39 Decision Trees and Expected Value

Decision trees are a tool that we can use to visualize and organize information to enable us to make the wisest decision. However, decision trees alone will not help us. We must also have a strong understanding of expected value so that we are able to draw conclusions from a decision tree. Here is the definition as is given by Giordano et al. [8].

Suppose a game has outcomes

![]()

is the expected value of the game.

A great way to understand expected value and decision trees is to see them in action. So, we are going to go through a problem I completed for Mathematical Models/Applications 2 [26].

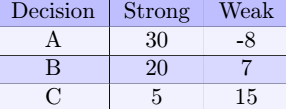

A new energy company, All Green, has developed a new line of energy products. Top management is attempting to decide on marketing and production strategies. Three strategies are considered and are referred to as A (aggressive), B (basic), and C (cautious). The conditions under which these strategies may be done are strong and weak. Management’s best estimates for net profits (in millions of dollars) are given in the following table. Build a decision tree to assist the company in determining its best strategy.

The probability of having strong conditions is 45%, and the probability of having weak conditions is 55%.

Solution

First, we start with a decision tree to organize the information we have been given. This decision tree is one I created with help from Kottwitz [14].

The value in each diamond provides the profit the company would gain for each strategy under each set of conditions. For example, if we want to know the profit the company will receive for the basic strategy under weak conditions, we start at the decision node, go across the branch labeled “Basic,” and then go down the branch labeled “Weak.” We arrive at the diamond that has a value of 7. Thus, the company would have a profit of $7 million.

The circles give the expected value for each strategy. Let’s look at how we got an expected value of $9.1 million for the aggressive strategy. Using the terminology of Definition VII.2, the Aggressive strategy is a game with outcomes ![]() weak and

weak and ![]() strong. The payoff of the weak outcome is -8, and the payoff of the strong outcome is 30. So,

strong. The payoff of the weak outcome is -8, and the payoff of the strong outcome is 30. So, ![]() and

and ![]() . The probability that the weak outcome will occur is 5%, and the probability the strong outcome will occur is 45%. Thus,

. The probability that the weak outcome will occur is 5%, and the probability the strong outcome will occur is 45%. Thus, ![]() and

and ![]() . Using the formula, we have

. Using the formula, we have

![]()

The expected values for the other two strategies can be found in a similar way.

If the company goes with the aggressive, they expect to have a profit of $9.1 million. For the basic strategy, they expect to have profit of $12.85 million, and for the cautious strategy, they expect to have a profit of $10.5 million. Because the company is trying to maximize its profits, they should go with the basic strategy.

Decision trees are very helpful in making decisions when there is a level of uncertainty. Such as in our problem above, the decision makers were not guaranteed strong conditions or weak conditions so they had to use some probability theory to determine what would likely be the best option.

Our next topic is an interesting one known as game theory. We are going to examine how a conflict between two parties will play out under different sets of conditions. Game theory is an important area of study because it allows us to model real world conflicts and predict how they will play out.