Standards

OVERVIEW OF Financial Processing Documents

This portion of the book is meant to provide a greater understanding of Indiana University’s mechanisms for moving funds and transferring balances between accounts.

These standards contain information about the transfer of funds (TF) document, distribution of income and expense (DI) document, general accounting adjustment (GEC) document, internal billing (IB) and service billing (SB) documents, accrual voucher (AV) document, and the appropriate usage of these documents.

- Transfer of Funds: The TF document is the document required for moving cash balances between Indiana University accounts within KFS. This page contains general information, requirements, and best practices associated with the transfer of funds document.

- Distribution of Income and Expense: The DI document is the document required for redistributing general ledger balances between the same basic accounting categories (asset, liability, income, and expense) within KFS. General information, distinguishing characteristics between the documents, requirements, and best practices are provided in this portion of the book. This information is included in the distribution of income and expense/general accounting adjustments standard.

- General Accounting Adjustment: The GEC document is the document required for adjusting general ledger balances across accounting categories (asset, liability, income, and expense) within KFS. General information, distinguishing characteristics between the documents, requirements, and best practices are provided in this portion of the book. This information is included in the distribution of income and expense/general accounting adjustments standard.

- Internal and Service Billing Documents: The IB and SB documents are the documents required for the recording of income and corresponding expense for any billings of goods or services between university accounts that exceed annual revenues of $100,000 within KFS. This page contains general information, requirements, and best practices associated with the internal and service billing documents.

- Accrual Voucher: The AV document is the document required to record adjusting entries, accrual entries, or recode entries to the proper posting period within KFS. This page contains general information, requirements, and best practices associated with the accrual voucher document.

UCO-SYS-2.00: Transfer of Funds

Prerequisites

Prior to reading the standard on transfer of funds, it is beneficial to review the below standards to gain foundational information:

Preface

This standard discusses elements of the transfer of funds document and how it is used internally within Indiana University. Information presented below will walk through a general understanding of the document, including how it looks, how to use it, and lastly, will specify requirements and best practices for users of the document.

Introduction

A transfer of funds (TF) document is used to move cash between accounts. Transactions between internal departments should use a TF document, unless the departments are billing for goods or services in excess of $100,000. The transfer of funds document is often used to cover an overdraft, reimburse an account for an expense incurred, provide a subsidy, transfer funds to close an account, fulfill a funding commitment, or to bill for goods and services in aggregate of $100,000 or less. Below are several common examples of transfers at the university:

- Monthly administrative charges, budget allotments, university tax, and intercampus transfers

Hawthorn Hall is pictured from the air on the Indiana University Northwest campus. - Reimbursement of depreciation within recharge units

- Subsidies

- Transfers from operating accounts to renewal and replacement accounts

- Recording an interdepartmental sale of capital equipment- This is done in conjunction with the asset transfer document

- Additions to loan funds and quasi-endowment funds

- Accruing a cash transfer from a previous month

- Lifecycle funding

- Matching the commitments and faculty endowment matches (FEMP)

- Transferring funds to close out accounts (for Contract & Grant accounts this would include residual balances and overdrafts)

- Moving cash from departmental accounts to Contract & Grants (C&G) “Cost-Share” subaccounts to cover expenditures that occur within those subaccounts

- Debt related transfers (i.e., debt funding, dedicated fee transfer, bond expenses)

- Accounts with internal activity under $100,000 will NOT be permitted to use internal billings, service billings, and/or ID billings without prior approval from the Chief Accountant or Controller. However, a transfer of funds document can be initiated to complete the transaction between university accounts

Importance and Impact of Transfer of Funds

Accuracy and the proper use of transfer of funds documents are important in ensuring cash balances are correct at account, organization, RC, and campus levels. Inaccurate cash positions can affect account and RC fiscal officer’s decision making. For example, if cash is overstated, a fiscal officer may make cash commitments which they cannot fulfill.

Misuse of transfer of funds can also lead to compliance issues. For example, there are many cost accounting restrictions when transferring funds within recharge/service center accounts. If cash is transferred into a service center account, it may not be transferred out. If a transfer is made in error, it can have a major impact on a service center’s rates and their ability to bill other Indiana University accounts.

Transfer of Funds

There are two kinds of transfers, mandatory and non-mandatory. Mandatory transfers are required to meet contractual agreements. Specific object codes are used to identify these transactions. An example of this type of transfer is moving dedicated student fees to the retirement of indebtedness sub-fund group for principal and interest payments on bonds.

Non-mandatory transfers are allocations of unrestricted cash between entities which are not required by contractual agreements. An example of a non-mandatory transfer would be if a dean makes a commitment to give a department $500 in support of a mission without expecting reimbursement.

Non-mandatory transfers are most commonly used and include:

- Non-mandatory additions to loan funds

- Additions to quasi-endowment funds

- Non-mandatory transfers to plant funds for:

- General or specific plant additions

- Renewals and replacements of plant assets

- Voluntary payments of debt principal

- Commitments from a campus to subsidize an organization’s operations

- Cover an overdraft

- Transfer funds to close out an account

- Reimbursement for goods or services when the billing department is not eligible to use internal billing or service billing documents

Embedded Rules for the TF Document

- There must be at least one accounting line in the From section and one accounting line in the To section

- The total in the From line(s) must equal the total in the To line(s)

- $0 balances are not allowed in the amount section of the TF document

- Negative amounts are not allowed (unless it is an Error Correction TF)

- KFS automatically generates cash object code offset entries as defined by the information entered into the document.

- Only transfer object codes are allowed to be used on transfer of funds documents. A list of transfer object codes is provided further down the page.

- The two object sub-types available to be used on transfer of funds documents must balance independently. They are the Mandatory Transfer (MT) sub-type and Non-mandatory Transfer (NT) sub-type

- The following transactions are unallowable on transfer of funds documents:

- Transfers between clearing fund accounts (68-XX-XXX) and university funds

- Transfers between agency fund accounts (97-XX-XXX) and university funds

- Transfers between restricted and non-restricted funds, with the exception of construction accounts funded by Indiana University Foundation (IUF) funds as discussed within the Construction Account Process for Capital Gifts from IU Foundation Reference Document.

- There are additional compliance rules associated with recharge accounting. These can be found in the Recharge Accounting Standards.

Object and Sub-Object Code Usage for Transfer of Funds Documents

Only specific object codes may be used on a transfer of funds document. The majority of non-mandatory transfer object codes are within the range 9900 – 9999. Non-mandatory transfers have an object sub type of “TN.” Mandatory transfer object codes are used by a select group at Indiana University and should not be available for general use. Mandatory transfer object codes have an object sub type of “MT.”

Due to the limited number of transfer object codes available, tracking can be difficult. If a greater order of granularity is required for an entity’s needs, sub-object codes can be implemented at the account level. This will allow an entity to have separate buckets for specific transfers and will be broken out on financial statements at the object code level.

Along with mandatory/non-mandatory classifications of object codes, there are also certain transfer object codes that hit the fund balance section of the balance sheet and some that flow through the income statement. Below are tables of all transfer object codes separated by this distinction.

The following transfer object codes will appear in the income statement and fund balance section respectively:

| Object Code | Object Code Name | Object Sub-Type | Example Usage |

|---|---|---|---|

| 9903 | Indirect Cost Income | TN | Transfer of residual amounts and overdraft coverage |

| 9912 | Administrative Charge Income | TN | Monthly administrative charges between fund groups |

| 9916 | Transfer In – Revenue | TN | Recording of revenue for the sale of goods or services – typically used when estimated internal activity is less than $100,000/year |

| 9918 | Budget Allotment Income | TN | Monthly budget allotments between fund groups and monthly University Tax |

| 9919 | Transfer In Accrual | TA | Accruing a transfer in of cash from previous period (only used on Accrual Vouchers) |

| 9920 | Transfer of Funds – Acad Salary | TN | Auto-generated cost share entries and HR transfers |

| 9923 | Transfer of Funds – Acad Assist | TN | Auto-generated cost share entries |

| 9924 | Transfer of Funds – Prof Salary | TN | Auto-generated cost share entries and HR transfers |

| 9925 | Transfer of Funds – Cler Salary | TN | Auto-generated cost share entries |

| 9930 | Transfer of Funds – Wages | TN | Auto-generated cost share entries |

| 9940 | Transfer of Funds – Sup & Exp | TN | Auto-generated cost share entries and lifecycle funding |

| 9951 | Administrative Charge Expense | TN | Monthly intercampus transfers (budget office) and monthly administrative charges within units |

| 9952 | Admin Charge – Campus | TN | Monthly administrative charges |

| 9953 | Admin Charge – Unit Admin | TN | Monthly University Tax |

| 9954 | Transfer of Funds – Fee Rem | TN | Auto-generated cost share entries |

| 9955 | Transfer of Funds – Indirect Cost | TN | Transfer of residual amounts and overdraft coverage |

| 9956 | Transfer of Funds – Fringe Benf | TN | Auto-generated cost share entries |

| 9957 | Transfer of Funds – Retirement | TN | Auto-generated cost share entries |

| 9958 | Transfer of Funds – Fell & Scho | TN | Auto-generated cost share entries and matching the promise campus match |

| 9959 | Transfer Out 20% Reallocation | TN | Auto-generated cost share entries |

| 9960 | Transfer of Funds – Travel | TN | Auto-generated cost share entries |

| 9966 | Transfer In – Expense | TN | Recording of expense for goods or services |

| 9977 | Budget Allotment Expense | TN | Monthly intercampus transfers (budget office) and monthly University Tax |

| 9978 | Transfer Out Accrual | TA | Accruing a transfer out of cash from previous period |

| Object Code | Object Code Name | Object Sub-Type | Example Usage |

|---|---|---|---|

| 1663 | Plant Transfer Income | TN | Transfer book value of assets from one plant fund account to another |

| 1697 | Mandatory Transfer/ Principle/Int | MT | Debt funding – used by Treasury only |

| 1698 | Mandatory Transfer Ded Student Fees | MT | Dedicated fee transfer for bonds – used by Treasury only |

| 1699 | Transfer In | TN | Bond expenses (Treasury) and EOY account adjustments for State of Indiana CG funds |

| 9915 | Transfer of Funds | TN | One-time subsidies and departmental commitments |

| 5163 | Plant Transfer Expense | TN | Transfer book value of assets from one plant fund account to another |

| 5197 | Mandatory Transfer Principal/Int | MT | Debt funding – used by Treasury only |

| 5198 | Mandatory Transfer Dedicated Stud Fees | MT | Dedicated fee transfer for bonds – used by Treasury only |

| 5199 | Transfer Out | TN | Bond expenses – used by Treasury only |

| 9900 | Transfer Out | TN | One-time subsidies and departmental commitments |

| 9970 | Transfer of Funds – Capital | TN | Record the interdepartmental sale of capital equipment – done in conjunction with an asset transfer document |

| 9979 | Transfer of Funds – Unapp Bal | TN | Faculty Endowment (FEMP) matches and overdraft coverage |

For a more comprehensive Excel version of these object codes, refer to the Summary of Transfer Object Codes Document.

Additional Restrictions for Recharge/Service Center Accounts

Transfers In: A recharge/service center 66 account can receive a subsidy through a transfer of funds document to help cover expenses, however, any excess subsidy will not be allowed to be transferred out of that 66 account. Once funds have been transferred into a recharge/service center 66 account, they cannot be transferred out for any reason other than what is cited below in the Transfers Out section.

Transfers Out: With the exception of a transfer out of depreciation to the dedicated renewal and replacement 92 account, transfers out of a recharge/service 66 account are not allowed.

As a best practice, if a recharge unit chooses to fund depreciation (reimburse expense) the units that have capital assets should annually transfer out cash in the amount equal to or less than their depreciation expense. This transaction is conducted using a transfer of funds document from the 66 account to the 92 account and the intent is to fund future capital purchases.

Please include a detailed description on the KFS transfer of funds document that includes the depreciation period (i.e. “Transferring depreciation expense for FY 2015”).

Recharge/service center units that have debt service should contact Recharge Accounting regarding transfers of funds.

Where is the Transfer of Funds Document Located?

See below for instructions on how to locate the transfer of funds document.

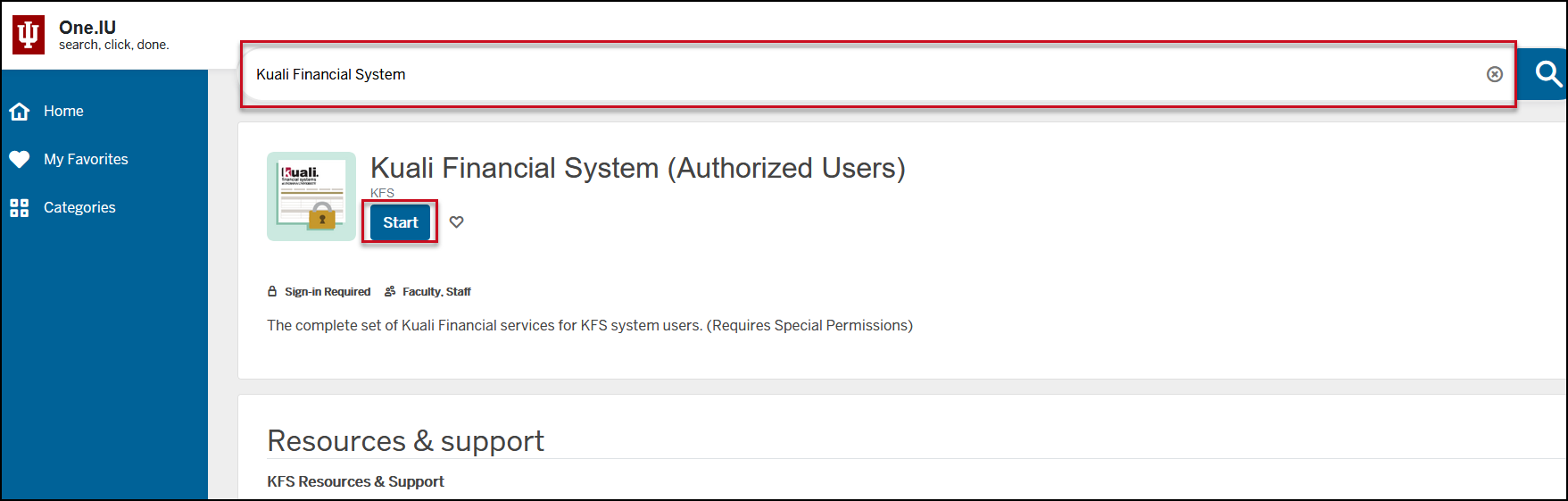

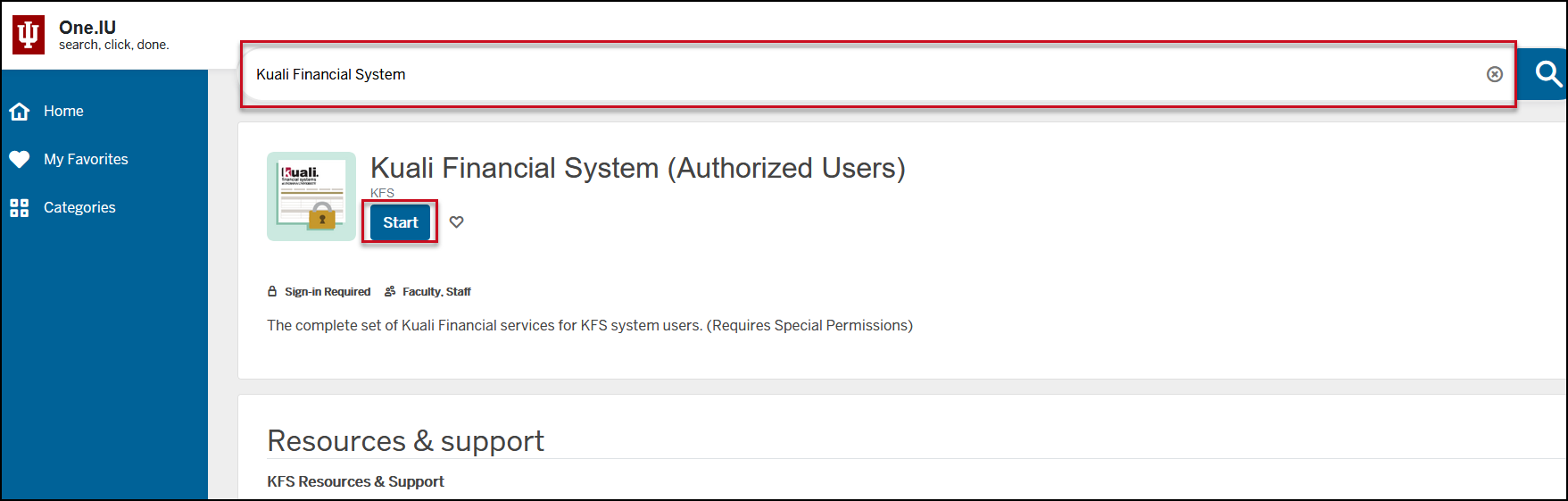

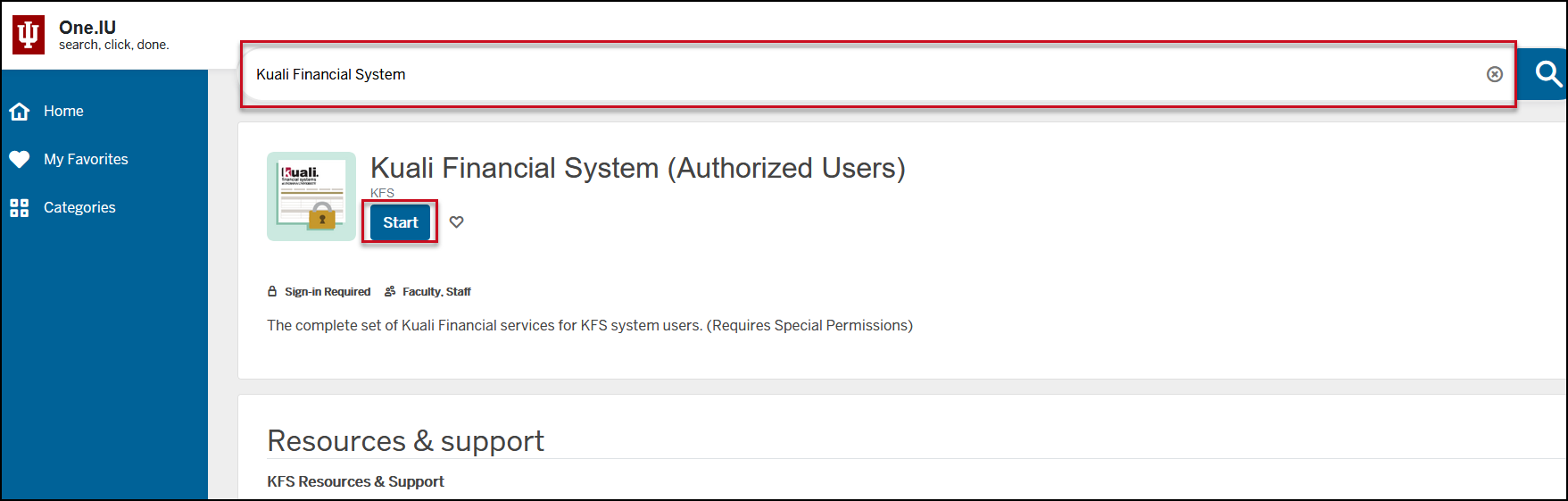

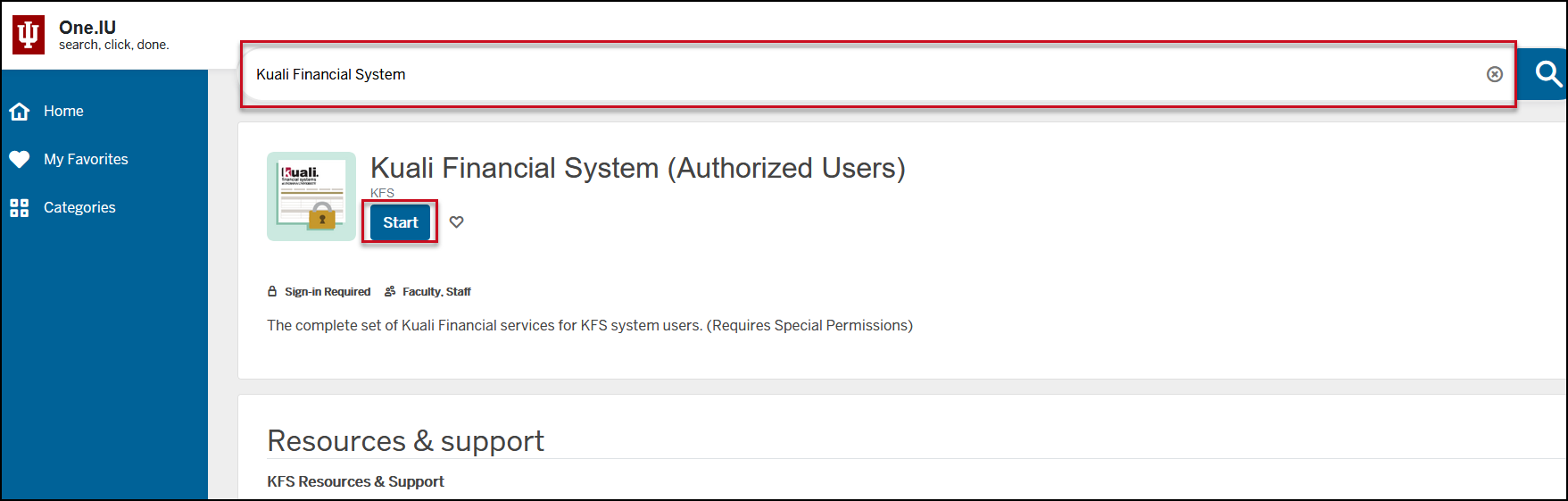

Transfer of funds documents are located in Kuali Financial System (KFS) which can be found in One.IU. Search for “Kuali Financial System” and select Kuali Financial System (Authorized Users). Mark this app as a favorite by clicking the heart icon next to the start button. Select Start.

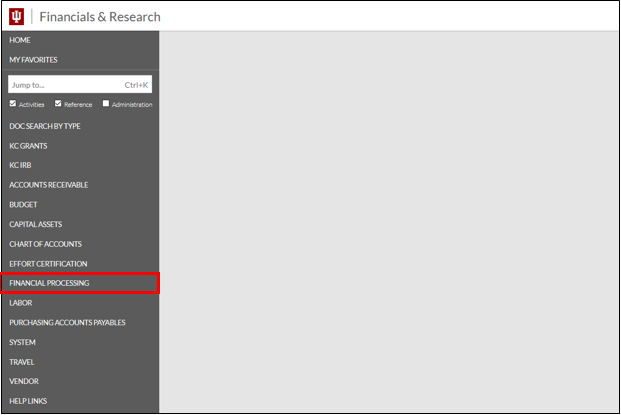

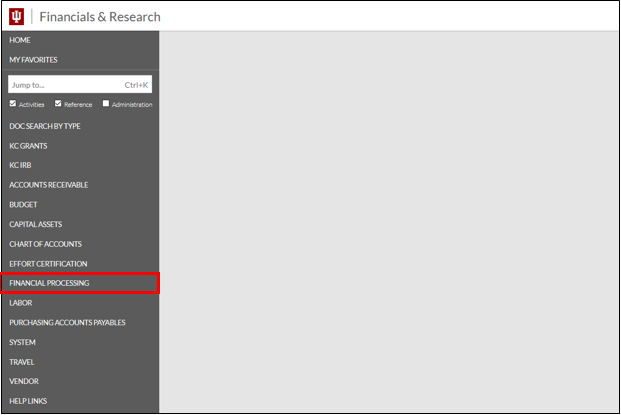

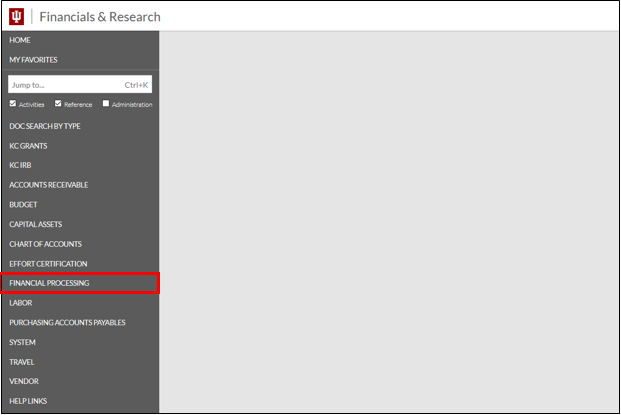

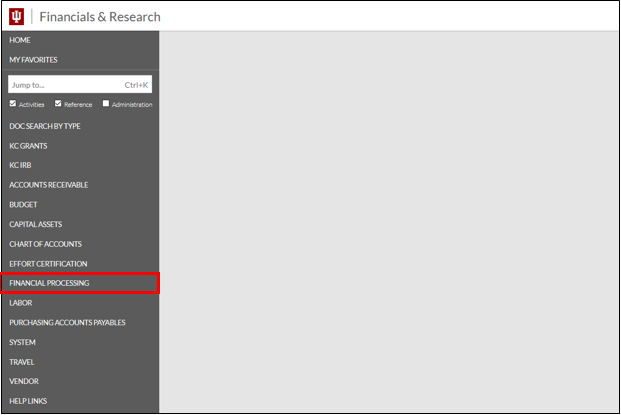

Once in the Kuali Financial System (KFS), users will see all available tiles. Navigate to the financial processing module.

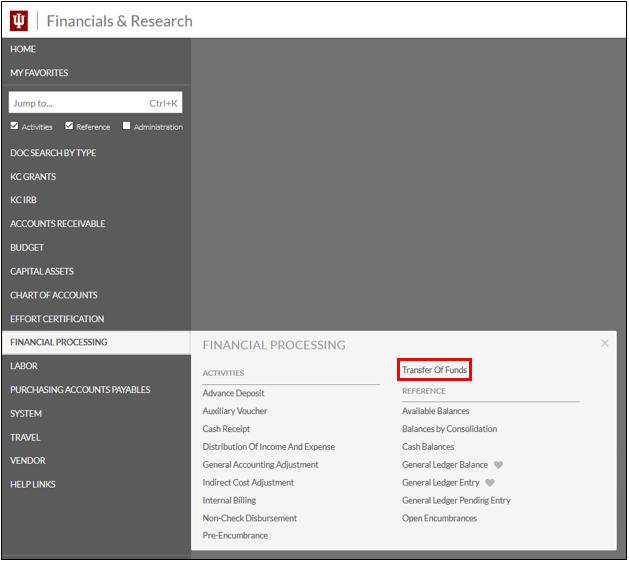

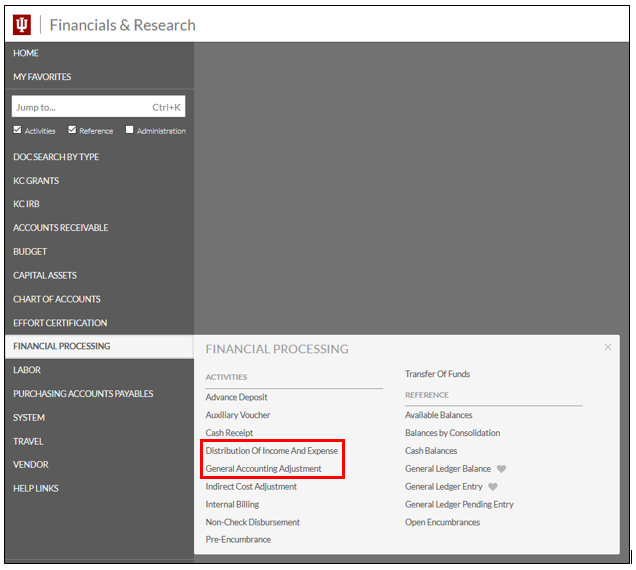

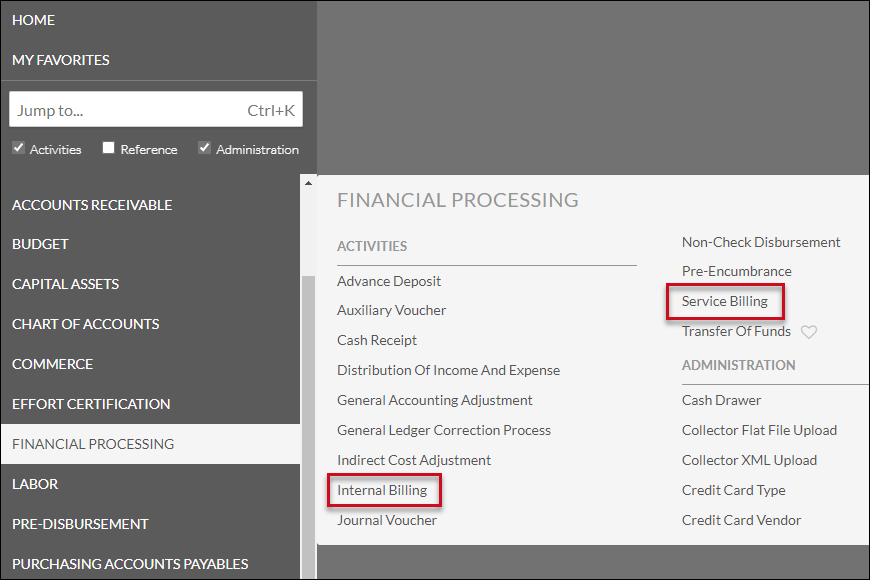

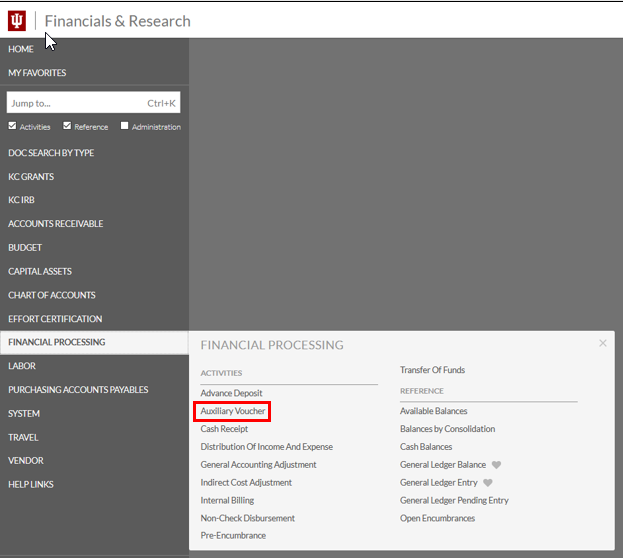

The tile expands to display all financial processing options. Selecting Transfer of Funds will generate a new transfer of funds document and take you to the document.

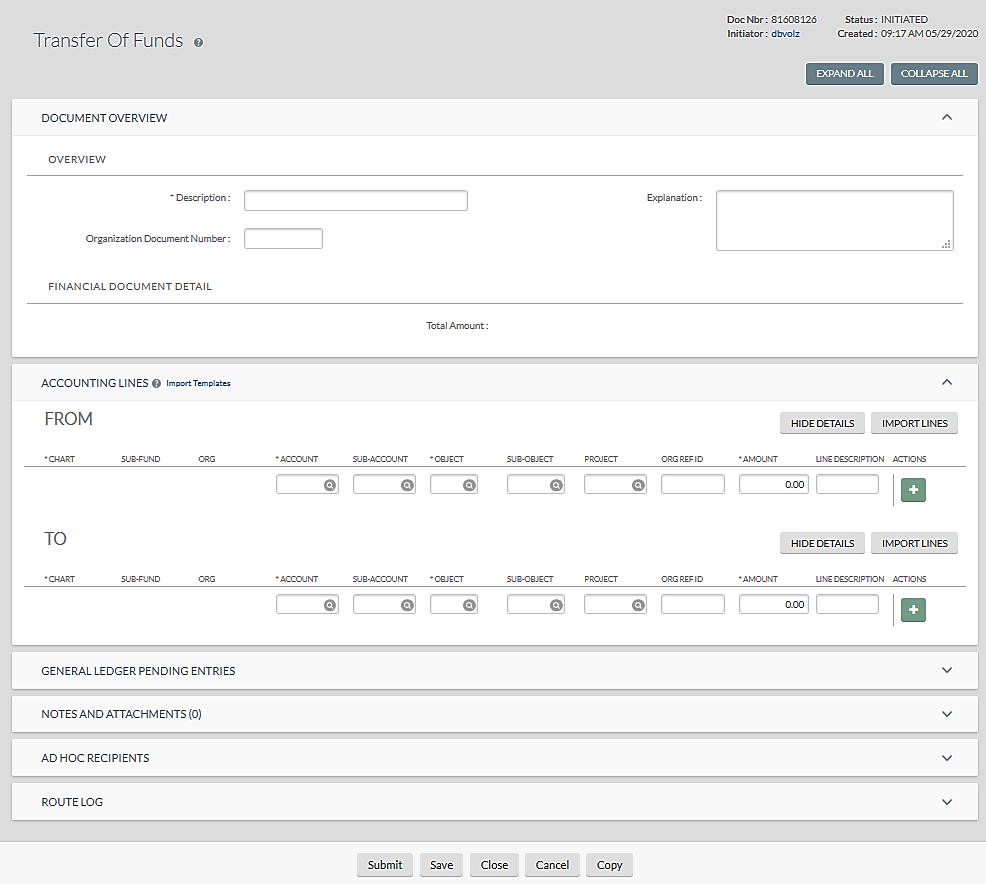

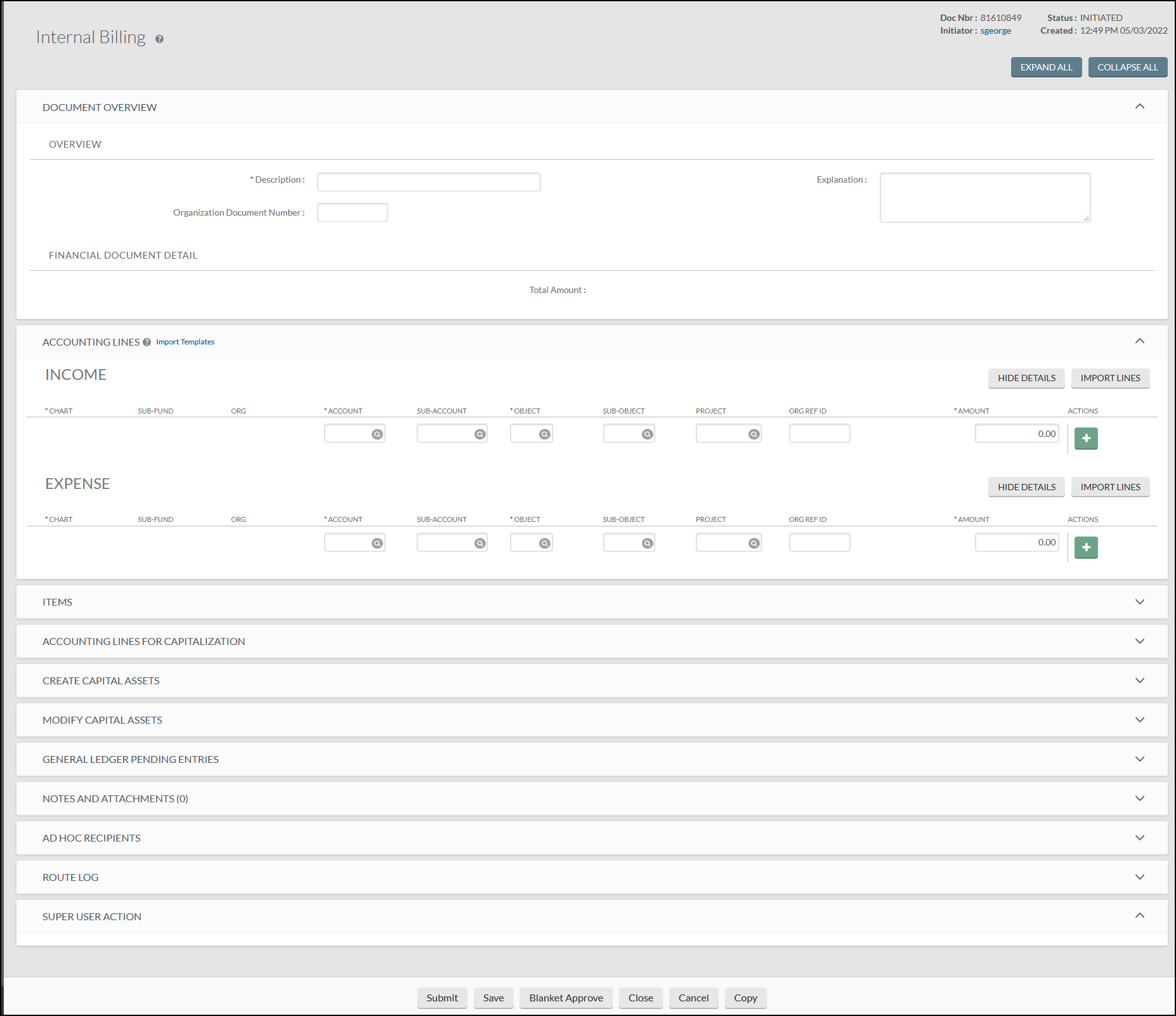

Once in the document, users will see that it is comprised of the standard financial transaction document tabs and does not have any unique tabs of its own. Below is an example of a new transfer of funds document.

Requirements and Best Practices

Requirements

- Review and become familiar with this standard and all reference materials prior to completing a transfer of funds document.

- Ensure supporting documentation for each document is adequate prior to approving. For further information on the substantiation of transfer of funds documents, refer to the individual Financial Statements Standards.

Quarterly Activities:

- Fiscal officers should review transfers to and from their accounts on a quarterly basis, at a minimum, to ensure accuracy of data.

Annual Activities:

- During year-end close, fiscal officers should review all transfers to and from their accounts and make any necessary corrections during the year-end close period. Also, any transfers intended to post in the current year must be submitted on a year-end distribution of transfer of funds (YETF) document. Please refer to the Closing Standards for more information.

Best Practices

- Fiscal officers should review transfers to and from their accounts on a monthly basis to ensure accuracy of data.

- Monitor the transfer of funds document. Users should stay up to date with any potential changes to the document and its requirements.

UCO-SYS-2.01: Distribution of Income and Expense/General Accounting Adjustment

Prerequisites

Prior to reading the standard on distribution of income and expense and general accounting adjustment, it is beneficial to review the below standards to gain foundational information:

- Accounting Fundamentals Standards

- Chart of Accounts and General Ledger Standards

- Financial Statements Standards

- Closing Standards

Preface

This standard discusses the distribution of income and expense (DI) and general accounting adjustment (GEC)* documents and how they are used internally within Indiana University. Information presented below will walk through a general understanding of these documents, how to use them, and lastly, will specify requirements and best practices for users of these documents.

*Note: The general accounting adjustment document was previously called the General Error Correction (GEC) document.

Introduction

The Kuali Financial System (KFS) has several documents that users can use to record transactions between university accounts. Each of these documents has a specific purpose and may have embedded chart of accounts (i.e., fund group, account, object code) restrictions to help ensure the document is used properly. This standard focuses on the distribution of income and expense and the general accounting adjustment documents. Guidance on the transfer of funds, budget adjustment, internal billing, service billings, and ID billings can be found in other standards within this book.

Importance and Impact of Distribution of Income and Expense (DI) and General Accounting Adjustment (GEC) Documents

Accuracy and proper use of DI and GEC documents is important in ensuring general ledger balances are correct at the account, organization, RC, and campus levels. Inaccurate general ledger balances can affect account and RC fiscal officer’s decision making as well as increase audit risk for the entire university.

Misuse of DI and GEC documents can lead to increased audit risk in Contract and Grant and cost accounting areas in addition to general financial statement audit risk.

Distribution of Income and Expense (DI)

The distribution of income and expense (DI) document is used for the reallocation or redistribution of dollars within the same basic object code category (asset, liability, income, and expense). This document gives users the ability to reallocate between accounts, sub-accounts, object, and sub-object codes. For example, credit card charges may originally post to a university administration account and are later distributed out to the various appropriate accounts using the DI document.

With the DI, offsetting entries to the 8000 (cash) object code are automatically generated “behind the scenes” by the system. This makes the DI useful for users who want to move cash along with other GL balances.

The distribution of income and expense document requires the approval of the fiscal officer or delegate of each account appearing on the document.

Accounts with internal activity under $100,000 are not permitted to use internal billings, service billings, and/or ID billings without prior approval from the Chief Accountant or Controller. However, a DI can be initiated to move costs between university accounts (expense to expense).

The year-end distribution of income and expense document is only available during year-end close. The year-end version allows the user to initiate a distribution of income and expense document and post it into the previous fiscal year after July 1st. The same business rules apply to the distribution of income and expense documents and the year-end distribution of income and expense documents; the only difference between the two documents is the routing. The year-end distribution of income and expense document does not route to the fiscal officer but does route to the Controller’s Office workgroup for approval.

Embedded Rules for the DI Document

- The DI document requires users to have the same object code category on both the From and To side of the document.

| Object Code Category From Side | Object Code Category To Side |

|---|---|

| Asset | Asset |

| Expense | Expense |

| Income | Income |

| Liability | Liability |

- Negative amounts are not allowed.

- DIs cannot be used to bill another account. They can, however, move expense from one account to another.

The following object sub-types are prohibited in the DI document:

| Sub-type | Description | Alternative |

|---|---|---|

| FR | Fringe Benefits | Use Benefits Expense Transfer document. |

| SA/HW | Salaries and Wages | Use Salary Expense Transfer document. |

| LD | Loss on Disposal of Assets | Use CAMS documents. |

| OP | Other Provisions | Use Accrual Voucher (AV) document. |

| MT | Mandatory Transfers | Use Transfer of Funds (TF) document. |

| TF | Transfer of Funds | Use Transfer of Funds (TF) document. |

| TN | Transfer – Generic | Use Transfer of Funds (TF) document. |

| BU | Budget Only Object Codes | Use Budget Adjustment (BA) document. |

| PL/DR | Plant and Depreciation | Use CAMS documents. |

| CA | Cash | Use Journal Voucher (JV) document.* |

| FB | Fund Balance | Use Journal Voucher (JV) document.* |

*The Journal Voucher document is used by Office of the University Controller administrative staff only. If this type of transaction needs to be corrected, contact the Accounting and Reporting Services team at uars@iu.edu.

General Accounting Adjustment (GEC)

The general accounting adjustment (GEC) document is used for two primary purposes.

- To correct inappropriate or incorrect account numbers, sub-account numbers, object codes, or sub-object codes in the general ledger. When possible, reference the specific document number of the transaction(s) being corrected. The Office of Research Administration (ORA) always prefers use of the GEC. By consistently referencing the details of each transaction, the GEC preserves and maintains the audit trail.

- To initiate an accounting adjusting entry (where an offset to cash is required). For example, a department recorded deferred revenue and needs to recognize revenue over a period.

Same as with the DI, offsetting entries to the 8000 (cash) object code are automatically generated “behind the scenes” by the system. Approval of the GEC is required of the fiscal officer or delegate of each account appearing on the document.

Accounts with internal activity under $100,000 will not be permitted to use internal billings, service billings, and/or ID billings without prior approval from the Chief Accountant or Controller. However, a GEC document can be initiated to move costs between university accounts.

Like the DI, the year-end general accounting adjustment document is only available during year-end close. The year-end version allows the user to initiate a general accounting adjustment document and post it to the previous fiscal year after July 1st. The same business rules apply to the general accounting adjustment document and the year-end general accounting adjustment document with the only difference between the two documents being the routing. The year-end general accounting adjustment does not route to the fiscal officer but does route to the Controller’s Office workgroup for approval.

The GEC document is unique in the sense that it requires the user to populate the Reference Origin Code and Reference Number in the accounting lines section of the document. These fields link the GEC to the original entry that is being corrected.

The Reference Origin Code is a two-character code that denotes the system from which a transaction originated. Some common codes include:

| Reference Origin Code | Reference Origin Description |

|---|---|

| 01 | Kuali Financial System (KFS) |

| PL | Human Resource Management System (HRMS) |

| BY | Buy.IU |

| CR | Chrome River |

| SIS | Student Information System (SIS) |

| EU | General Ledger Generated Offsets (uploaded electronic file) |

If a transaction’s Reference Origin Code is unknown, it can be determined by looking at the general ledger entry the GEC is correcting.

The Reference Number is a unique document identifier specific to the transaction that is being modified. Examples of Reference Numbers include KFS Doc IDs, BUY.IU PO numbers, Payroll Run IDs, and check numbers. If a transaction’s Reference Number is unknown, it can be determined by looking at the general ledger entry the GEC is correcting. In the event that the user is making an adjusting entry that involves multiple documents, the user should specify ’01’ in the Reference Origin Code field and ‘ADJ’ in the reference number field.

Embedded Rules for the GEC Document

- In most cases, the To and From sides of the document must balance. When multiple object types are used, document entries may all be on either the To or From sides. In those cases, the debits and credits must balance.

- GECs cannot be used to bill another account. They can, however, move expense from one account to another.

- Negative amounts are not allowed.

- Not for use with fund balance object codes or object type code IC (income not cash).

The following object sub-types are prohibited in the GEC document:

| Sub-type | Description | Alternative |

|---|---|---|

| AS | Assessment | Use Transfer of Funds (TF) or Distribution of Income and Expense (DI) documents. |

| BU | Budget Only Object Codes | Use Budget Adjustment (BA) document. |

| DR | Depreciation | Use CAMS documents. |

| FR | Fringe Benefits | Use Benefits Expense Transfer document. |

| HW/SA | Salaries and Wages | Use Salary Expense Transfer document. |

| LD | Loss on Disposal of Assets | Use CAMS documents. |

| LO | Loss on Retirement of Assets | Use CAMS documents. |

| OP | Other Provisions | Use Accrual Voucher (AV) document. |

| MT | Mandatory Transfers | Use Transfer of Funds (TF) document. |

| PL | Plant Capital Assets | Use CAMS documents. |

| TN | Transfer – Generic | Use Transfer of Funds (TF) document. |

| VA | Valuations and Adjustments | Use Distribution of Income and Expense (DI) document. |

| CA | Cash | Use Journal Voucher (JV) document.* |

| FB | Fund Balance | Use Journal Voucher (JV) document.* |

*The Journal Voucher document is used by Controller’s Office administrative staff only. If this type of transaction needs to be corrected, contact the Accounting and Reporting Services team at uars@iu.edu.

Correcting Errors Related to Capital Assets with a General Accounting Adjustment (GEC)

In addition to moving general ledger balances from one account to another, the GEC can be used to make changes to capital assets. Below are multiple scenarios in which a GEC can be used to modify capital assets and how the modification is to be performed:

To use a GEC document to change an asset from capital to expense:

- In the Accounting Lines tab, enter the capital asset object code for the existing asset on the From side and enter the new, non-capital object code on the To side.

- In the Accounting Lines for Capitalization section, click Generate. Select the line. Click Modify Asset, enter the existing capital asset number, and click Redistribute Total Amount.

To use a GEC document to change an existing expense to a capital asset:

- In the Accounting Lines tab, enter the non-capital asset object code for the existing asset on the From side and enter the new, capital object code on the To side.

- In the Accounting Lines for Capitalization section, click Generate. Select the line. Click Create Asset, enter the required asset information, and click Redistribute Total Amount.

To use a GEC document to move an asset from one account to another:

- In the Accounting Lines tab, enter the existing account number for the asset on the From side and enter the new account number on the To side.

- In the Accounting Lines for Capitalization section, click Generate. Select both lines. Click Modify Asset, enter the existing capital asset number, and click Redistribute Total Amount.

Comparison of Documents

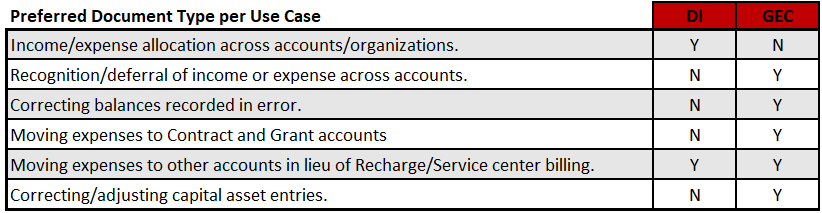

There are many instances in which a user may need to move cash and other general ledger balances between accounts. Perhaps a previous transaction was recorded in error, or maybe an agreement has been made to share expenses or income across multiple accounts. In either of these cases, a distribution of income and expense (DI) or general accounting adjustment (GEC) can be used. As in the example, there are many instances in which both document types can be used. However, there are preferred and sometimes required document types for most situations. Some common examples and their preferred document type are listed in the table below:

Where is the DI/GEC Document Located?

See below for instructions on how to locate the DI and GEC documents.

DI and GEC documents are located in Kuali Financial System (KFS), which can be found in One.IU. Search for “Kuali Financial System” and select Kuali Financial System (Authorized Users). Mark this app as a favorite by clicking the heart icon next to the start button and then select Start.

Once in the Kuali Financial System (KFS), users will see all available modules. Navigate to the financial processing module.

The tile expands to display all financial processing options. Selecting Distribution of Income and Expense or General Accounting Adjustment will generate a new document.

Requirements and Best Practices

Requirements

- Review and become familiar with this standard and all reference materials prior to completing a DI or GEC document.

- Ensure supporting documentation for each document is adequate prior to approving. For further information on the substantiation of DI/GEC documents, refer to the individual Financial Statements Standards.

Quarterly Activities:

- Review DI/GEC documents to and from your unit’s accounts on a quarterly basis, at a minimum, to ensure accuracy of data.

Annual Activities:

- Review all DI/GEC documents to and from your unit’s accounts as part of year-end closing procedures and make any necessary corrections during the year-end close period. Also, any DI/GEC documents intended to post in the current year must be submitted on a year-end distribution of income and expense (YEDI) or year-end general accounting adjustment (YEGE) documents. Please refer to the Closing Standards for more information.

Best Practices

- Review DI/GEC documents To and From by entity to ensure accuracy of data on a monthly basis.

- Monitor the DI/GEC documents on a regular basis and stay up to date on any potential changes to the document and its requirements.

UCO-SYS-2.02: Internal and Service Billing Documents

Prerequisites

Prior to reading the standard on internal and service billing documents, it is beneficial to review the below standards to gain foundational information:

- Accounting Fundamentals Standards

- Chart of Accounts and General Ledger Standards

- Financial Statements Standards

- Closing Standards

- Recharge and Service Center Units Standards

- UCO-RSC-1.00 Rate Submission Requirements for Recharge Centers Standard

Preface

This standard discusses the elements of internal billing, the KFS internal billing (IB) and service billing (SB) documents, and how they are used within Indiana University. Information presented below will walk through a general understanding of the documents and will specify requirements and best practices.

Introduction

Internal billing is a billing for goods or services between two IU units.

The IB and SB documents are used to record the income and corresponding expense for any billings of goods or services between university accounts that exceed annual revenues of $100,000. Internal billing documents are used by units that have minimal billings to other units. The IB will route for approval to fiscal officers of accounts being billed. The service billing document is also used to bill internal units. However, the SB is limited to use by units with large volume billing and does not route for approval. Internal billing activities under $100,000 in annual revenues are required to use other KFS document types. The department providing the good or service will record income and a corresponding expense for the receiving department. These transactions are also referred to as interdepartmental sales and purchases.

Importance and Impact of the Internal and Service Billing Documents

The timely and proper recording of income and expense transactions between internal accounts is important to ensure that university financial records are accurate, timely budgetary planning, and recovery of all reimbursable expenditures from external sponsoring organizations (e.g. contract and grant accounts).

Incorrect usage of internal or service billings can lead to compliance issues. For example, sponsored accounts require billings be completed within a stated period of time and to meet specific requirements of the sponsor.

Internal Billings and Service Billings

The Kuali Financial System (KFS) has several documents available for users to record transactions between university accounts. The IB and SB documents are used ONLY to bill for internal transactions where one university department is providing a good or service to another university department for a fee. Each document has a specific purpose and has embedded chart of account (i.e., fund group, account, and object code) restrictions to help ensure the document is used properly.

The IB document should be used by approved recharge accounts that have a small to moderate volume of transactions. The IB routes for approval to the fiscal officer of each account listed on the expense side of the document.

The use of the SB document is limited to departments that have frequent mass billings for which the IB cannot be used. The SB is a restricted use document and does not route for approval.

Note: Access to the SB document requires pre-approval by the Office of the University Controller (UCO). In order to gain access to the SB document, an organization fiscal officer should complete the following steps:

- Receive approval from the campus fiscal administrator.

- Read the KFS Service Billing Requirements and Agreement.

- Complete the Modify Service Billing Initiators form at the bottom of the agreement. Access to the form is limited to account fiscal officers.

Embedded Rules for the IB and SB Documents

The IB/SB documents have rules in the documents to prevent them from being used for transactions other than interdepartmental billings. Users do not have the ability to bypass or change the embedded rules on the IB or SB document.

- Account Restrictions – the account listed on the income side of the document will be required to be in the auxiliary service fund (AUXSER), external agency (EXTAGY), or internal agency (INTAGY) sub-fund groups or in a program income account

- Object Code Restrictions – an income object code (object type: IN) is required on the income side of the document and an expense object code (object type: ES, EE, EX) is required on the expense side of the document

- The IB and SB documents must have at least one line in both the income and expense sections of the document

- In the accounting lines tab, the total in the income section must equal the total in the expense section

- Negative amounts are allowed to correct a previously posted billing

Where are the Internal Billing and Service Billing Documents Located?

See below for instructions on how to locate the internal billing and service billing documents.

Internal billing and service billing documents are located in Kuali Financial System (KFS), which can be found in One.IU. Search for “Kuali Financial System” and select Kuali Financial System (Authorized Users). Mark this app as a favorite by clicking the heart icon next to the start button and then select Start.

Once in the Kuali Financial System (KFS), users will see all available tiles. Navigate to the financial processing module.

The tile expands to display all financial processing options. Selecting Internal Billing will generate a new internal billing document and take you to the document. The service billing document will be visible only to employees with approved access to the document.

Below is an example of the internal billing document in KFS.

Requirements and Best Practices

Requirements

- Review and become familiar with the material on this page; as well as, the reference material prior to completing an IB or SB document.

- Ensure supporting documentation for each document is adequate, prior to approving. For further information on the substantiation of IB and SB documents, please review the UCO-AFO-1.02 Financial Transaction Substantiation Standard.

- Each IB or SB document should represent a single instance of billing activity. Departments may bill more than one unit for the same instance on a single document as long as the activity is the same.

- Complete billing documents on all recharge accounts, at a minimum, on a quarterly basis. Make sure all billing transactions are completed in the fiscal year in which the goods or service was provided.

Best Practices

- Fiscal officers should review billings to and from their accounts on a monthly basis to ensure accuracy of data. Fiscal officers should contact the initiator of the IB or SB document for additional information about the transaction.

- Review employee access to the SB document and request information be updated on a regular basis.

UCO-SYS-2.03: Accrual Voucher

Prerequisites

Prior to reading the standard on the accrual voucher, it is beneficial to review the below standards to gain foundational information:

- Accounting Fundamentals Standards

- UCO-CLS-1.00 Accrual Accounting Standard

- Chart of Accounts and General Ledger Standards

- Financial Statements Standards

Preface

This standard discusses the elements of accrual voucher (AV) document and how it is used within Indiana University. The information presented below will walk through a general understanding of the document and will specify requirements and best practices. The university’s requirements for accrual accounting are outlined in the UCO-CLS-1.00 Accrual Accounting Standard.

Introduction

The KFS accrual voucher (AV) document is used to record adjusting entries, accruals, or recode entries to the proper posting period of the transaction for preparation of accurate and timely internal and external financial reports.

AV postings are allowed to the current period, future open periods, and the previous period if the document is posted/approved by the designated cutoff date. The standard monthly cutoff date is the 10th of the following month. In certain months, the cutoff date may be moved to accommodate year-end, weekends, or holidays. Please refer to the UCO Fiscal Officer Calendar for actual cutoff dates for each month. Prior periods that have been closed may not be reopened.

Importance and Impact of the Accrual Voucher

The timely and proper recording of income and expense transactions is important to ensure that university financial records are accurate, timely, and complete. It is also important to ensure the timely recovery of reimbursable expenditures from external sponsoring organizations and accurate payment of taxes to the state and federal government, for example. Accrual vouchers allow an entity to record transactions to assess the financial position more accurately for the period.

The main reasons for completing accrual adjusting entries are to:

- Ensure accuracy and consistency of the university’s financial statements in accordance with Governmental Accounting Standards Board (GASB) and Generally Accepted Accounting Principles (GAAP).

- Provide informed management and executive decision making.

- Support comparative analysis between financial statement periods and organizations.

Types of Accrual Vouchers

The AV document consists of three separate document types:

Accrual: The accrual type (AVAE) is used to post accrual entries to the general ledger that must be reversed in a designated month following the posting period. A reversal date is required for this type of AV, which is normally during the next fiscal period, although it may be any open period.

Adjustment: The adjustment type (AVAD) is used to post adjusting entries. A reversal date is not allowed for this document type.

Recode: The recode type (AVRC) is used to properly reclassify account balances posted to the prior period. The recode entry creates an accrual in the fiscal period specified on the document and is automatically reversed in the current fiscal period. The reversal date defaults to the creation date of the document and cannot be changed. However, the actual reversal occurs on the date the document reaches full approval. In addition, a recode generates a distribution of income and expense (DI) entry. This entry reclassifies the income or expense activity, with cash as the offset transaction, and posts in the current period.

Note: A recode AV for transactions in the previous period must be submitted within 10 days of the end of the previous period.

Rules for the Accrual Voucher

General Rules for the Accrual Voucher

- The university operates on a full accrual basis, which includes all funds.

- Each transaction recorded on an AV must represent a single accounting event and be fully supportable for audit purposes. Transactions for different accounting events or activities should not be combined on the same AV document. For example, accounts receivable and accounts payable transactions should not be combined on the same AV document.

- AVs only impact actual (AC) balances and are never used to impact budgeted activity.

- An AV should always be recorded to satisfy Generally Accepted Accounting Principles and should never be recorded to satisfy budget to actual outcomes or org reversion outcomes for the period.

- All units should ensure that any manual AV document generated does not duplicate automated accrual entries made at the university level (e.g. automated AP accrual). For more information about system-generated accruals, please see the UCO-CLS-1.00 Accrual Accounting Standard.

- Each period, CRUs should assess significant activity (i.e. contractual agreements, payables, receivable, etc.) to ensure that significant accrual entries have been recorded timely and accurately.

- Units should check with their Campus Controller regarding any questions related to AV documents and Accrual Entries.

Embedded Rules for the Accrual Voucher

The accrual voucher (AV) has rules embedded in the documents to prevent them from being used for certain transactions. Users do not have the ability to bypass or change the embedded rules on the AV.

- The accounting period chosen must be open. Accounting periods AB (Annual Balance), BB (Beginning Balance), and CB (C&G Beginning Balance) are not allowed on an AV document.

- Accrual vouchers for an open period must be approved by the designated cutoff date. The standard cutoff date is the 10th of the following month. In certain months, the cutoff date may be moved to accommodate year-end, weekends, or holidays. Please refer to the UCO Calendar for actual cutoff dates for each month.

- If the AV type is accrual, a reversal date is required. An accrual entry may have a reversal date that reverses in the future, even the next fiscal year.

- There must be at least two accounting lines in the document.

- All accounts must belong to the same chart and sub-fund.

- On an accounting line, you must enter a credit or debit amount, but not both.

- Negative values are not allowed.

- Debits and credits must balance.

- Certain object code sub-types may be restricted from being used on the Auxiliary Voucher. These include the following sub-types:

- AM – ART AND MUSEUM

- AS – ASSESSMENT

- BD – BUILDING

- BF – BUILDING AND ATTACHED FIXT FED FUNDED

- BU – BUDGET ONLY OBJECT CODES

- C4 – LEASE

- C5 – INTANGIBLE LEASED ASSETS

- C7 – LEASE RECEIVALBE

- C8 – LEASE DEFERRED INFLOW

- C9 – SBITA OBLIGATION

- CA – CASH

- CF – CAPITAL MOVEABLE EQUIPMENT – FED FUNDED

- CL – CAPITAL LEASE PURCHASES

- CM – CAPITAL MOVEABLE EQUIPMENT

- CO – CAPITAL MOVEABLE EQUIPMENT – OTHER OWNED

- CP – CONSTRUCTION IN PROCESS

- DR – DEPRECIAITON

- ES – EQUIPMENT START-UP COSTS

- FB – FUND BALANCE

- IF – INFRASTRUCTURES

- LA – LAND

- LE – LEASEHOLD IMPROVEMENTS

- LF – LIBRARY ACQUISITION – FED FUNDED

- LI – LIBRARY ACQUISITION

- MT – MANDATORY TRANSFERS

- PI – PLANT – INDEBTEDNESS

- PL – PLANT – CAPITAL ASSETS

- RE – RESERVES

- TF – TRANSFER OF FUNDS

- TN – TRANSFERS – GENERIC

- UC – UNIVERSITY CONSTRUCTED

- UF – UNIVERSITY CONSTRUCTED – FEDERAL FUNDED

- UO – UNIVERSITY CONSTRUCTED – FEDERAL OWNED

- As of June 1, 2023, compensation, wages payable, and vacation/sick object codes will not be allowed on the AV document. These are restricted to system-generated transactions, salary transfer (ST), journal voucher (JV), non-check disbursements (ND), and budget adjustment (BA) documents.

- As of June 1, 2023, the AV document must meet a minimum threshold of $100,000 per document for processing. Documents that do not meet the $100,000 threshold will receive an error message and will not be submitted.

- The fiscal officer for each account must approve the AV document.

- Additional approvals may be established within the review hierarchy.

- Please see the UCO-CLS-2.01 Material Transactions Standard for appropriate supporting documentation.

- All transactions over $5M as of June 1, 2023 will route to the Campus Controller for review.

- All transactions over $5M as of June 1, 2023 will require supporting documentation be attached to the KFS document.

Where is the Accrual Voucher Located?

See below for instructions on how to locate the accrual voucher document.

Accrual vouchers are located are located in Kuali Financial System (KFS), which can be found in One.IU. Search for “Kuali Financial System” and select Kuali Financial System (Authorized Users). Mark this app as a favorite by clicking the heart icon next to the start button and then select Start.

Once in the Kuali Financial System (KFS), users will see all available tiles. Navigate to the financial processing module.

The tile expands to display all financial processing options. Selecting Auxiliary Voucher will generate a new AV document and take you to the document.

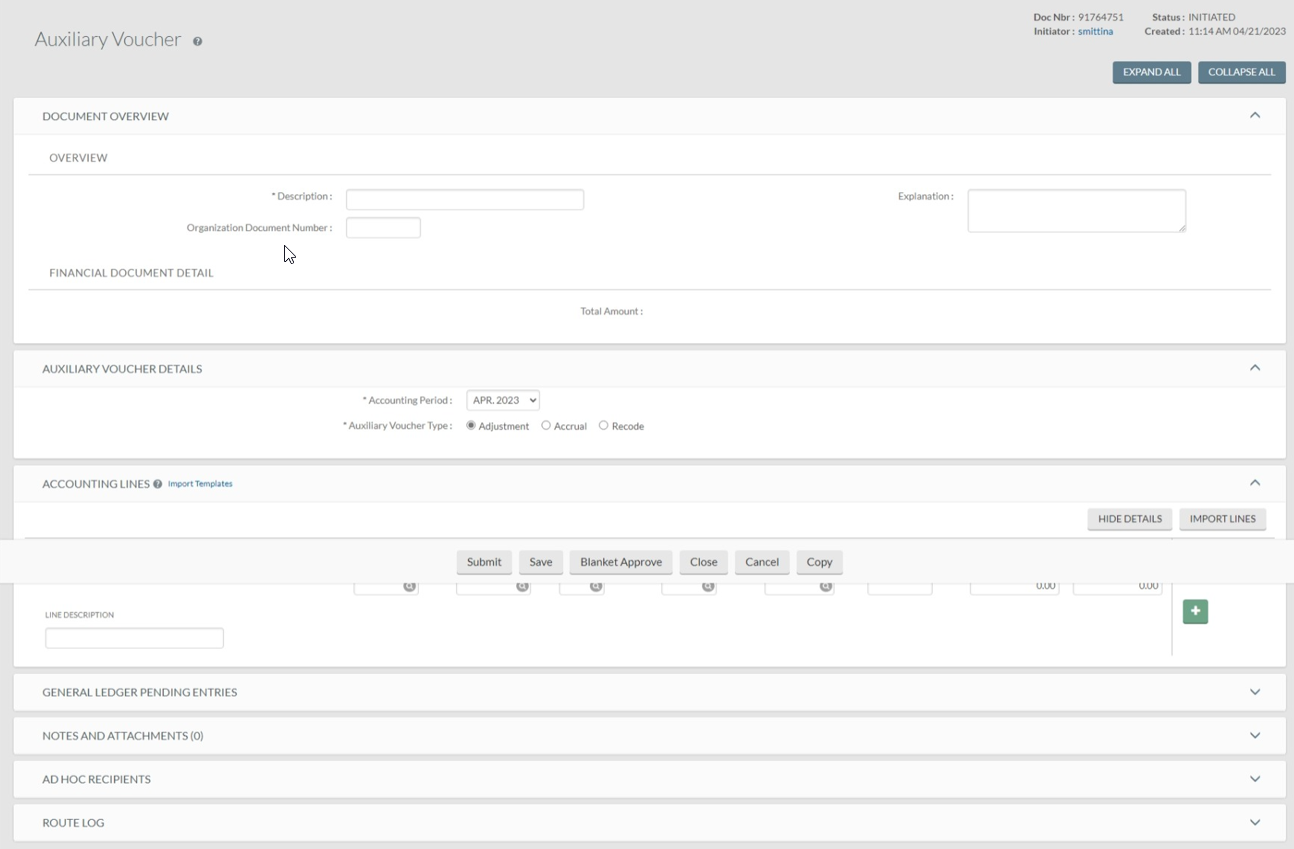

Below is an example of the accrual voucher document.

Requirements and Best Practices

Requirements

- Review all system-generated (automated) accruals for material accuracy and completeness. Fiscal officers should understand the cause of any material variances. Additionally, fiscal officers should not duplicate any system-generated (automated) accruals. Any questions regarding system accruals should be discussed with your Campus Controller.

- Record any appropriate manual accrual or deferral entry over the IU required threshold to ensure the accuracy of the interim and annual financial statements; refer to the Closing Standards for threshold values.

- Ensure that all significant contracts or external agreements of the departmental organization have been reviewed timely and communicated to the Campus Controller to ensure that accrual entries are properly recorded in the appropriate period.

- Ensure that proper substantiation for all accrual entries are available upon request by external or internal auditors and that documentation is attached to all transactions where required.

- Ensure that all accounts and object codes (income statement and balance sheet) are reconciled on a quarterly basis to identify any missing or inaccurately recorded accrual entries and that all entries have appropriately reversed from a prior period.

- Substantiate all balance sheet balances that have resulted from manual accrual entries. Refer to the substantiation information within the Closing Standards for further information.

Best Practices

- Complete the closing procedures required above on a monthly basis to ensure accurate and timely financial results.

Furnishes goods or services to another Indiana University department for the convenience of the university and charges a fee directly related to providing the goods or services, and not more than the allowable costs.

Service fund is an enterprise that furnishes goods or services to other internal university departments and charges a fee directly related to, and equal to, the cost of the goods or services. This means that the entity is self-supporting, but is not allowed to make a profit.

This fund group is in direct relationship with the university mission and acts as reimbursement to the university for use of university property or service. This fund is managed by individual campuses and fiscal officers.

The internal agency fund acts as the fiscal agent or trustee for the university. For financial reporting purposes, this fund group balance is reported as unrestricted at fiscal year-end. Common uses of this fund include withholdings for taxes for employees and sales tax. This fund group is managed internally by UCO.

The organization responsible for establishing accounting and financial reporting standards for state and local governments and those entities that are funded by state and local government.

US Generally Accepted Accounting Principles (US GAAP) is the combination of authoritative standards (requirements) and the commonly accepted ways of recording and reporting accounting information.