Standards

Rate Submission Requirements Overview

Review the below standards for guidance on the importance of recharge activities, the billing requirements, and the reporting requirements for recharge and service centers.

Understanding rate submission requirements, rate submission frequency, how to process key financial documents within KFS for recharge activities, as well as expectations related to recharge center operations is crucial for compliance with Uniform Guidance. Units that bill for goods or services within or between university accounts must have approved recharge rates on file with the Office of the University Controller (UCO). The below standards emphasizes the significance of recharge activities, outlines reporting obligations of recharge/service centers, how and when to utilize the internal and service billing documents in KFS, and outlines exceptions for recharge activities. Recharge centers differ in the scope and intricacy of services provided, and the procedures are structured to offer adaptability to cater to a diverse range of operations.

UCO-RSC-1.00: Rate Submission Requirements for Recharge and Service Centers

Prerequisites

Prior to reading the Rate Submission Requirements for Recharge Centers standard, it is beneficial to review the below standards to gain foundational information:

- Accounting Fundamentals Standards

- Recharge and Service Center Units Standards

- UCO-RSC-4.00 Unallowable Expenses for Recharge and Service Centers Standard

- UCO-RSC-3.00 Allocating Costs to Internal and External Activities Standard

Preface

To comply with Uniform Guidance, units that bill for goods or services provided to other university units or within their own unit may only do so with approved recharge rate(s) on file with the Office of the University Controller (UCO). This standard discusses the importance of recharge activities and the reporting requirements of recharge/service centers. Recharge centers vary in the volume and complexity of services rendered and these procedures are designed to provide flexibility to meet the needs of a variety of operations.

Introduction

Recharge/service centers are units within Indiana University that furnish goods and/or services to other Indiana University departments for the convenience of the university and charge a fee directly related to, but not more than, the allowable cost to provide the goods or services.

Typically, any internal transaction that records income to one university account and an expense to another using any KFS document type effectively creates a recharge center activity. Exceptions to this rule include the following:

- Departments Hosting Conferences that Use IU Conferences Services – This activity is typically not considered recharge activity for the department hosting the conference and is not required to be recorded in an account in the recharge sub-fund group. The fiscal officer is NOT required to submit rates to Recharge Accounting.

Any activity related to the sale of goods or services provided in conjunction with the conference must be maintained in a recharge account and segregated from accounting for the conference activity. Contract and grant accounts can be charged for conferences as long as the charges are allowable per the grant and approved by Office of Research Administration. Please refer to the UCO-COA-1.01 RC, Org, and Account standard to determine the correct account to record this activity.

- External Agencies – Indiana University (IU) may enter into a contractual agreement to serve as a fiscal agent for certain entities which are external to IU governance for the purpose of facilitating mutual achievement of education, research, and public services purposes and goals, but only in such instances where the purpose and function of the external agency relates to, and is consistent with, IU’s mission. Any such arrangement must meet the requirements specified in policy FIN-TRE-90 External Agency Agreements. Occasionally, external agencies are allowed to use IU systems to streamline processes. The accounts associated with the external agencies are excluded from IU financial statements and they are considered an IU department.

- Departmental activities that have an agreed upon, sponsored, fixed price arrangement – These contracts must be specified in a formal non-federal, non-state, or non-pass-through contract with the Office of Research Administration. The Office of Research Administration will confirm a formal contract exists.

- Program Income Accounts – Gross income earned by a non-federal entity that is directly generated by a supported activity or earned as a result of the federal award during the period of performance except as provided in 2 CFR part 200.307 paragraph (f). Program income includes but is not limited to income from fees for services performed, the use or rental or real or personal property acquired under federal awards, the sale of commodities or items fabricated under a federal award, license fees and royalties on patents and copyrights, and principal and interest on loans made with federal award funds.

Importance and Impact of Submitting Recharge Rates

Recharge center operations may be subject to federal and non-federal audits of sponsored programs. As a recipient of federal funding, Indiana University must comply with OMB Uniform Administrative Requirements, Cost Principles, and Audit Requirements for Federal Awards (2 C.F.R. §200) (Uniform Guidance). Uniform Guidance requires that recharge centers charge according to actual usage using nondiscriminatory rates, these rates should be calculated to recover no more than the actual costs of the good or service provided (§200.468). Noncompliance with Uniform Guidance could result in audit findings, reflect negatively on future award proposals, limit federal cost reimbursement, and lead to repayments or fines to the granting agency.

Rate Setting Compliance Guidelines

Any IU department, unit, or core activity operating a recharge center must comply with the rate setting guidelines defined in this standard. The rate submission requirements for recharge/service center activities are determined by the amount of annual internal revenue recorded in the last completed fiscal year or whether the department is billing a contract and grant account. The individual requirements for each category are summarized in the requirements and best practices portion of this standard below.

Requirements and Best Practices

Requirements

- Internal activities with internal revenue MORE than $5,000,000

a.) Internal activity above $5,000,000 must be segregated into individual recharge/service center AUXSER sub-fund accounts.

b.) These accounts must use internal billing or service billing documents to charge other university departments.

c.) These accounts may NOT charge more than the allowable cost of producing the goods or services. Internal rates may not exceed external rates for the same goods or services.

d.) The account fiscal officer is required to submit a new recharge rate ANNUALLY using an approved rate setting template. Rate setting templates should be submitted to Recharge Accounting at rates@iu.edu.

e.) Any midyear rate changes require resubmission to Recharge Accounting.

f.) These units are required to meet ANNUALLY with their campus controller to go over the unit’s rate setting methodology.

- Internal activities with internal revenue MORE than $100,000

a.) Internal activity above $100,000 must be segregated into individual recharge/service center AUXSER sub-fund accounts.

b.) These accounts must use internal billing or service billing documents to charge other university departments.

c.) These accounts may NOT charge more than the allowable cost of producing the goods or services. Internal rates may not exceed external rates for the same goods or services.

d.) The account fiscal officer is required to submit a new recharge rate BIENNIALLY (every two years) using an approved rate setting template. Rate setting templates should be submitted to Recharge Accounting at rates@iu.edu.

e.) Any midyear rate changes require resubmission to Recharge Accounting.

- Internal activities with internal revenue LESS than $100,000

a.) Activities that have less than $100,000 in anticipated internal revenue will be required to use distribution of income and expense, general accounting adjustment (expense to expense transactions only), or transfer of funds documents to complete transactions between university accounts. Note: The $100,000 is measured at the activity and/or account level, not the transactional level. For more information regarding this activity, please see the UCO-RSC-2.00 Internal Recharge Activity in Accounts under $100,000 in Internal Revenue standard.

- Ensure each recharge center has submitted their rate setting template(s) prior to billing and in advance of the deadline according to the revenue limits on this page.

- Departments that meet the specified requirements for submitting a process narrative must submit the process narrative to the UCO Internal Controls function.

Best Practices

- Fiscal officers must continuously monitor the fund balance on recharge accounts and resubmit a new rate template if needed to prevent the fund balance from becoming a deficit or surplus.

- Submitters and preparers of recharge rates should be aware of potential changes to the rate setting requirements and monitor updates posted on the UCO website and in the UCO fiscal officer newsletter.

- Departments that do not meet the specified requirements for submitting a process narrative should document and periodically review their standard procedures to ensure they are complete and accurate.

UCO-RSC-1.01: Internal and Service Billing Documents

Prerequisites

Prior to reading the standard on Internal and Service Billing Documents, it is beneficial to review the below standards to gain foundational information:

- Accounting Fundamentals Standards

- Chart of Accounts and General Ledger Standards

- Financial Statements Standards

- Closing Standards

- Recharge and Service Center Units Standards

- UCO-RSC-1.00 Rate Submission Requirements for Recharge Centers Standard

Preface

This standard discusses the elements of internal billing, the KFS internal billing (IB) and service billing (SB) documents, and how they are used within Indiana University. Information presented below will walk through a general understanding of the documents and will specify requirements and best practices.

Introduction

Internal billing is a billing for goods or services between two IU units.

The IB and SB documents are used to record the income and corresponding expense for any billings of goods or services between university accounts that exceed annual revenues of $100,000. Internal billing documents are used by units that have minimal billings to other units. The IB will route for approval to fiscal officers of accounts being billed. The service billing document is also used to bill internal units. However, the SB is limited to use by units with large volume billing and does not route for approval. Internal billing activities under $100,000 in annual revenues are required to use other KFS document types. The department providing the good or service will record income and a corresponding expense for the receiving department. These transactions are also referred to as interdepartmental sales and purchases.

Importance and Impact of the Internal and Service Billing Documents

The timely and proper recording of income and expense transactions between internal accounts is important to ensure that university financial records are accurate, timely budgetary planning, and recovery of all reimbursable expenditures from external sponsoring organizations (e.g. contract and grant accounts).

Incorrect usage of internal or service billings can lead to compliance issues. For example, sponsored accounts require billings be completed within a stated period of time and to meet specific requirements of the sponsor.

Internal Billings and Service Billings

The Kuali Financial System (KFS) has several documents available for users to record transactions between university accounts. The IB and SB documents are used ONLY to bill for internal transactions where one university department is providing a good or service to another university department for a fee. Each document has a specific purpose and has embedded chart of account (i.e., fund group, account, and object code) restrictions to help ensure the document is used properly.

The IB document should be used by approved recharge accounts that have a small to moderate volume of transactions. The IB routes for approval to the fiscal officer of each account listed on the expense side of the document.

The use of the SB document is limited to departments that have frequent mass billings for which the IB cannot be used. The SB is a restricted use document and does not route for approval.

Note: Access to the SB document requires pre-approval by the Office of the University Controller (UCO). In order to gain access to the SB document, an organization fiscal officer should complete the following steps:

- Receive approval from the campus fiscal administrator.

- Read the KFS Service Billing Requirements and Agreement.

- Complete the Modify Service Billing Initiators form at the bottom of the agreement. Access to the form is limited to account fiscal officers.

Embedded Rules for the IB and SB Documents

The IB/SB documents have rules in the documents to prevent them from being used for transactions other than interdepartmental billings. Users do not have the ability to bypass or change the embedded rules on the IB or SB document.

- Account Restrictions – the account listed on the income side of the document will be required to be in the auxiliary service fund (AUXSER), external agency (EXTAGY), or internal agency (INTAGY) sub-fund groups or in a program income account

- Object Code Restrictions – an income object code (object type: IN) is required on the income side of the document and an expense object code (object type: ES, EE, EX) is required on the expense side of the document

- The IB and SB documents must have at least one line in both the income and expense sections of the document

- In the accounting lines tab, the total in the income section must equal the total in the expense section

- Negative amounts are allowed to correct a previously posted billing

Where are the Internal Billing and Service Billing Documents Located?

See below for instructions on how to locate the internal billing and service billing documents.

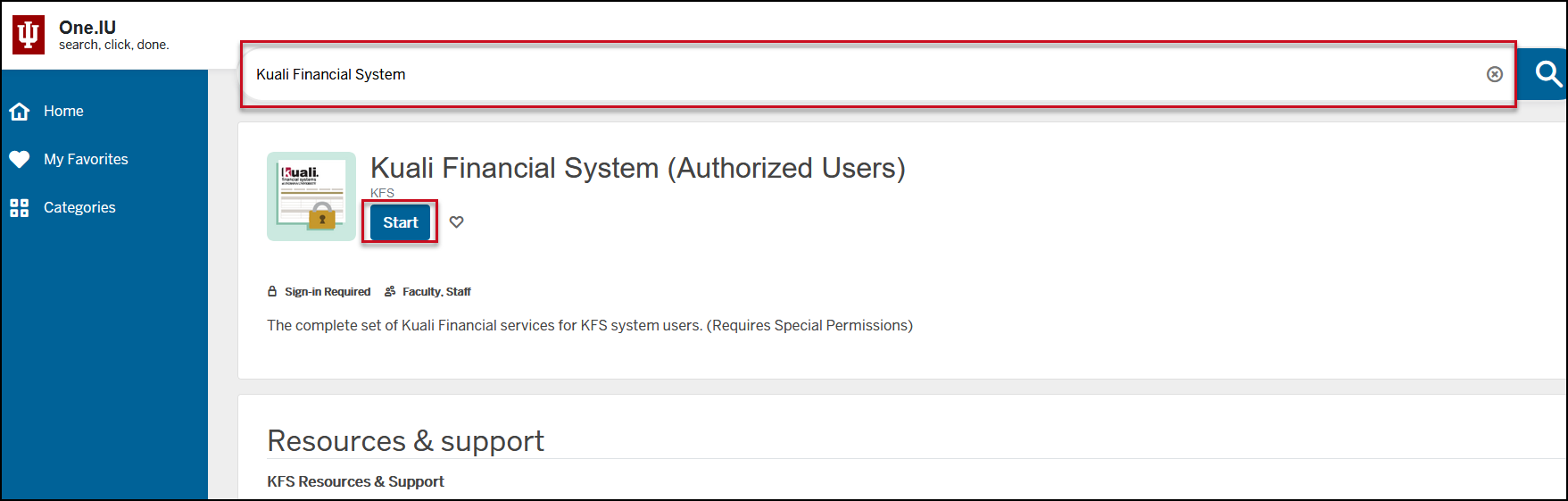

Internal billing and service billing documents are located in Kuali Financial System (KFS), which can be found in One.IU. Search for “Kuali Financial System” and select Kuali Financial System (Authorized Users). Mark this app as a favorite by clicking the heart icon next to the start button and then select Start.

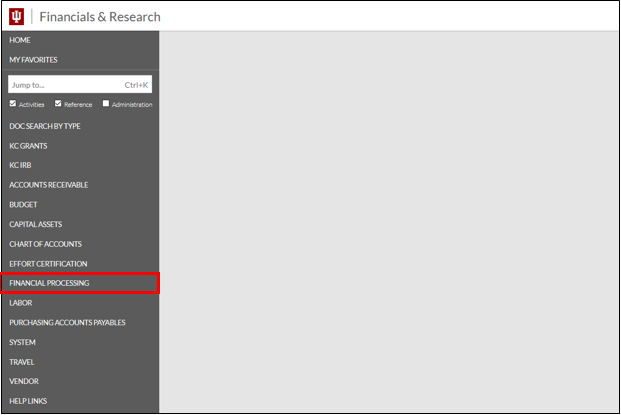

Once in the Kuali Financial System (KFS), users will see all available tiles. Navigate to the financial processing module.

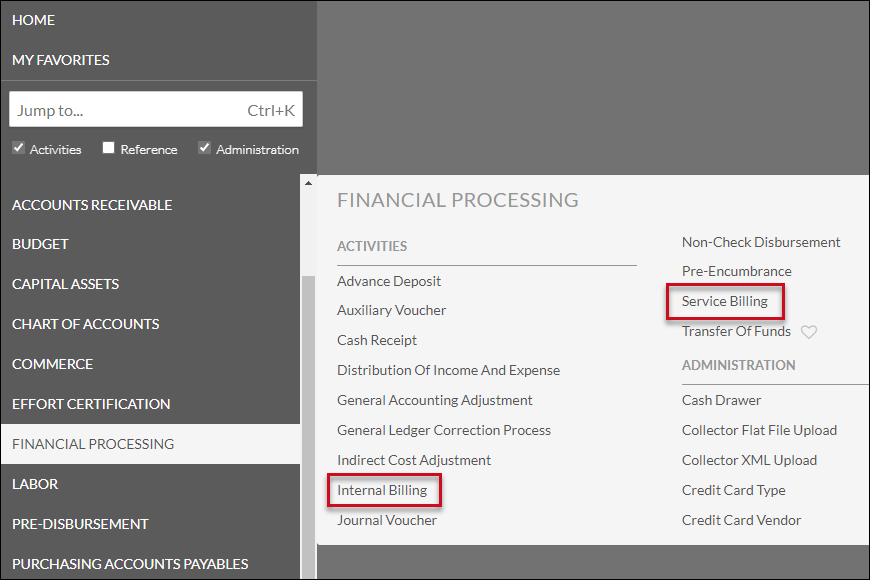

The tile expands to display all financial processing options. Selecting Internal Billing will generate a new internal billing document and take you to the document. The service billing document will be visible only to employees with approved access to the document.

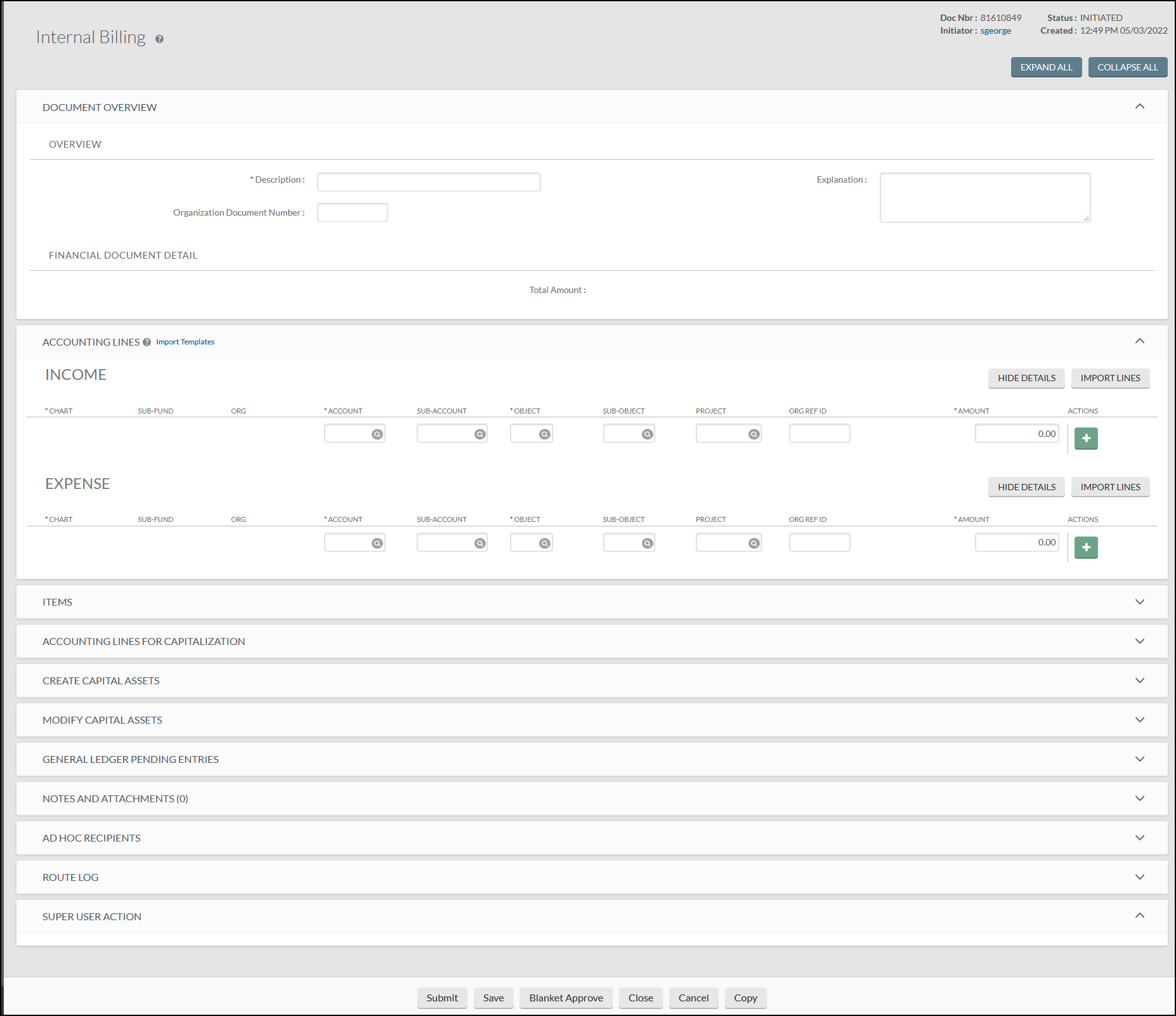

Below is an example of the internal billing document in KFS.

Requirements and Best Practices

Requirements

- Review and become familiar with the material on this page; as well as, the reference material prior to completing an IB or SB document.

- Ensure supporting documentation for each document is adequate, prior to approving. For further information on the substantiation of IB and SB documents, please review the UCO-AFO-1.02 Financial Transaction Substantiation Standard.

- Each IB or SB document should represent a single instance of billing activity. Departments may bill more than one unit for the same instance on a single document as long as the activity is the same.

- Complete billing documents on all recharge accounts, at a minimum, on a quarterly basis. Make sure all billing transactions are completed in the fiscal year in which the goods or service was provided.

Best Practices

- Fiscal officers should review billings to and from their accounts on a monthly basis to ensure accuracy of data. Fiscal officers should contact the initiator of the IB or SB document for additional information about the transaction.

- Review employee access to the SB document and request information be updated on a regular basis.

Service fund is an enterprise that furnishes goods or services to other internal university departments and charges a fee directly related to, and equal to, the cost of the goods or services. This means that the entity is self-supporting, but is not allowed to make a profit.

This fund group is in direct relationship with the university mission and acts as reimbursement to the university for use of university property or service. This fund is managed by individual campuses and fiscal officers.

The internal agency fund acts as the fiscal agent or trustee for the university. For financial reporting purposes, this fund group balance is reported as unrestricted at fiscal year-end. Common uses of this fund include withholdings for taxes for employees and sales tax. This fund group is managed internally by UCO.