapter). These two components of the strategic planning process provide the foundation for decision making and growth opportunities.

Strategic Business Units and Portfolio Analysis

Strategic Business Units (SBUs)

As previously mentioned, strategic planning is a long-term process that helps an organization allocate its resources to take advantage of different opportunities. In addition to marketing plans, strategic planning may occur at different levels within an organization. For example, in large organizations top executives will develop strategic plans for the corporation. These are corporate-level plans. In addition, many large firms have different divisions, or businesses, called strategic business units. A strategic business unit (SBU) is a business or product line within an organization that 1) has its own competitors, customers, and 2) profit center for accounting purposes. A firm’s SBUs may also have 3) their own mission statement (purpose) and will generally develop strategic plans for themselves. These are called business-level plans. The different departments, or functions (accounting, finance, marketing, and so forth) within a company or SBU, might also develop strategic plans. For example, a company may develop a marketing plan or a financial plan, which are functional-level plans.

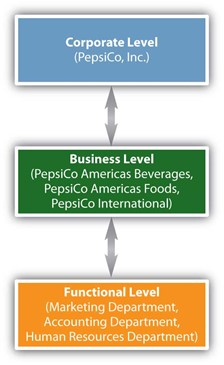

The figure below shows an example of different strategic planning levels that can exist within an organization’s structure. The number of levels can vary, depending on the size and structure of an organization. Not every organization will have every level or have every type of plan.

Figure 2.2.1: Organizational Levels

image courtesy of https://saylordotorg.github.io/text_principles-of-marketing-v2.0/s05-04-where-strategic-planning-occur.html

Portfolio Analysis

When a firm has multiple strategic business units, it must determine the objectives and strategies for each SBU and how to allocate resources among the various SBUs. A group of SBUs can be considered a portfolio, just as a collection of artwork or investments compose a portfolio. To evaluate each business unit, companies sometimes utilize what is called a portfolio planning approach. A portfolio planning approach involves analyzing a firm’s entire collection of business units relative to one another. One of the most widely used portfolio planning approaches was developed by the Boston Consulting Group (BCG).

Most businesses have limited resources and need to determine how to allocate those resources. Using the portfolio planning approach allows businesses to see the various business segments and determine which ones should be grown, which will be just maintained, and which will help to fund the growth of others. This approach ensures that SBU strategies are complementary to each other and that all are working towards achieving the objectives of the organization.

The Boston Consulting Group Matrix (a.k.a “Growth / Share Matrix”)

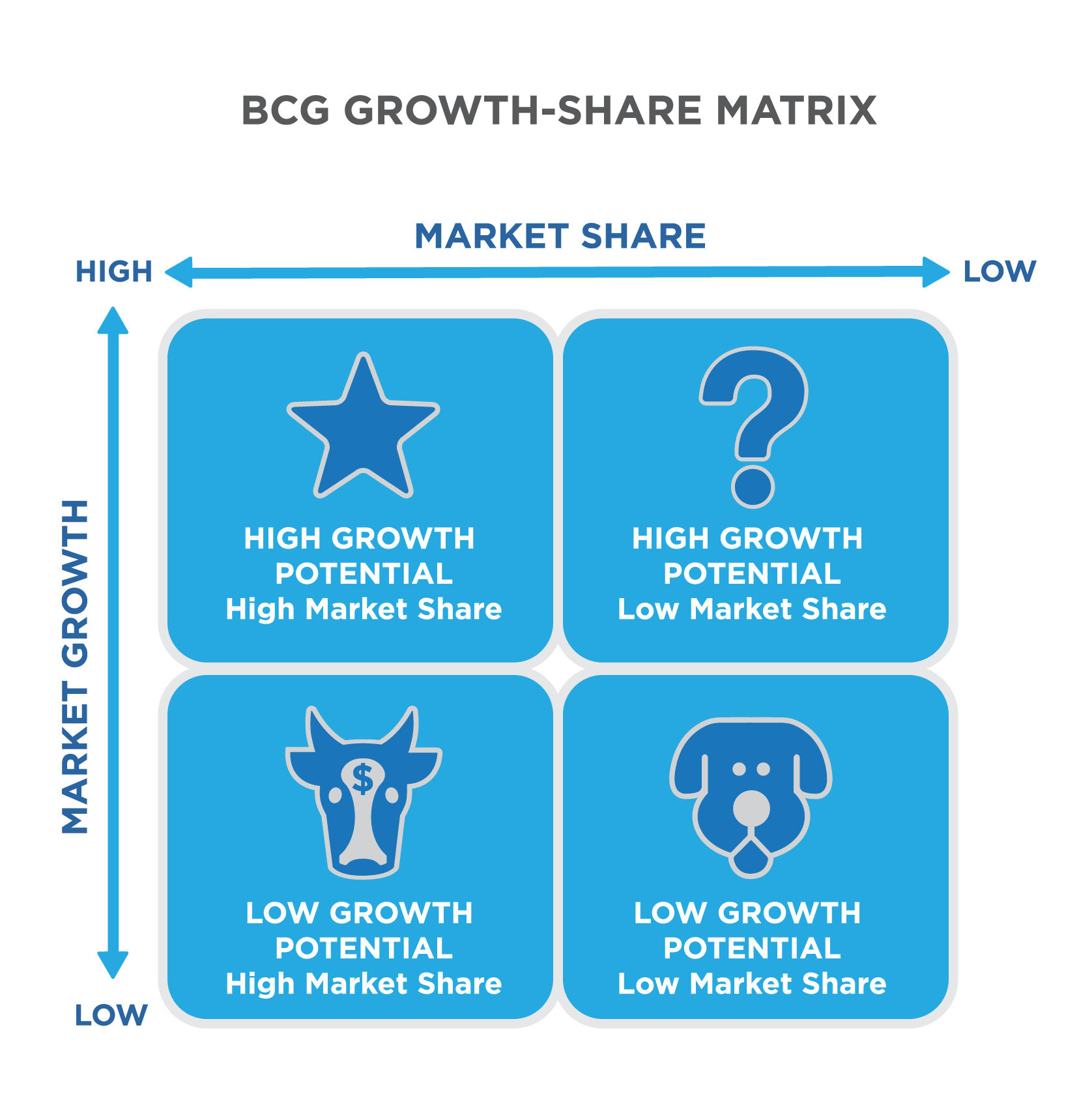

The Boston Consulting Group (BCG) matrix helps companies evaluate each of its strategic business units based on two factors: (1) the SBU’s market growth rate (i.e., how fast the unit is growing compared to the industry in which it competes) and (2) the SBU’s relative market share (i.e., how the unit’s share of the market compares to the market share of its competitors). Because the BCG matrix assumes that profitability and market share are highly related, it is a useful approach for making business and investment decisions. However, the BCG matrix is subjective, and managers should also use their judgment and other planning approaches before making decisions. Using the BCG matrix, managers can categorize their SBUs (products) into one of four categories. We will now look at each of the four categories, or quadrants, in the matrix.

Figure 2.2.2: Boston Consulting Group (BCG) Matrix

image courtesy of https://courses.lumenlearning.com/clinton-marketing/chapter/reading-the-bcg-matrix/

Stars

When you hear the term ‘star’, you probably think ‘the best’. Everyone wants to be a star. However, is that reaction a valid one? A star is a product with high growth potential and a high market share compared to the competition. To maintain the growth of the star products, a company will need to invest money to keep the product competitive, improve distribution channels and to promote. This expense can be quite large. So the question becomes, is this star profitable? Does the revenue generated from the star exceed its expenses? Sometimes a star can lose money or barely be profitable. They are not always ‘the best’ as the term ‘star’ implies.

Cash Cows

The term ‘cash cow’ is one that many of you have probably heard before without really understanding what it means. A cash cow is a product with low growth opportunities and a relatively high market share. Cash cows have a large share of a shrinking market. Although they generate a lot of cash, they do not have a long-term future. While resources need to be invested in the cash cow to keep it competitive, they do not require the same investments as stars do. Companies with cash cows need to manage them so that they continue to generate revenue to fund other products.

Question Marks or Problem Children

Did you ever hear an adult say they did not know what to do with a child? The same question or problem arises when a product has a low share of a high-growth market. Managers classify these products as question marks or problem children. The business managers must decide whether to invest in question marks and hope they become stars or gradually eliminate or sell them. Question marks are not profitable but have a chance of being turned into a star, with the right investment.

Dogs

A dog is a product with low growth and low market share. Dogs do not make much money and do not have a promising future. There is a negative image that many have of dogs but, the truth is, they can be profitable and might be able to fund investment in a question mark either by their limited profits, by selling them off, or by discontinuing them thus freeing up resources. Most of the everyday products you use, are considered dogs. They are smaller products that don’t generate a large amount of revenue but enough revenue to justify their existence. In fact, most products are classified as dogs.

Strategies

The BCG matrix helps managers make resource allocation decisions. Depending on the product, a firm might decide on several different strategies. One strategy is to build market share for a business or product, especially a product that might become a star. Many companies invest in question marks because potential market share is available for them to capture. The success sequence is often used to help question marks become stars. With the success sequence, money is taken from cash cows (if available) and invested into question marks in hopes of them becoming stars.

Holding market share means the company wants to keep the product’s share at the same level. When a firm pursues this strategy, it only invests what it must to maintain the product’s market share. When a company decides to harvest a product, the firm lowers its investment in it. The goal is to try to generate short-term profits from the product regardless of the long-term impact on its survival. If a company decides to divest a product, the firm drops or sells it. That is what Procter & Gamble did in 2008 when it sold its Folgers coffee brand to Smuckers. Proctor & Gamble also sold Jif peanut butter brand to Smuckers. Many dogs are divested, but companies may also divest products because they want to focus on other brands they have in their portfolio.

As competitors enter the market, technology advances, and consumer preferences change, the position of a company’s products in the BCG matrix is also likely to change. The company must continually evaluate the situation and adjust its investments and product promotion strategies accordingly. The firm must also keep in mind that the BCG matrix is just one planning approach and that other variables can affect the success of products.

You Try It!